USD/CAD Signal Update

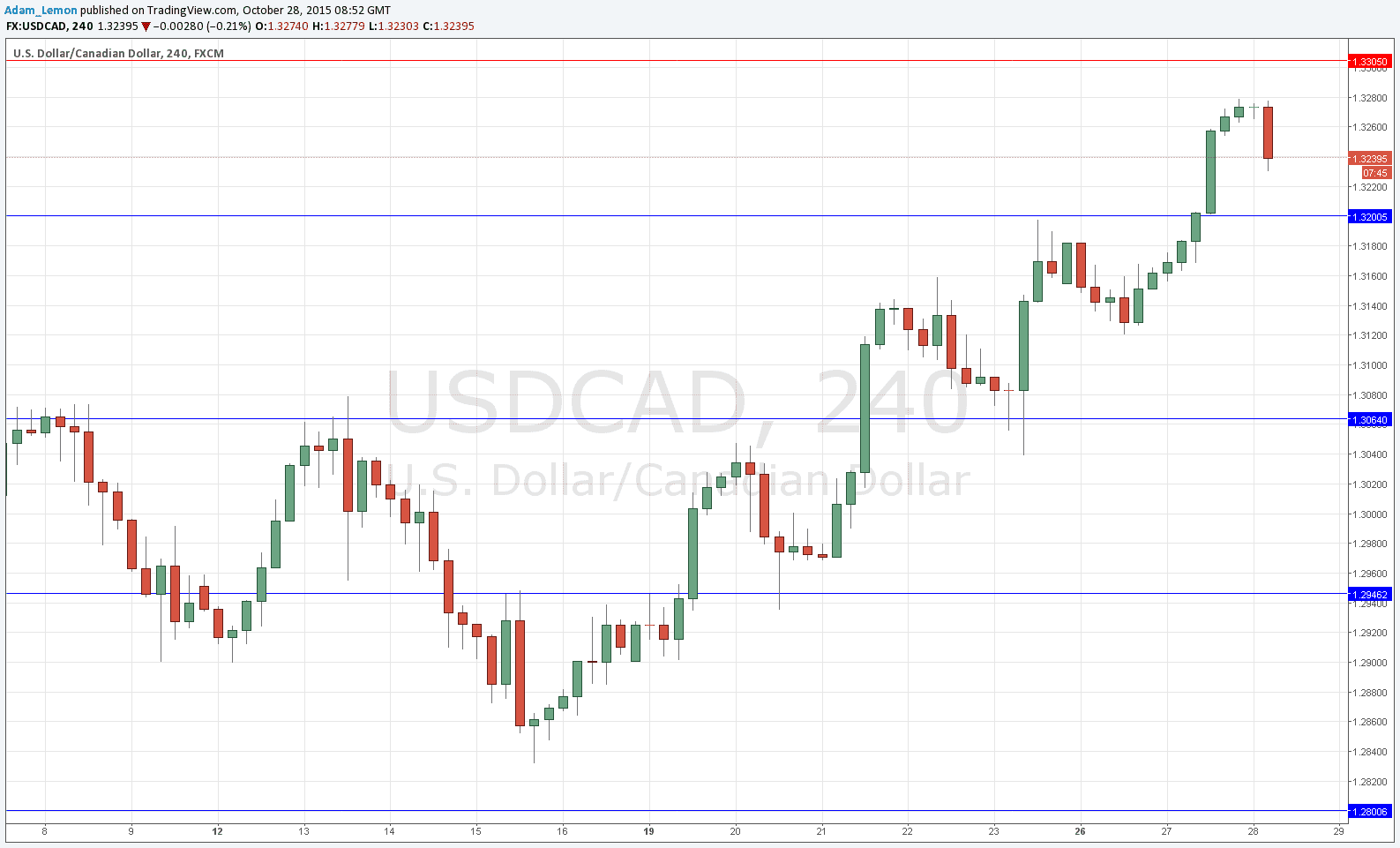

Yesterday’s signals produced a losing short trade off a bearish inside bar break from the resistance identified at 1.3200.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered between 8am London time and 5pm New York time today.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3200.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3064.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3305.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

I had thought that the resistance level at 1.3200 would hold yesterday but I was wrong. We broke up through it, but over the past few hours the pair has begun falling sharply again. It is now very likely that the level at 1.3200 has flipped from resistance to support so if you are looking to get long before the FOMC release later, that would probably be a good area at which to seek an entry.

Regarding the USD, there will be a release of the FOMC Statement and Federal Funds Rate at 6pm London time. There is nothing due concerning the CAD.