USD/CAD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 1.3200.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken between 8am London time and 5pm New York time today.

Long Trade 1

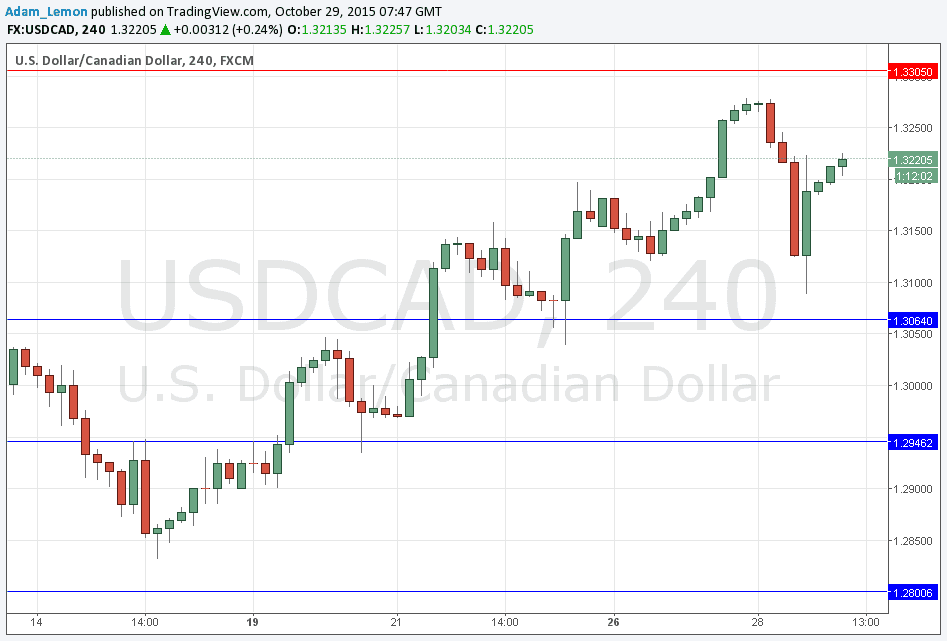

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3064.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3305.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

The key level of 1.3200 was easily broken yesterday in the sharp rise of CAD that was driven by a very large increase in the price of crude oil over the day: about 5%!

The FOM release then caused a recovery back into the bullish trend, so looking at the big picture, it seems to be still intact.

If the price cannot make a new high within the next few days, it will be very likely to fall to the support at 1.3064.

Regarding the USD, there will be a release of Advance GDP and Unemployment Claims at 12:30pm London time. There is nothing due concerning the CAD.