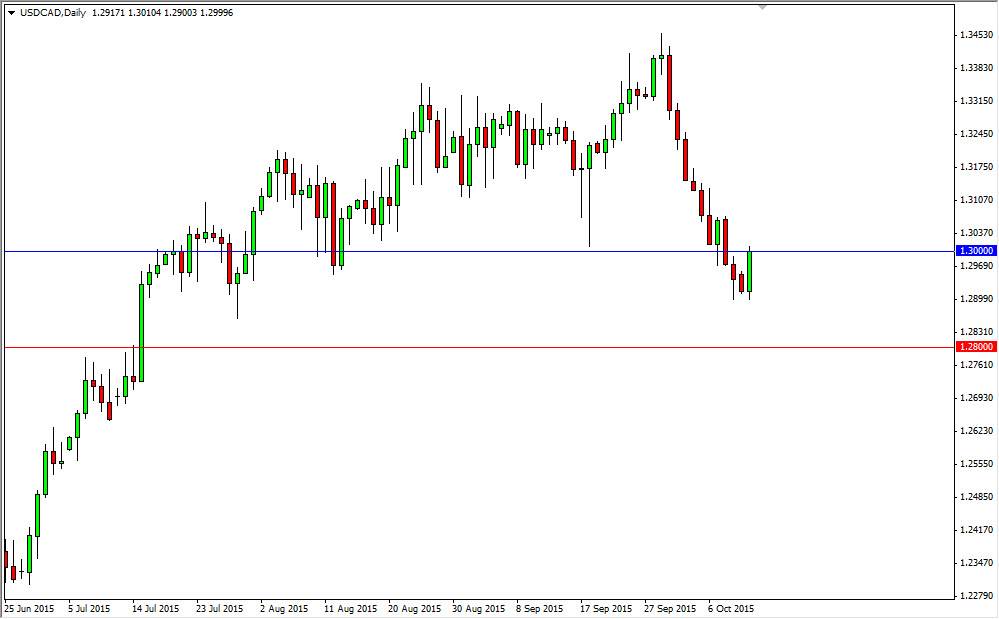

The USD/CAD pair bounced significantly during the course of the session on Monday to test the 1.30 level. That of course shows a significant amount of strength, and as you have been reading, I recognize support as an area between the 1.28 level on the bottom, and the 1.30 level on the top. In other words, we found buyers right in the middle of the support “zone” that I have been talking about. Ultimately, I believe that this pair does go higher, but we need to clear the 1.30 level decisively. On that move, the market should then reach towards the 1.33 handle. I recognize that it is going to be difficult to make this move right away, and of course the oil markets are very volatile. However, it does look like oil is softening a bit, and that of course should work against the value the Canadian dollar in general.

Uptrend

Regardless of what we have seen over the last several sessions, this pair is still very much in an uptrend. Yes, it has broken down significantly but at the end of the day it makes a lot of sense that we continue to go higher as the area that we are in right now is the massive resistance that pushed back every time the markets tried to rally during the financial crisis.

Many of you probably wanted trading currencies back then, but I can tell you that it was an absolutely wild time. It seems like the markets were proving the old adage, “markets can stay irrational much longer than you can stay liquid” on an almost daily basis. The fact that the area that we are at right now held as resistance during that particular scenario suggests that we should see quite a bit of support in this area.

A break above the top of the range for the Monday session, shows that this market will continue to go higher. I even believe that selling is an impossibility until we get well below the 1.28 level. This is essentially the US dollar going “on sale” recently, and it looks like value hunters are out in full force.