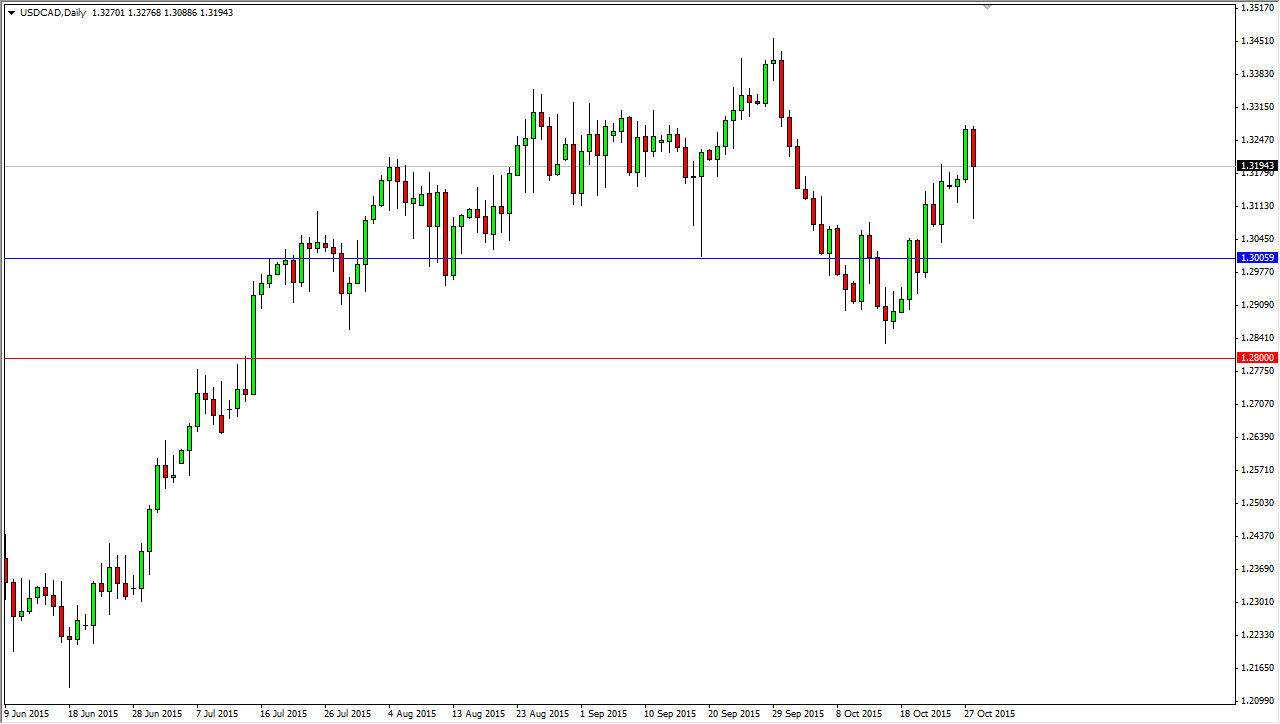

The USD/CAD pair fell rather drastically during the course of the session on Wednesday, as the oil markets skyrocketed. However we found enough support below to turn things back around and end up forming a hammer. Because of this, I believe that this market continues to go much higher and it’s only a matter of time before the buyers take over again. I think that the 1.30 level below is massively supportive, and it’s only a matter time before that area becomes a bit of a floor. After all, that support runs all the way down to the 1.28 level, and I believe that is essentially what is defining the trend at the moment. In other words, as long as we can stay above there I am a buyer only.

The significance of 1.30

I’ve stated several times that I think the 1.30 level is massively significant, but I mean this zone not just the actual price. After all, this is a level that has offered significant resistance in the past, even during the financial crisis which of course saw the United States dollar rapidly appreciate in value as the world rushed for safety. I think now that we have broken above there, it should now be massively supportive as is the basic tenet of technical analysis - “what was once the ceiling becomes the floor.”

Oil markets do look like they are trying to strengthen a bit, but quite frankly in the end they are quite soft still, and that of course will work against the value the Canadian dollar longer-term. On top of that, the United States drills much more of its own oil than it used to, so while the old correlations won’t necessarily apply here. In fact, I believe that you will probably see a declining Canadian dollar while oil prices rise as it will more than likely be a beneficiary of a strengthening US economy more than anything else. However, I think we are a little ways away from that being the reason. Nonetheless, I only buy this pair.