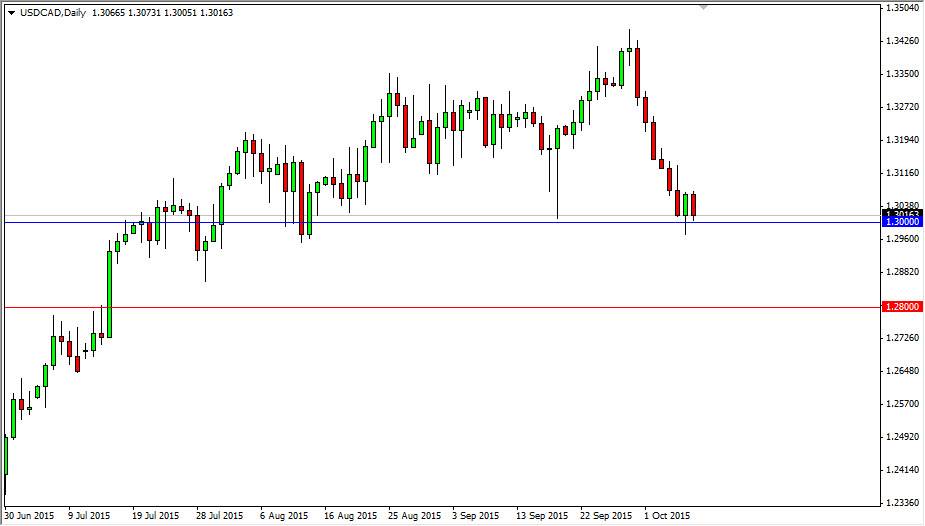

The USD/CAD pair fell during the course of the session on Thursday, as we continue to test the 1.30 level. This is an area that I’ve been paying attention to for quite some time as it was where the uptrend during the financial crisis stopped abruptly. That made it a bit of a “brick wall”, and the fact that we broke above there is of course a very bullish sign. On top of that, I see quite a bit of support all the way down to the red line on this chart, which is the 1.28 handle. It is essentially a support “zone” based upon what we have seen as far as resistance recently.

With that being the case, I don’t really have any interest in selling this market until we get well below the 1.28 handle. I’m not saying that we can get down there, obviously we can, but at the end of the day I prefer to be a little bit more conservative in my entries.

Oil market correlation

Pay attention to the oil markets, because they have been rallying lately. That of course can move the Canadian dollar but it doesn’t have to. Just think of it as “another reason” why the pair could fall. The $50 level in the light sweet crude market is a monumental resistance barrier, and if we get above that it is likely that this pair falls significantly. On the other hand though, we are seeing quite a bit of support in this area, so we can break above the top the hammer that formed during the day on Wednesday, at that point in time I would be willing to start buying and aiming towards the 1.32 handle.

I recognize that even if we break higher is going to be very volatile, so having said that it will take a significant amount of wherewithal to hang onto the trade.