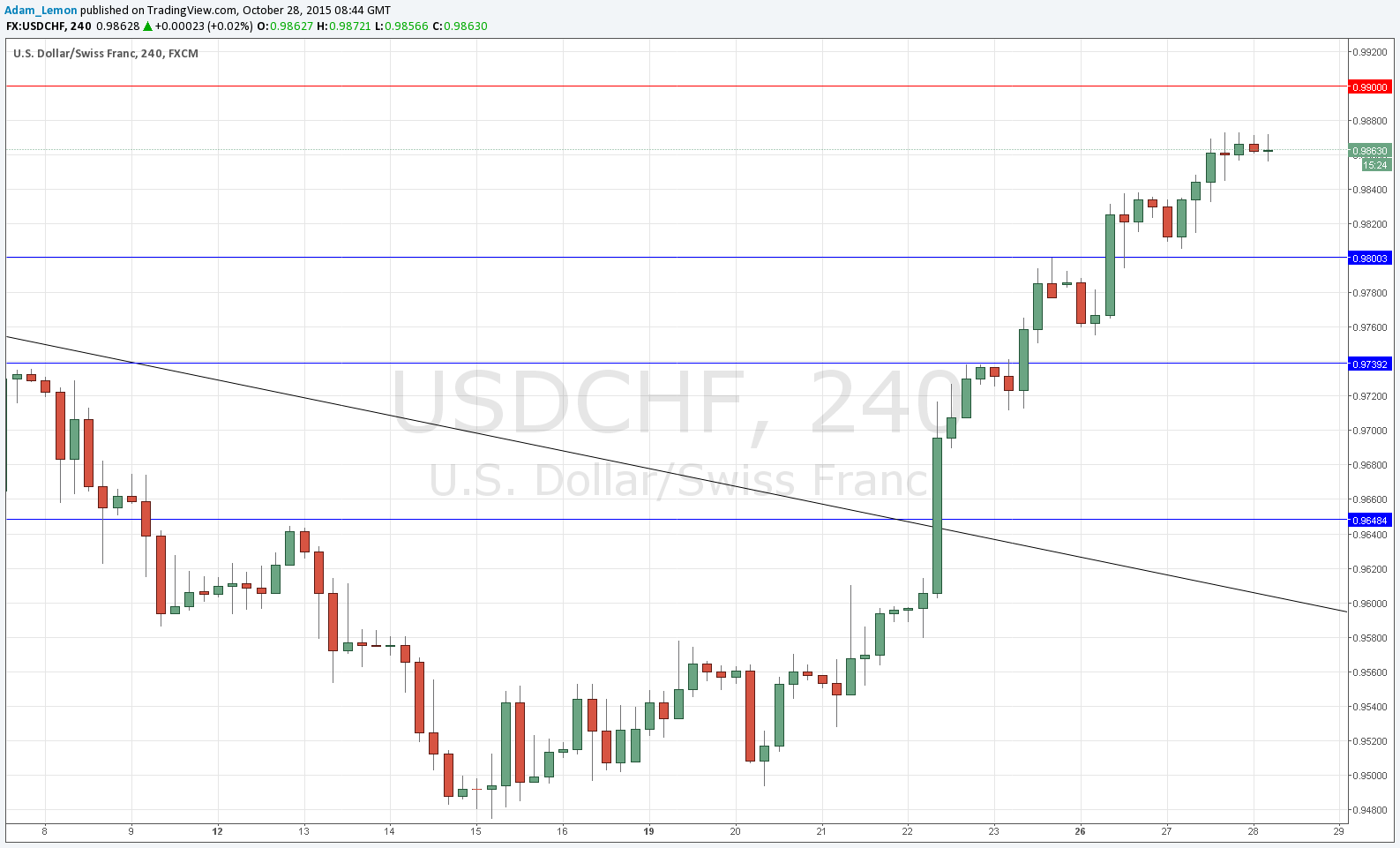

USD/CHF Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trade 1

Long entry after bullish price action on the H1 time frame following a touch of 0.9800.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry after bullish price action on the H1 time frame following a touch of 0.9739.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.9900.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

The bullish momentum here continued for yet another day although the candles are showing signs that this move may be topping out a little short of the anticipated resistance at 0.9900.

There will probably be minor support at around 0.9840 and a stronger, key level at the round number of 0.9800.

The CHF is the weakest currency around right now so it is that side of the pair that is really driving things. A USD-positive FOMC later today would make this the logical pair to be long of.

Regarding the USD, there will be a release of the FOMC Statement and Federal Funds Rate at 6pm London time. There is nothing due concerning the CHF.