USD/JPY Signal Update

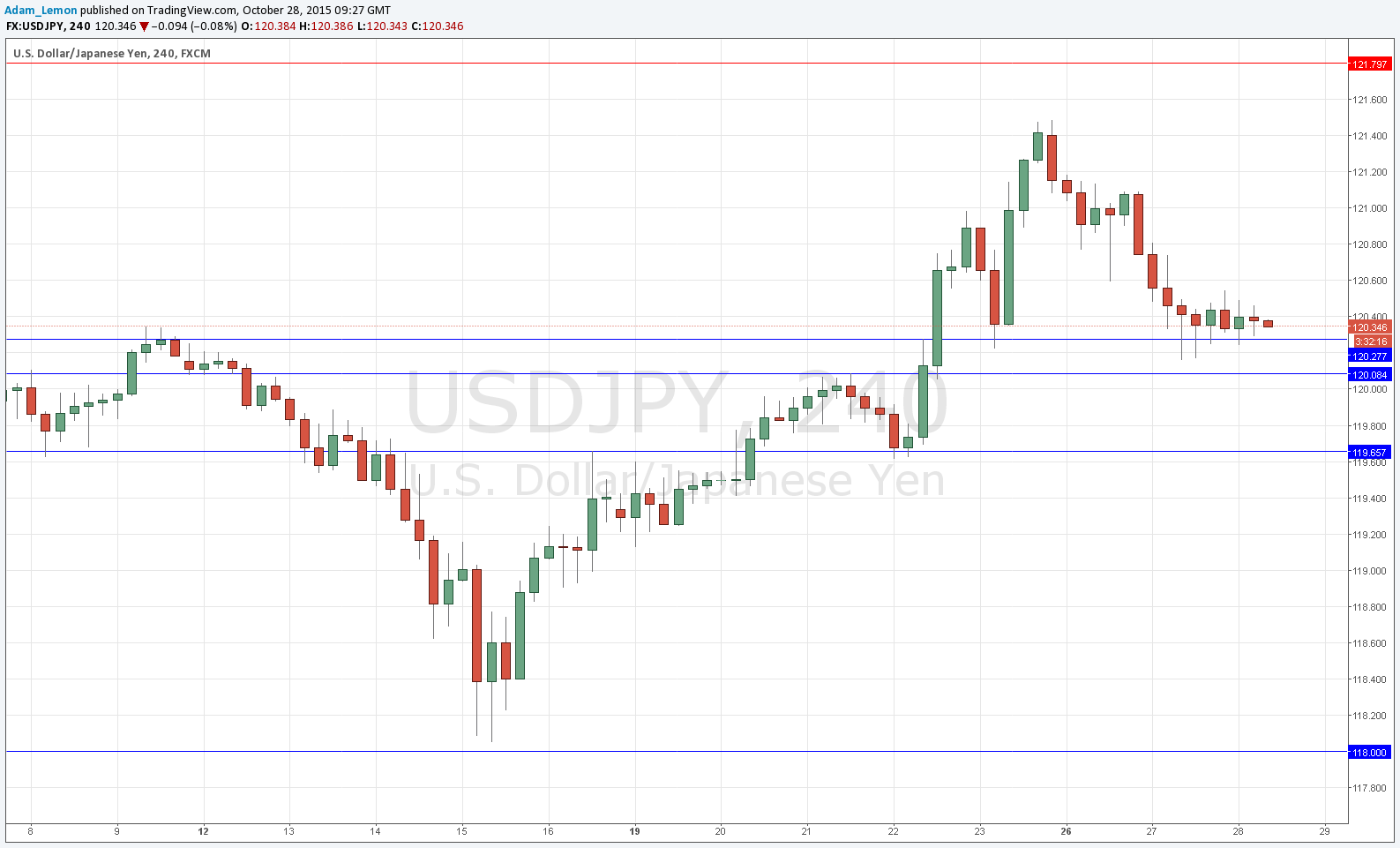

Yesterday’s signals would have produced a long trade off the continuous rejections of the support at 120.28. However this trade is not really going anywhere so I think an exit with a small loss of a few pips is must more preferable than trying to hang on and hoping the FOMC won’t hit the stop loss.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next entry into the zone between 120.28 and 120.08.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run. .

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 119.66.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 121.79.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

I was correct to see support beginning at 120.28, and for a couple of days now the price has just not been able to get below this supportive zone. The line of least resistance looks clearly to be long, but the USD is probably going to be extremely quiet until the FOMC release, and as the JPY is strong, and we are expecting volatility, it does not seem to be worth hanging in there. I think it could still be used as a base for a long trade following the FOMC if there is in initial stab down following the report then a bullish reversal. However it might well be that the support at 119.66 becomes more important to hold any sharp move down.

Regarding the USD, there will be a release of Core Durable Goods Orders data at 1:30pm London time, followed by CB Consumer Confidence at 3pm. There is nothing due concerning the JPY.