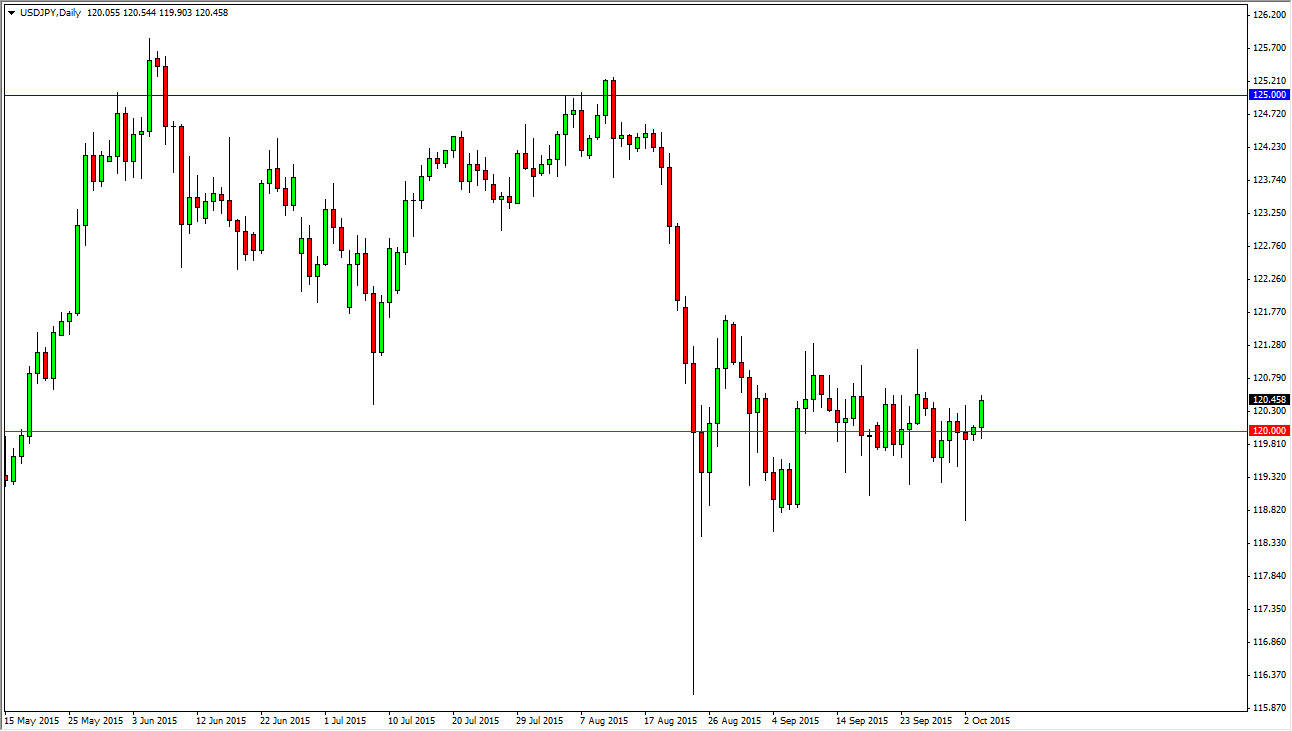

The USD/JPY pair rose during the course of the session on Monday, using the 120 level as a bit of a springboard. With that, it looks like the market is favoring the upside in general, and that every time we pullback we should continue to have buyers step into this market. On top of that, the market will more than likely move today as the Bank of Japan has an interest rate announcement and more importantly a question and answer session afterwards.

With this, the market should have quite a bit of volatility going forward, and I think that the market could very well get a bit of a shock coming out of the Bank of Japan today as they suggest more quantitative easing. With that I believe that the market should ultimately go higher though, as if the Bank of Japan does increase the quantitative easing in this market, we should then have quite a bit of bullishness come into the currency pair.

Pullbacks are buying opportunities as well

I believe that there are significant amounts of buying opportunities below as well, as the market should continue to favor the US dollar overall, and I believe that the 119 level is the beginning of significant support all the way down to the 118.50 level. I believe this is most obvious due to the fact of the massive hammer that formed on the day the US dollar melted down. Now we have simply gone sideways for some time, looking for the “all clear signal” to start buying this pair yet again. I do think it happens eventually, we just need the right momentum to take advantage of that. Until then, it will be a bit difficult but I think it’s only a matter of time before that does in fact happen. I am long of this currency pair, and will continue to be going forward. I have absolutely no interest in selling at this point in time and I believe that the Bank of Japan will certainly get involved in this market falls far enough.