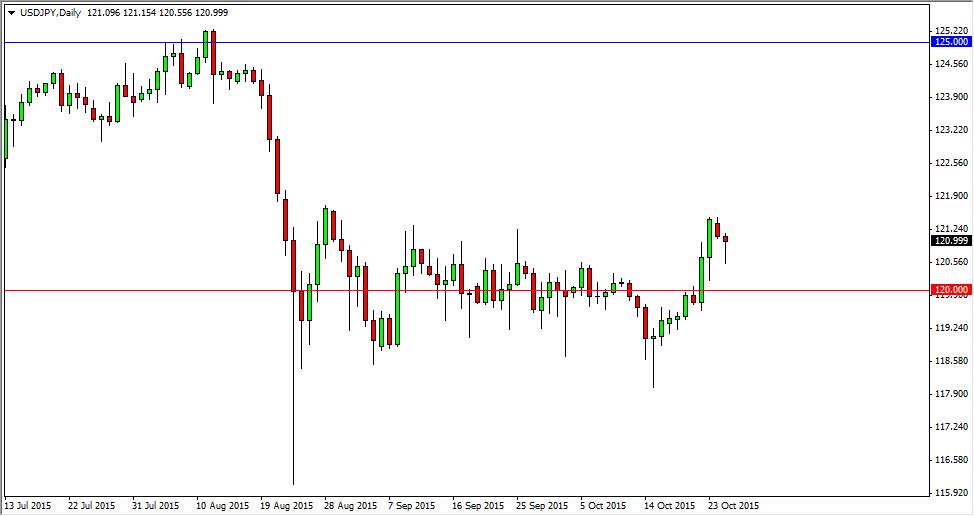

The USD/JPY pair initially fell during the course of the session on Monday, but found enough support near the 120.50 level to turn things back around and form a hammer. That hammer of course is a very positive sign, and if we can break above the top of that hammer I would be very comfortable buying this pair. After all, we have been grinding sideways overall, and it looks as if we are trying to build enough momentum to finally break out above the 121.50 region. That is the top of the recent consolidation, and if we can get above there this market should move towards the 125 handle.

The 125 handle has been massively resistive in the past, but sooner or later I do feel that this market will break above there. In the meantime though, the Federal Reserve has done no favors for the US dollar, as it walked away from a potential rate hike recently. With that being the case, the markets will be a bit jittery when it comes to buying the US dollar and the Japanese yen, but as long as risk appetite comes back into the marketplace, this pair should go higher.

Stock markets

One indicator of where this pair goes a lot of times will be stock markets. The stock markets tend to be a bit healthy looking at this moment in time, and that should send the market higher, perhaps the single reason to push this market to higher levels. If we broke down below the bottom of the hammer though, we could fall a bit but I anticipate there is more than enough support below to keep this market somewhat afloat. I believe that the 120 handle is supportive, and most certainly the 118.50 level is supportive, as it has been the bottom of the recent consolidation. Quite frankly, this market has gone nowhere for several months now, which can only last so long.