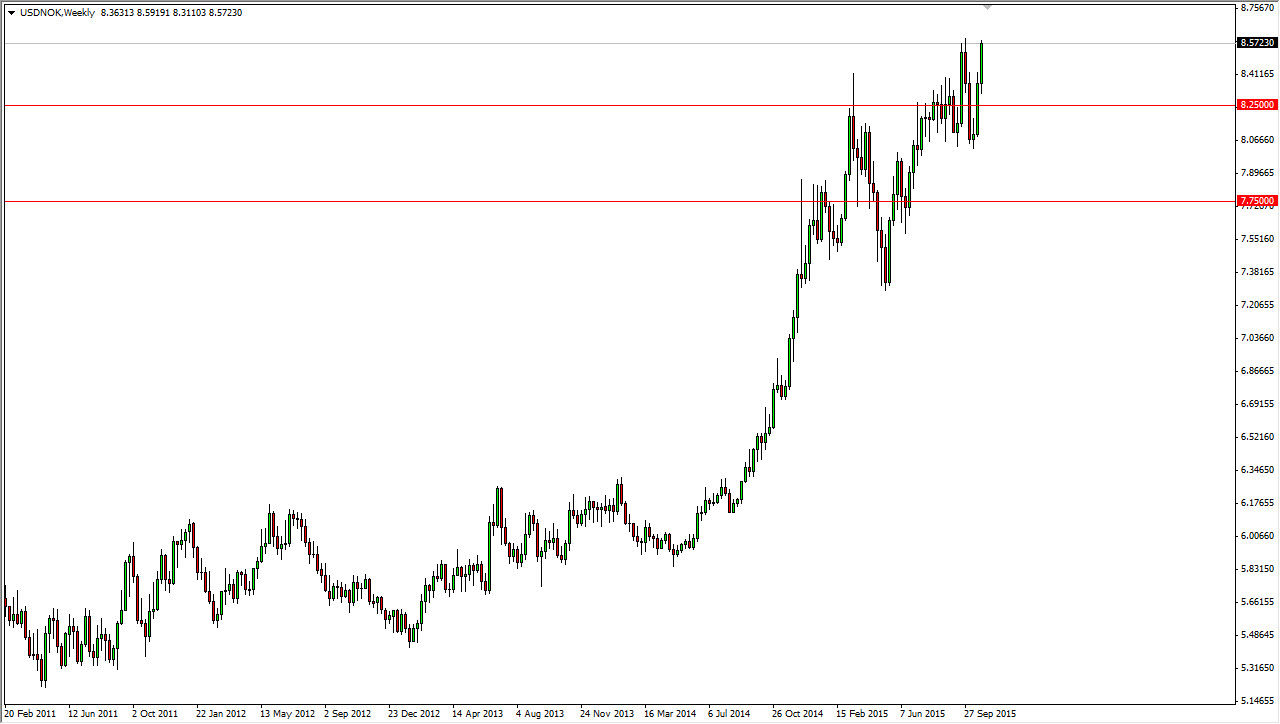

The USD/NOK pair continues to show real strength overall, as we are reaching towards the highs again at the 80.57 region. With this being the case, the market should continue to go much higher, and as a result I fully anticipate seeing this market reach towards the 8.60 level relatively soon. With that being the case, I don’t see any way whatsoever in selling this market, as even a pullback should have more than enough support below to keep this market going higher. Remember, in a world that seems to be skittish economically to say the least, the Norwegian krone is not the first place people were going to go for safety. That’s one of the main attractions of going long this pair because we have the safety of the US dollar.

Don’t forget oil

Oil of course heavily influences this market, as the Norwegian krone is a proxy for drilling in the North Sea. Ultimately, I don’t even have a scenario in which I start selling this pair, because even if oil rises, it’s going to be difficult to overcome the strength of the US dollar in this economic scenario.

Ultimately, this market is probably going to go to the 9.00 level, but it is going to take some time. As you can see, we have been in a nice uptrend for some time now, but it does get choppy from time to time. That of course is because the market isn’t the most liquid of currency pairs, and as a result a lot of different things can move the market a couple of hundred pips.

Ultimately, the market looks as if it is trying to grind higher after the impulsive move late last year. You have to think of this market and longer-term trends though, and you have to be willing to wait for profits. It’s more or less going to be an investment, so don’t sit there and stare at the monitor. You need to place your trading and give it time to run.