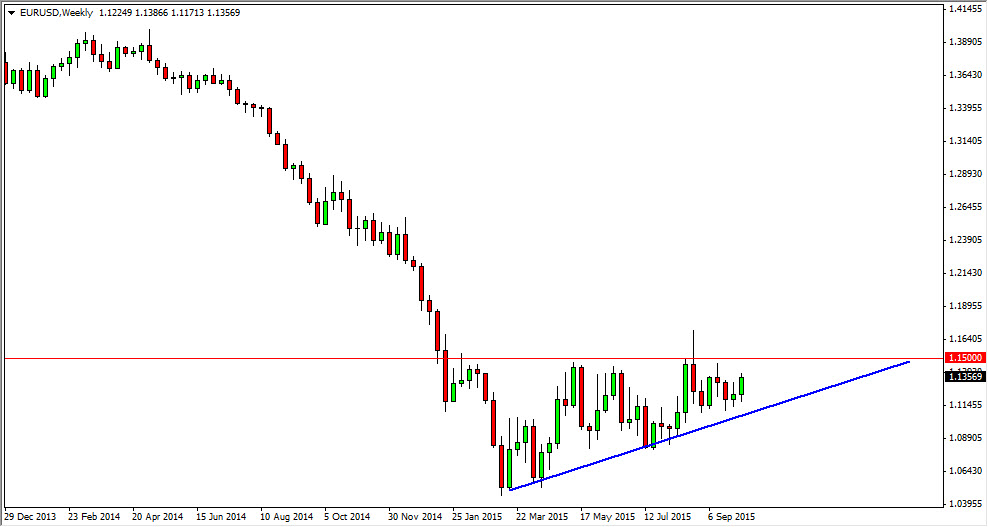

EUR/USD

The EUR/USD pair broke higher during the course of the week, forming a fairly positive candle. With that being said, the market is overall in an ascending triangle, so I believe that once we get above the 1.15 level things could get very interesting. In the meantime though, expect a lot of volatility in choppiness with an upward bias.

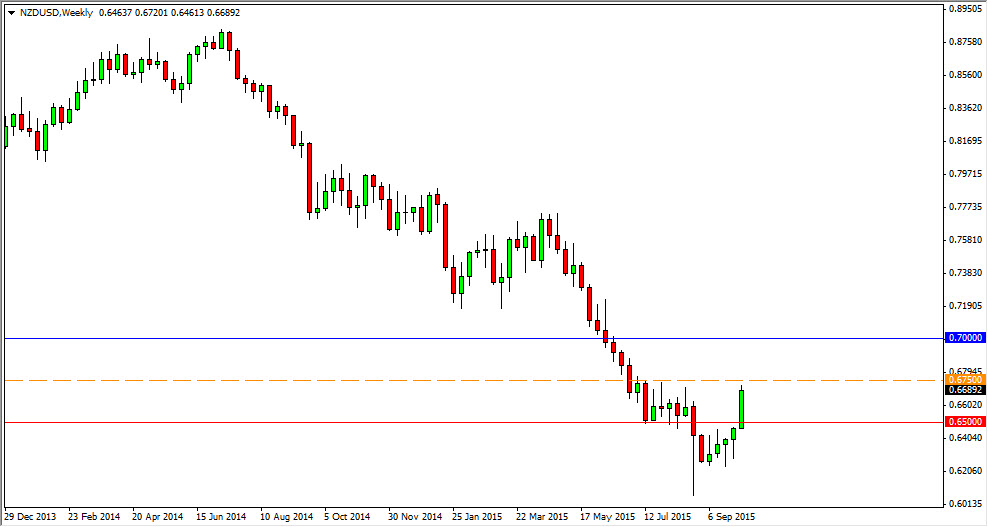

NZD/USD

The NZD/USD pair broke higher during the course of the week, but stayed just below the 0.6750 handle. We need to get above there in order to see this market continue to go higher, and as a result I am still waiting for that move. As long as we stay below there I would be a seller of resistive candles. And as a side note, the Friday candle was a shooting star. A break down below the bottom of the Fridays range should be a selling opportunity. However, if we break above the orange dashed line on the chart, I feel that this market will probably reach towards the 0.70 level.

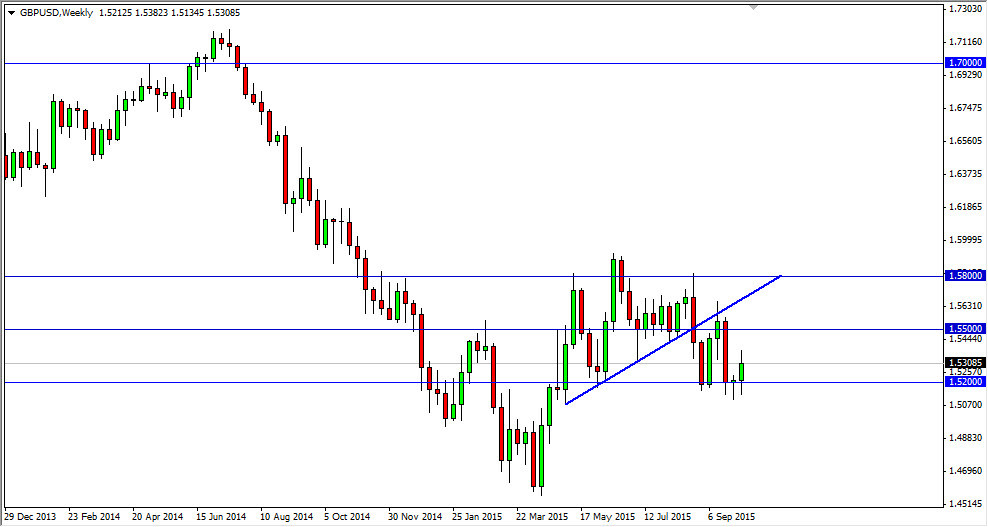

GBP/USD

The GBP/USD pair initially fell during the course of the week but found enough support near the 1.52 level to turn things back around. Ultimately, we ended up forming a positive candle but at the end of the day I feel what’s happening is that we are simply looking to consolidate between the 1.52 level, and the 1.55 level above. Expect a lot of choppiness between here and there, and as a result I think that the market is probably going to be the domain of short-term range bound traders.

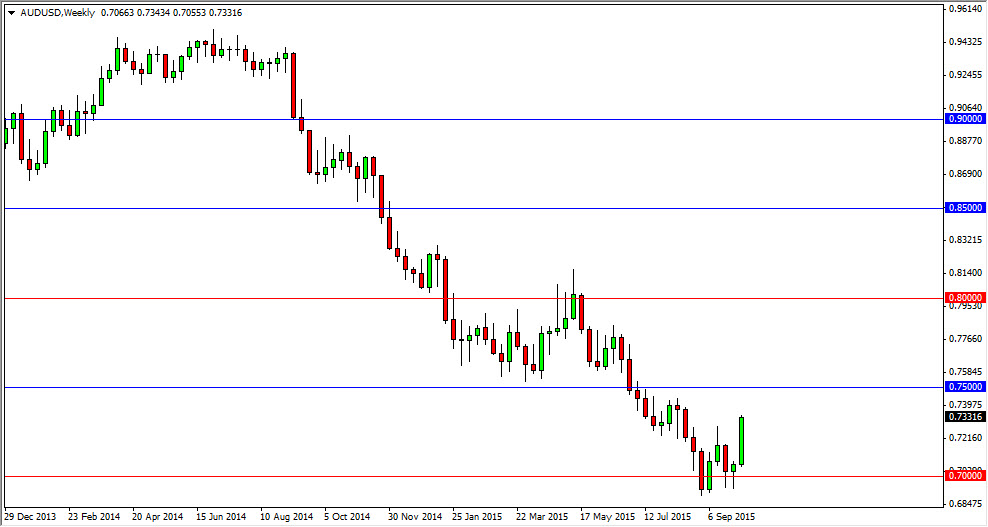

AUD/USD

The AUD/USD pair broke higher during the course of the week, showing real strength. By doing so, I do think that we continue to go higher but the 0.75 level above is going to be resistive. With that, I think you’re going to have short-term buying opportunities on pullbacks, but at the end of the day the range for the week should be fairly quiet. I have no interest in selling at this point, just simply because I see so much in the way of noise below.