EUR/USD

The EUR/USD pair fell significantly during the course of the week as the European Central Bank suggested that the market could expect a bit of stimulus coming forward. With that being the case, the Euro should continue to lose value, and we ended up crashing into the uptrend line at the 1.10 handle. With this being the case, I think that if we break down below the 1.10 level, the market should continue to drop down to the 1.08 handle, and then eventually the 1.05 handle. If we get some type of supportive daily candle though at the uptrend line, I could be convinced to buy on a bounce.

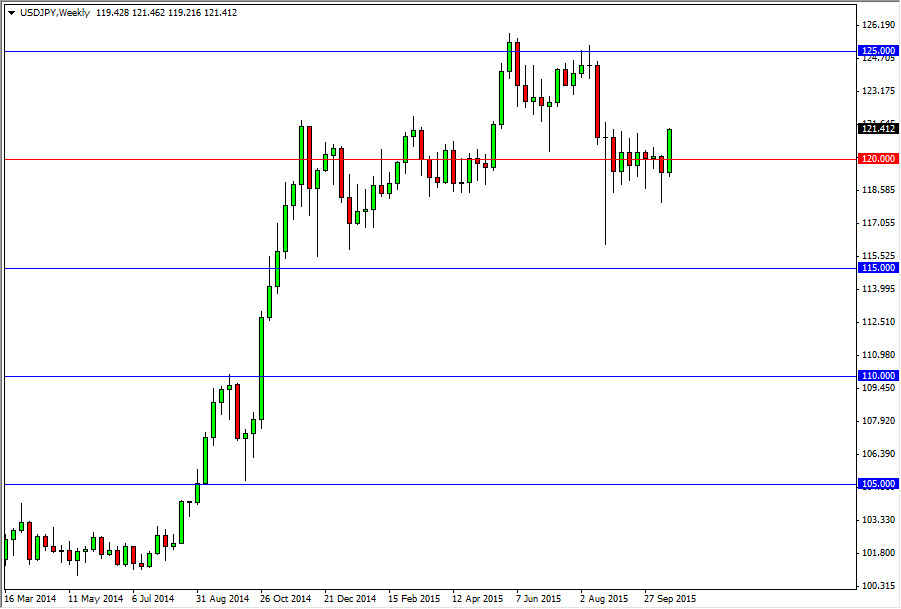

USD/JPY

The USD/JPY pair broke higher during the course of the week, clearing the top of the hammer that had formed from the previous week. With that being the case, the market looks as if it is ready to break out, and if we can get above the top of the range for the Friday session, the market will then go to the 125 handle.

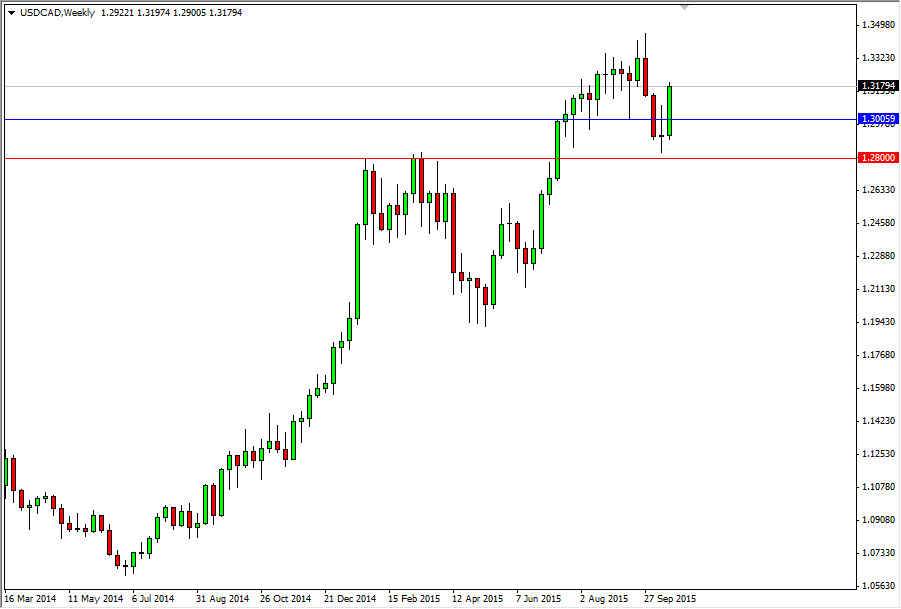

USD/CAD

The USD/CAD pair broke higher during the course the week, clearing the top of the shooting star from the previous week. That being the case, the market should be going higher, reaching towards the 1.34 level. I have no interest whatsoever in selling, as the 1.28 level should essentially be the “floor” in the market at this point in time.

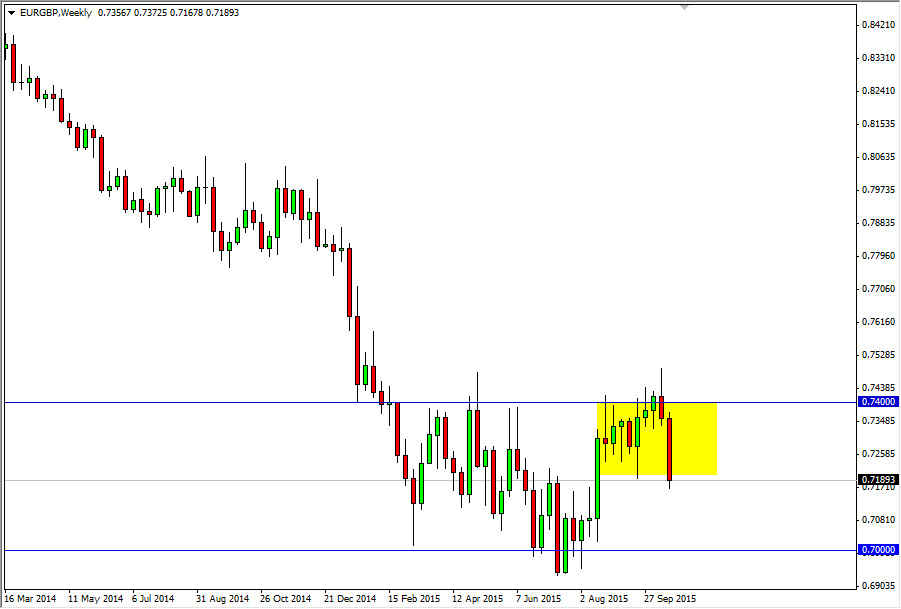

EUR/GBP

The EUR/GBP pair broke down during the course of the week, and as a result the 0.72 level was attacked. This is an area that has been massively supportive though, but at this point in time I think if we can break down below the bottom of the range for the week, we could drift down to the 0.70 level, offering quite a bit of a selling opportunity.