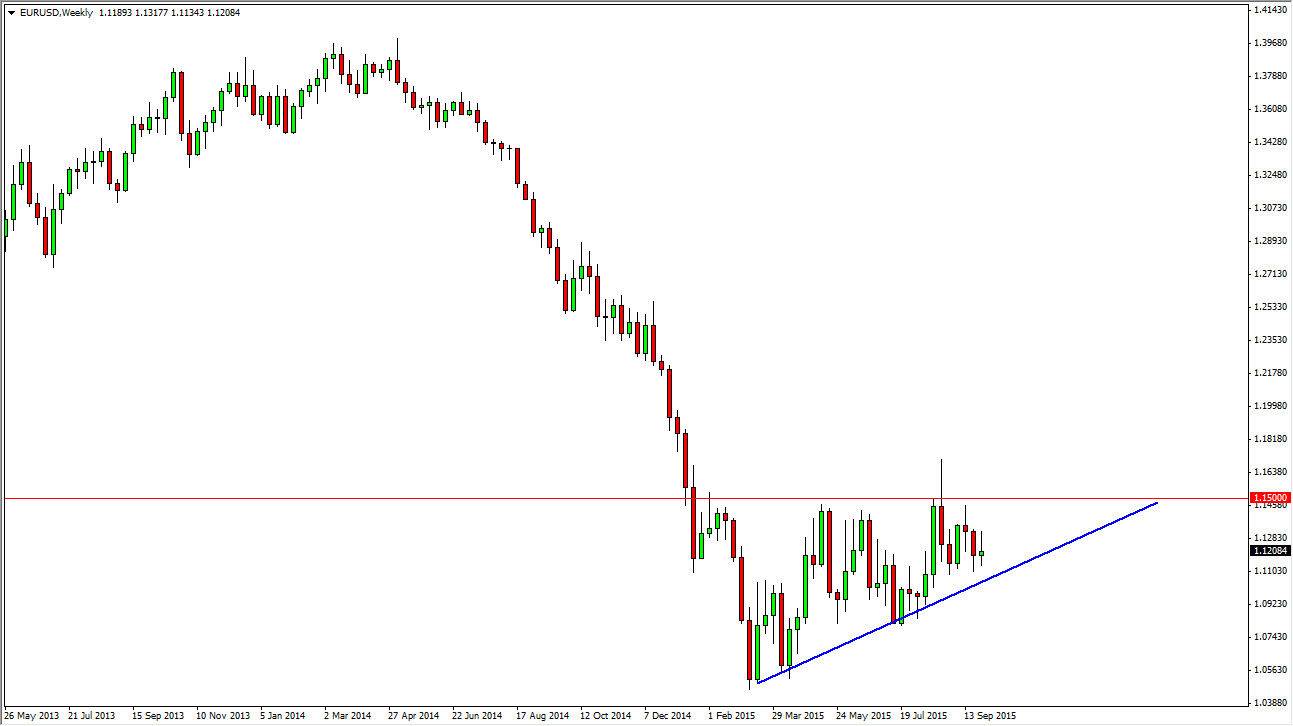

EUR/USD

The EUR/USD pair had a very volatile week, and I believe that will continue to be the case. However there is an uptrend line just below that could offer support from time to time, so therefore I am looking to buy this market when I get a chance. Supportive candles will be opportunities to go long. However, the 1.15 level above continues to be massive resistance, so I think short-term trading at best will be the way to go.

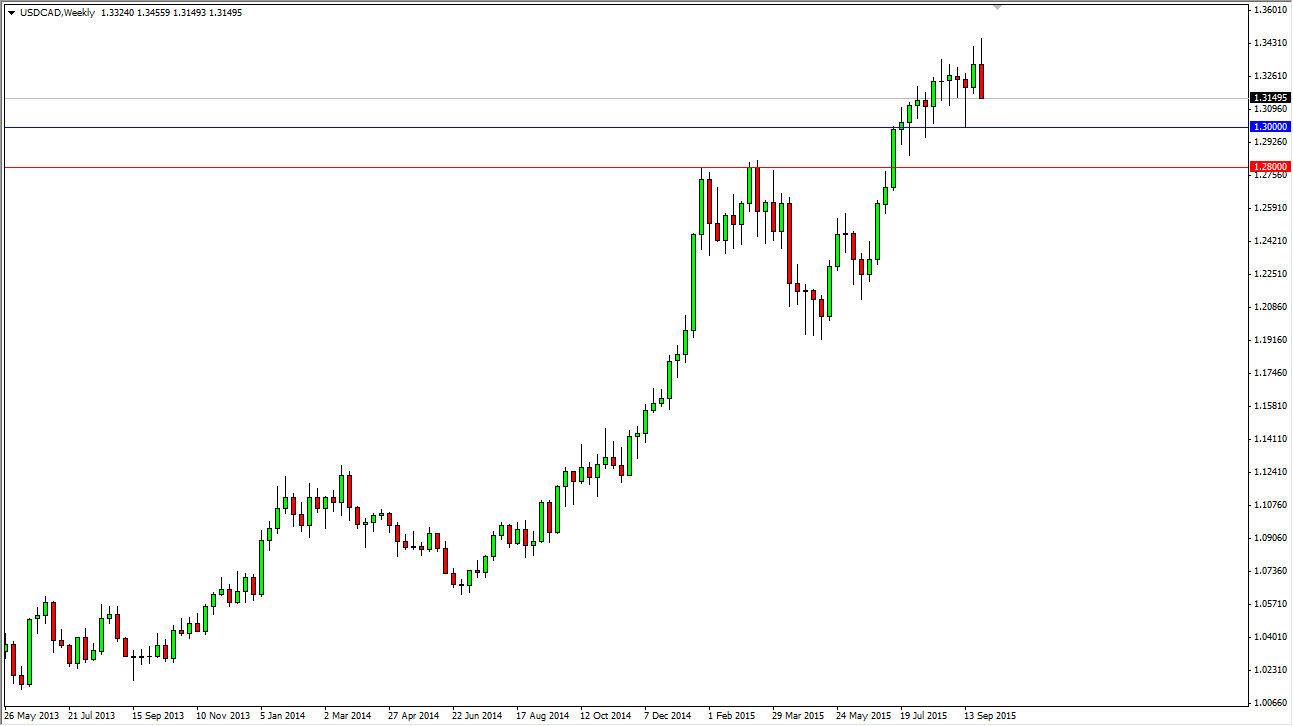

USD/CAD

The USD/CAD pair broke down during the course of the week, as we initially tried to break out to the upside but then found quite a bit of bearish pressure. This of course wasn’t helped by the jobs number, but quite frankly there is a massive amount of support below at the 1.30 level, and the Canadian dollar isn’t exactly insulated from any problems in America. So having said that, I am a buyer of a supportive candle once we get one on the daily chart.

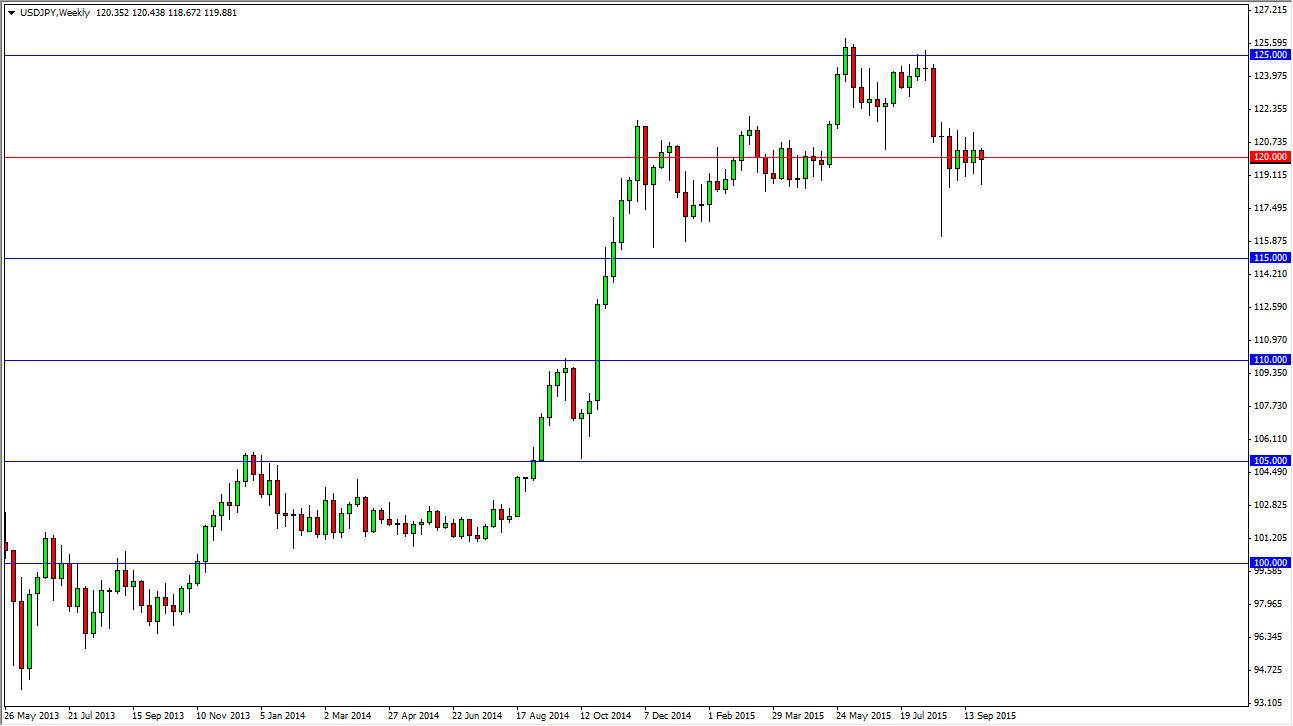

USD/JPY

The USD/JPY pair broke down during the course of the week but found enough support to turn things back around and form a hammer yet again. That being the case, I feel that the market will eventually go higher, but we need to get above the 121 handle to start buying. This market should then reach towards the 125 level given enough time. I am still bullish of this market but I recognize that there is a lot of crosswinds at the moment.

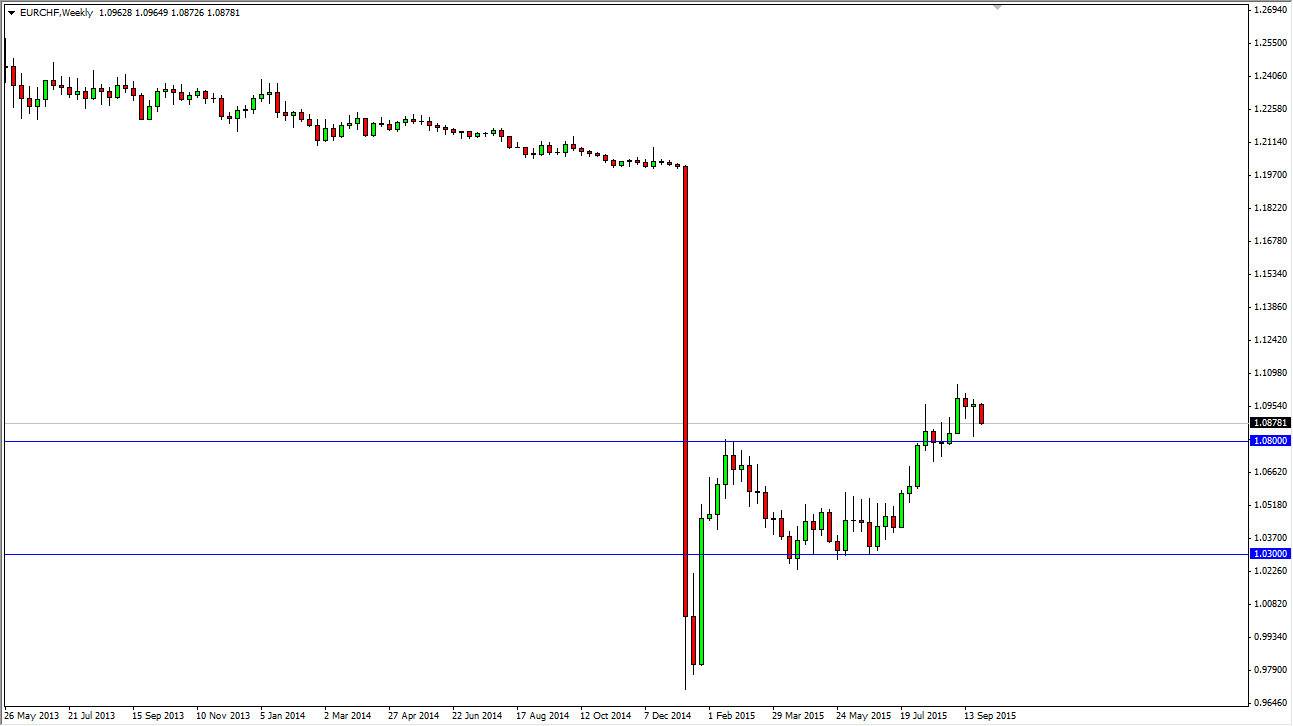

EUR/CHF

The EUR/CHF pair fell during the course the week but remains well above the 1.08 handle. Because of this, the market looks as if it is going to try to find some type of support below to turn things back around and form a positive move. With this, we should see buyers come back so therefore I am a buyer of this particular pair. The 1.10 level above getting broken to the upside should send this market looking for the 1.20 level given enough time.