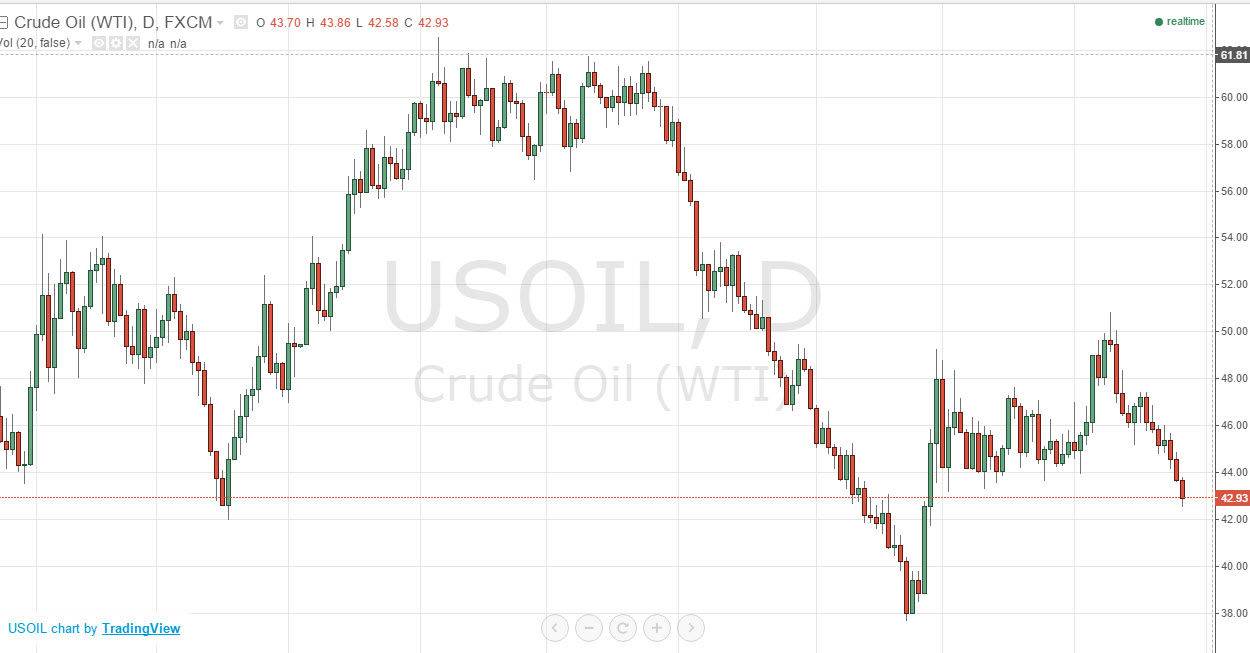

During the session on Tuesday, the WTI Crude Oil market finally broke well below the $44 level, showing that continued weakness should be what we see. Today will be interesting though, as we have an FOMC Statement coming out, and that of course can affect the value the US dollar. After all, this commodity is priced in that currency, so if it has a significant move it could of course affect the way this market trades. Nonetheless, we have a definite move to the lower side at this point, so I think that this market is going to continue to drift.

Ultimately, we also have a Crude Oil Inventories announcement coming out of the United States as well, and if it shows any lack of supply at all, this market could fall apart. I think that the $40 level is going to be the target going forward, perhaps even the $38 level. Now that we have broken below this area, it shows that the buyers are most certainly retreating.

Lack of demand?

We have to ask whether or not there is enough demand out there for crude oil. After all, there seems to be a lot of concern about global economic activity recently, and Chinese numbers certainly have done nothing to build up confidence at this point in time. Remember, China is the second largest consumer of crude oil, and if they are not using it as much, it certainly has a negative effect on the market. Add to the fact that the US economy isn’t strong enough for interest-rate hikes, you have people worried about whether or not there is going to be enough global growth to support any type of bullishness.

With that being said, I do think that we will find buyers below, I don’t think that oil is going to collapse completely. I just think that we’re going to have to retest the bottom yet again. On a break below the bottom of the range for the day on Tuesday, I am a seller. On a resistive candle after short-term rally, I am a seller there as well.