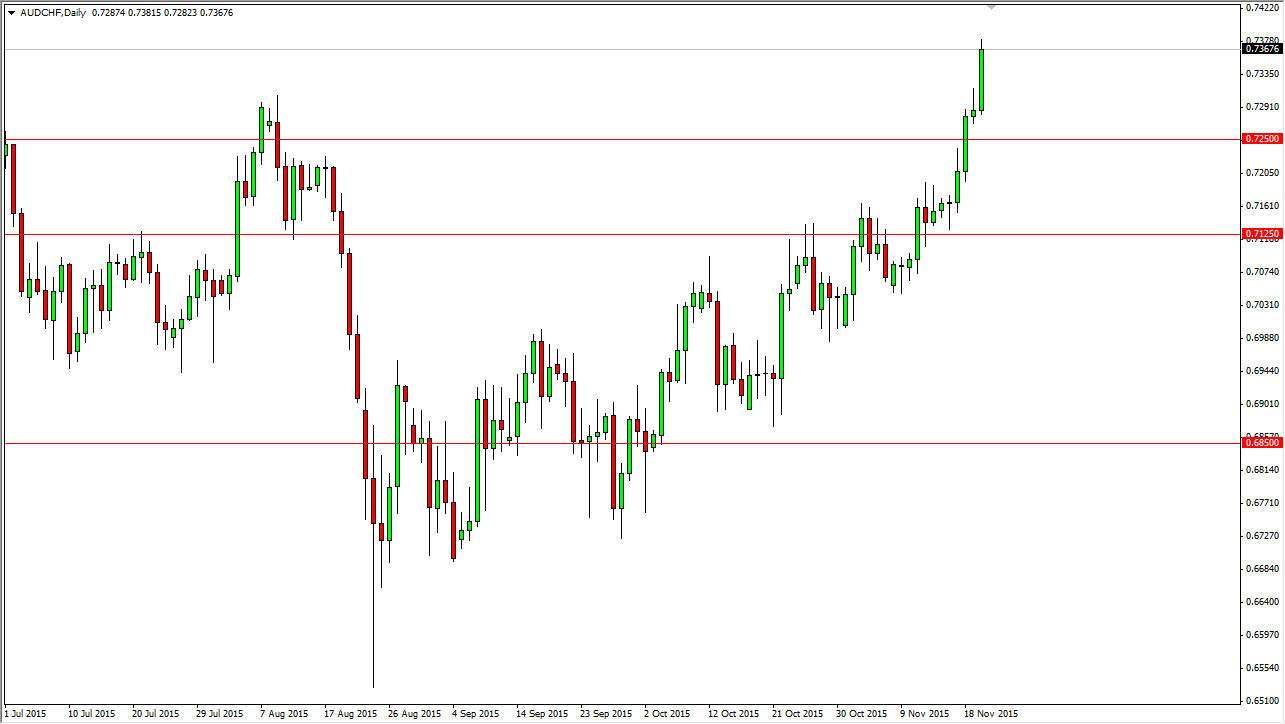

During the session on Friday, you can see that the AUD/CHF pair broke out to the upside. In fact, we not only broke out to a fresh, new high but we also broke above the top of the shooting star from the previous Thursday session. With that being the case and the fact that the candle is so strong, I believe that this market will continue to go much higher. After all, when you look at the Australian dollar against the US dollar, it is much stronger than the New Zealand dollar is, and with that it seems to be a situation where the Aussie dollar is the stronger of the commodity currencies in that region, and as a result although the Swiss franc is falling in value against most currencies, the Aussie should be stronger than its cousin. In other words, this is a market that should continue to grind higher.

Pullbacks

I believe that pullbacks should continue to offer buying opportunities as this market will probably go back to the next psychologically significant level, the 0.75 handle. Ultimately, the market should continue to be bullish and offer not only short but also long-term moves to the upside.

It is not until we break down below the 0.7125 level that I would consider selling this market. I believe that the market should work against the Swiss franc going forward, because the Swiss National Bank is most certainly going to work against the value the Swiss franc itself. On top of that, the European Union is struggling right now economically, and that of course hurts the Swiss economy. With that being the case, and the fact that we have a positive swap in this market, I feel that the longer-term move is still to the upside. If we get any type of move in the gold markets, it’s possible that could influence this market, but at this point in time it appears it seems to be more about Switzerland and less about Australia.