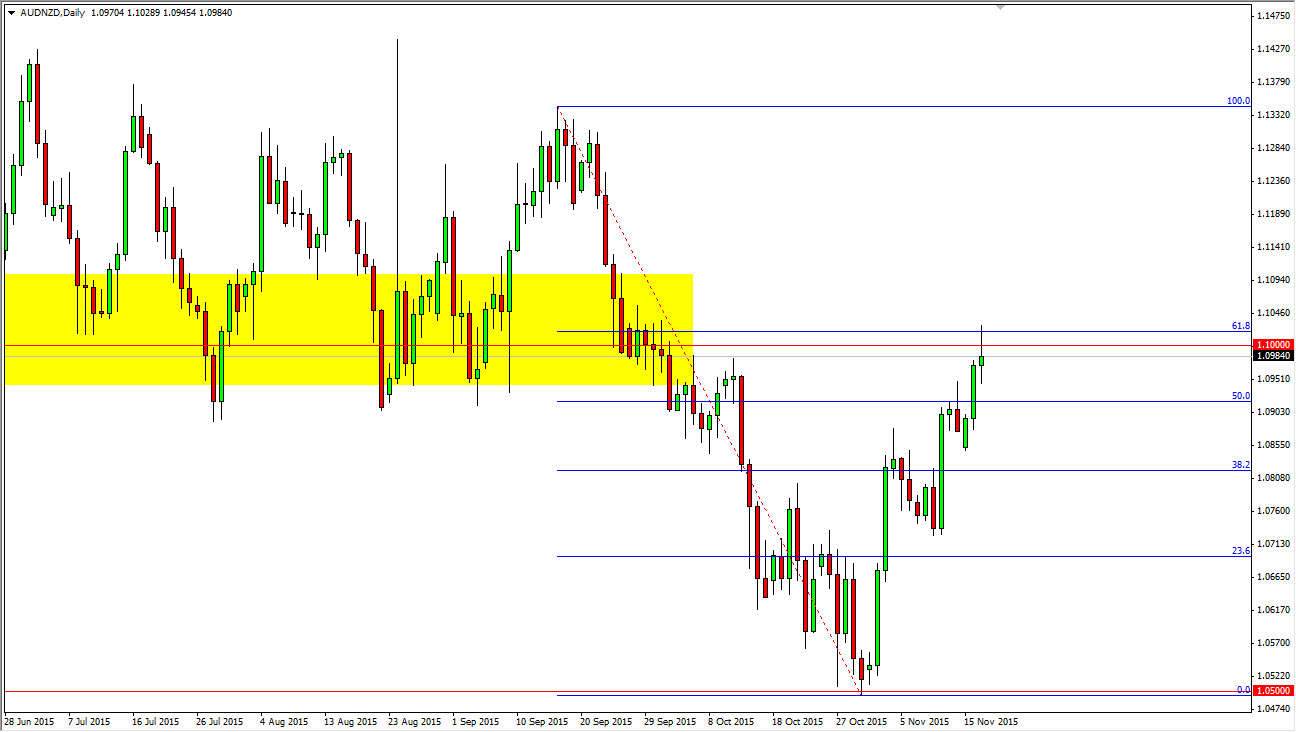

The AUD/NZD pair initially fell during the course of the session on Tuesday, but then turned back around to show significant resistance above. At that point, we turned back around and ended up forming a bit of a shooting star. The shooting star of course is a very negative sign, and as a result it has of course caught my attention. On top of that, the 1.10 level offered quite a bit of resistance, and the fact that we formed this shooting star at that area suggests that perhaps the sellers are starting to take notice. You also have to recognize that it was previously supportive, and with that I feel that this pair could fall from here.

However, I will admit that as recently as last week we had formed a candle that showed promise for a pullback at the 50% Fibonacci retracement level. I thought perhaps we could fall from there, but we did not for any real length of time. However, you have to keep in mind that this pair tends to be very choppy in general.

Intertwined Economies

The two economies of New Zealand and Australia are very intertwined, and as a result this currency pair tends to be very choppy. I don’t think that’s going to be any different here, so we need to break down below the bottom of the shooting star in order for me to feel comfortable selling, but I think that would show that the 61.8% Fibonacci retracement has held. More importantly, the 1.10 level has held which of course has been important in the past.

Ultimately, I think the market will pay attention to this area and as a result this could be very important. If we break above the top of the shooting star, that would negate the negativity of this market and should send the market looking for the 100% Fibonacci retracement level, which is roughly 1.1350 according to my calculations. So having said that, depending on which direction we break, I’m just simply going to follow the market.