AUD/USD Signal Update

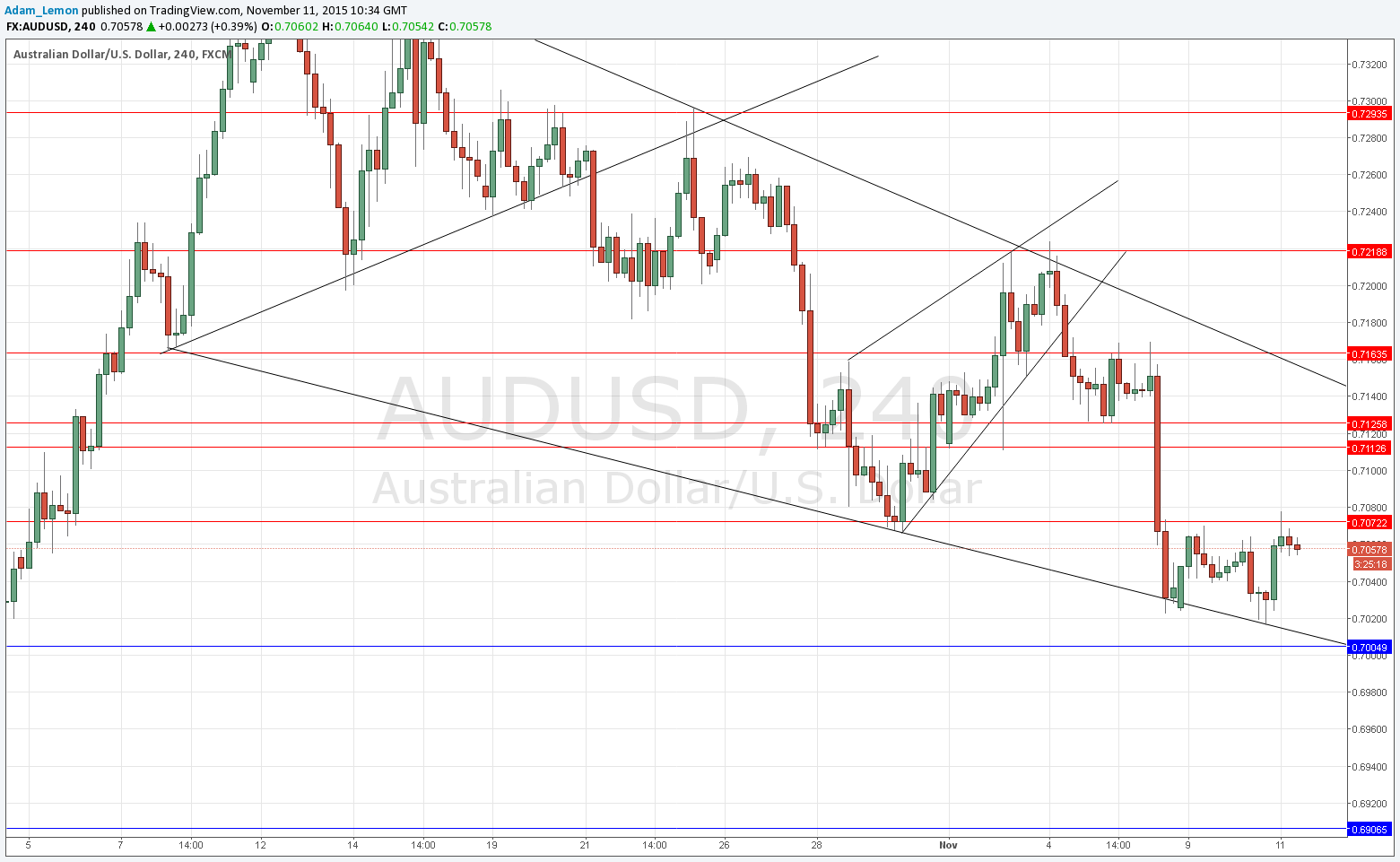

Yesterday’s signals produced a short trade off the bearish inside candle rejecting the resistance at 0.7072. As this trade doesn’t really seem to be going anywhere but is a few pips in profit it is probably best to close out for a small win.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be made between 8am and 5pm Tokyo time today only.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the supportive lower channel trend line currently sitting at around 0.7013.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7005.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 3

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7005.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 0.7113 and 0.7126.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 0.7155,

especially if it is confluent with a rejection of 0.7163..

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

This is a very nice pair to look at from a technical perspective as it is in very well-defined trend lines with quite clear support and resistance levels.

I see more potential on the short side so any pull backs to 0.7113 or higher levels can be expected to be good shorting opportunities. The resistance at 0.7272 has held but the price action looks too unclear to say this level is probably going to hold.

It is also worth noting that there will soon be great supportive confluence at around 0.7000: a key round number, a horizontal level, and a channel trend line are all coming together there.

There is nothing due today concerning the USD, it is a public holiday in the USA. Regarding the AUD, there will be releases of Employment Change and Unemployment Rate data.