AUD/USD Signal Update

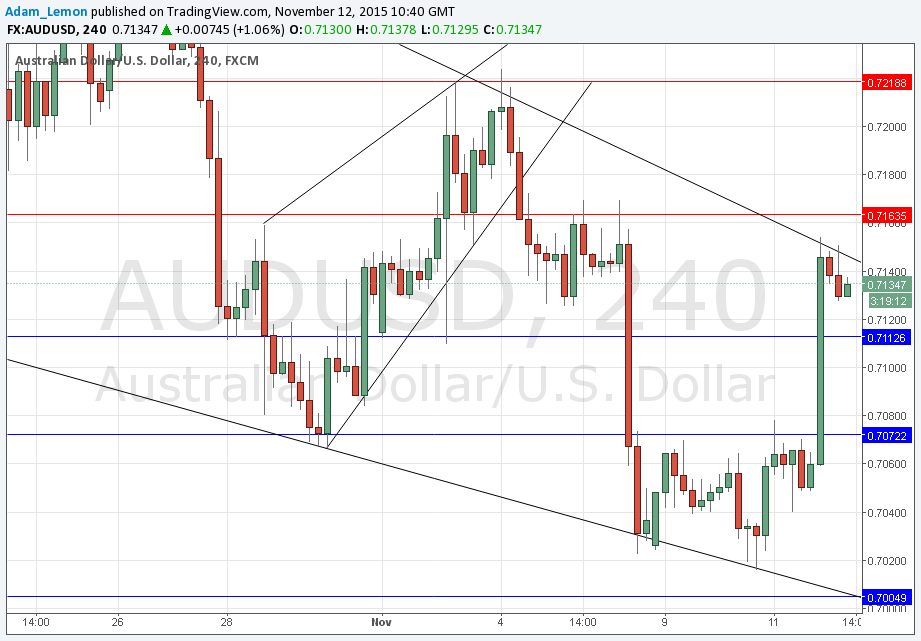

Yesterday’s signals might have triggered a short trade off the bearish trend line shown in the chart below at around 0.7150. Such a trade is becoming a pure gamble as we approach the volatility we should expect around the New York open.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be made between 9am New York time and 5pm Tokyo time today only.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7113.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7075.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 3

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7005, especially if such a rejection is confluent with a touch of the supportive lower channel trend line in the same area.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 0.7150 and 0.7163.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7218.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

The strong Australian job numbers, as well as the USD news due later today, has put this pair very much in focus. The price rose by more than 1% but was halted by the long-term channel trend line at around 0.7150.

This pair is behaving very well technically. I think the support levels are going to be stronger the lower we go, and the confluence around 0.7000 of a long-term trend line, proven support, and psychology are going to make that an extremely supportive level.

The bearish channel trend line may still hold but the price remains too close to it for comfort pending the new release.

There is nothing due today regarding the AUD. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time, followed at 2:30pm by the Chair of the Federal Reserve speaking at a conference.