AUD/USD Signal Update

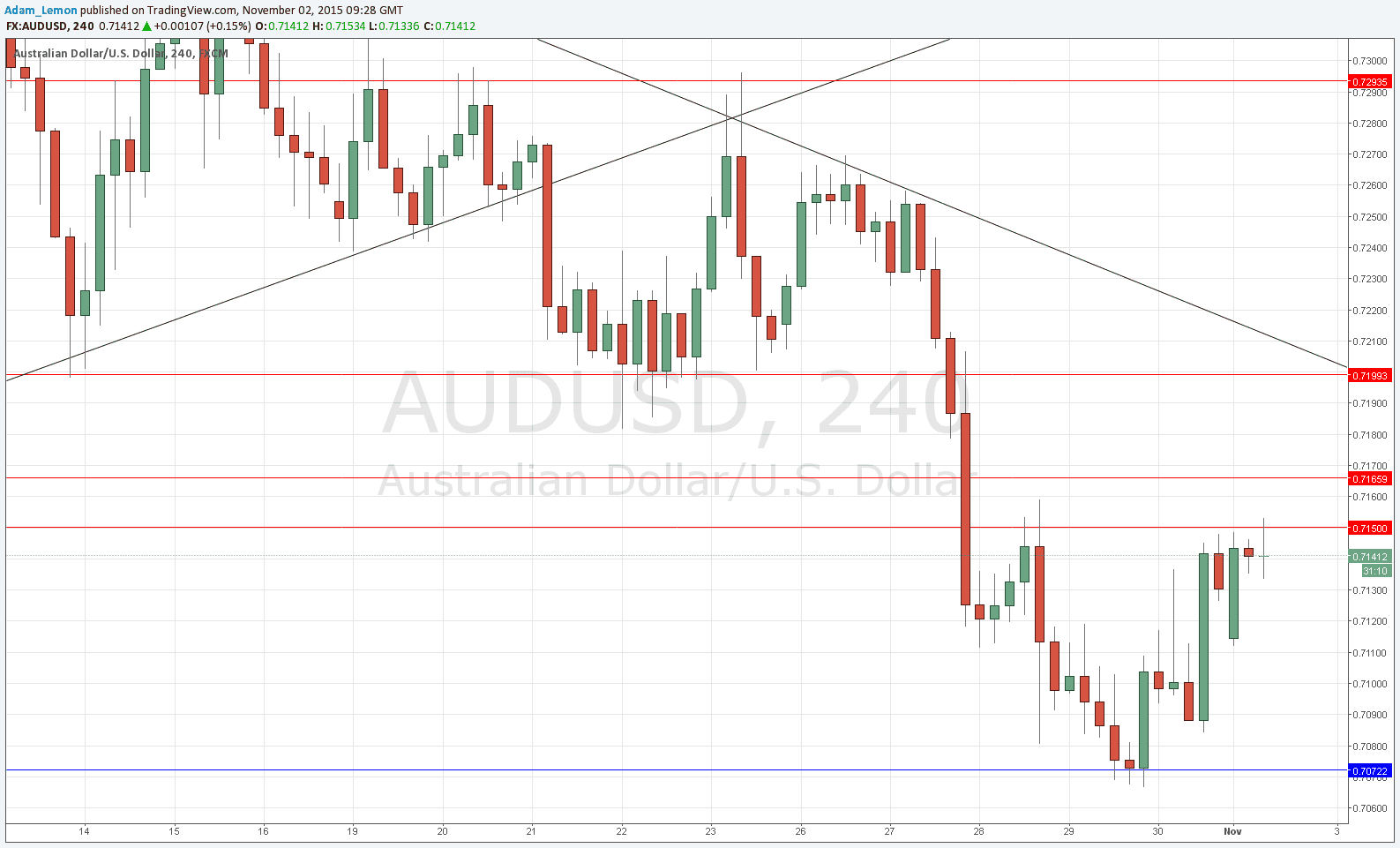

Last Thursday’s signals produced an excellent winning long trade from the bullish reversal off the anticipated support at 0.7072. This has been good for about 80 pips already. If you are still in the trade please be careful with the profit as there is a lot of resistance above and we have already touched the resistant level at 0.7150.

Today’s AUD/USD Signals

Risk 0.75%

Trades may be entered between 8am and 5pm New York time today only.

Long Trade 1

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7072.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 0.7150 and 0.7166.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7200. If this rejection is confluent with the bearish trend line, that will be even better.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

The AUD has been very weak over recent weeks. In fact it is vying with the CHF for the status of the weakest major global currency. However in recent days it has shown a recovery off the support at 0.7072 and is now bouncing gently off the first major resistance zone at 0.7150. The next resistance above that is a flipped horizontal level confluent with a long-term bearish trend line and a round number at 0.7200, so that level could be something really special. In any case it looks very much like it is time to look for short entries, provided we cannot get up past 0.7150 in any meaningful way. If we do get past there, watch out for 0.7200.

Regarding the USD, there will be a release of ISM Manufacturing PMI data at 3pm. Concerning the AUD, there will be a release of the RBA Rate Statement and Cash Rate at 3:30am London time.