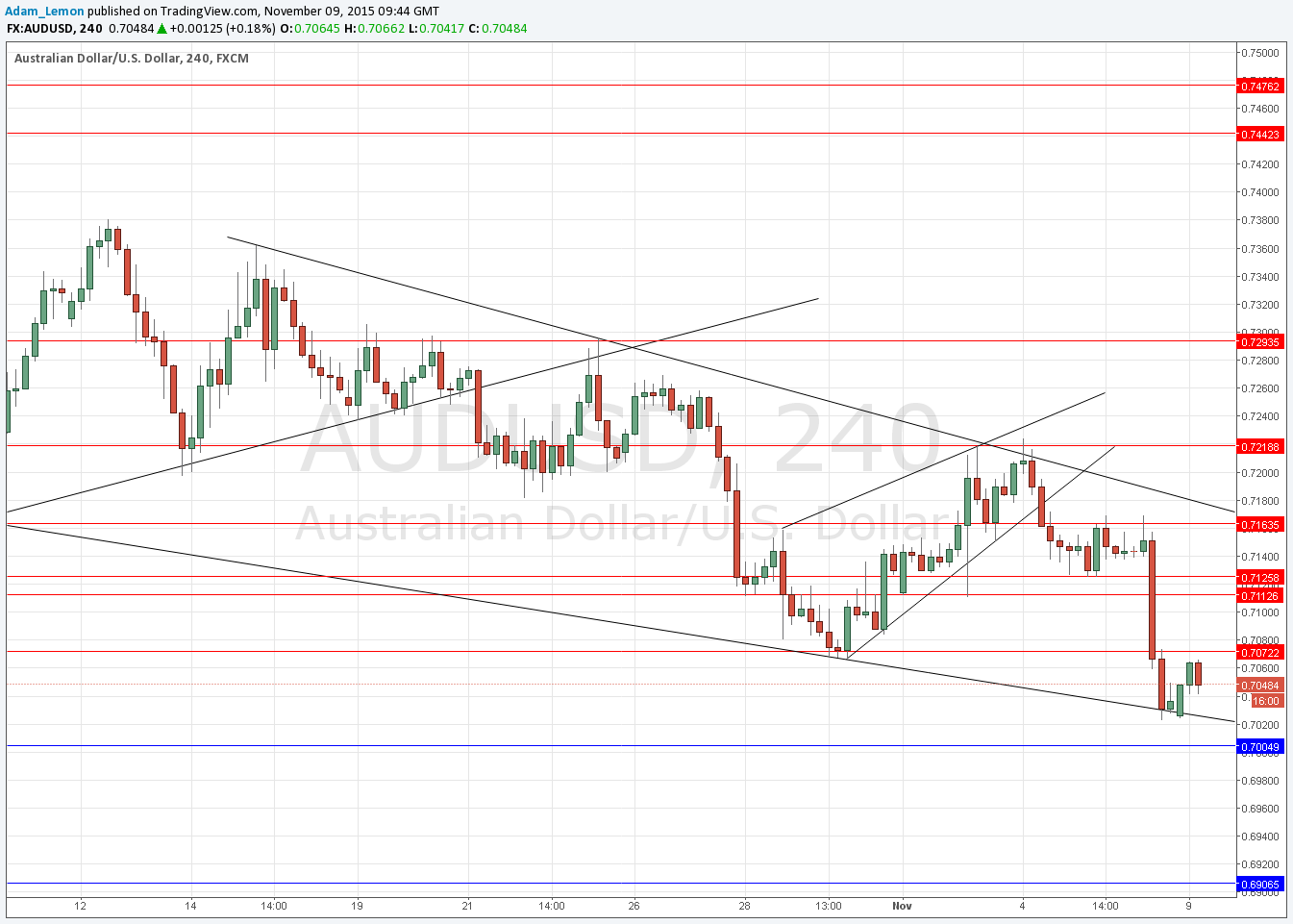

AUD/USD Signal Update

Last Thursday’s signals expired without being triggered as the bearish price action was higher than 0.7155.

Today’s AUD/USD Signals

Risk 0.75%

Trades may be entered between 8am and 5pm New York time today only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7005.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6907.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7072.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 0.7113 and 0.7126.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

I forecast yesterday that “a break below the first supportive trend line would suggest a trip down to at least 0.7150”. I was right about that but a little wrong about the price remaining within range until the RBA Rate Statement and USD Non-Farms due on Friday.

The area around 0.7150 remains important, in fact the price level at 0.7155 appears now to be acting as resistance but I am cautious of using that level.

There will probably quite a lot of volatility during the early Asian session tonight and early New York session tomorrow so anything might happen. It will probably be best to take such small profits as might be achieved before the Asian session begins tonight.

Regarding the AUD, there will be a release of NAB Business Confidence at 12:30am. There is nothing due concerning the USD.