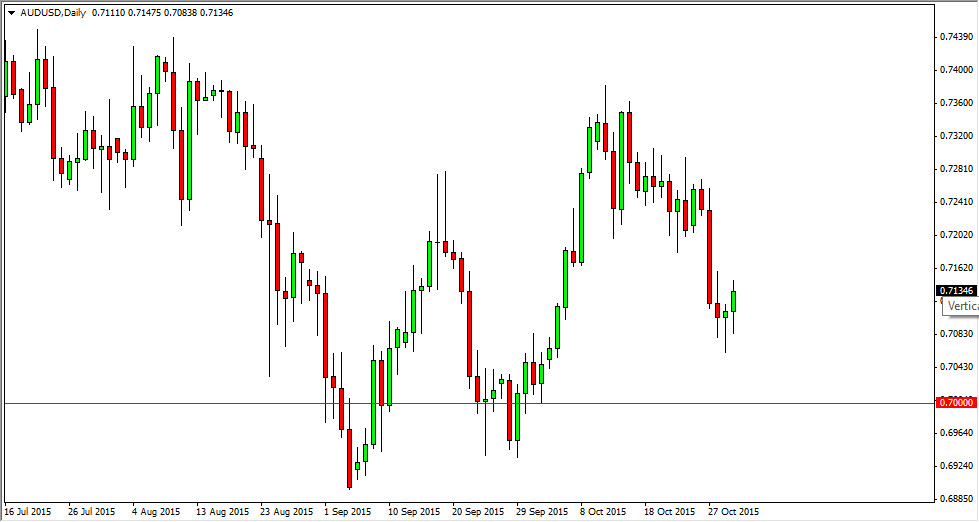

The AUD/USD pair initially fell during the course of the day on Friday, but found enough support near the 0.71 level to turn things back around and form a rather significant hammer. The hammer of course suggests that the market is going to go higher, probably reaching towards the 0.7250 level. What I also find interesting about this is the fact that the Friday candle was preceded by the hammer on Thursday. In other words, this is a market that’s ready to go much higher.

There is a significant amount of support just below, extending all the way down to the 0.70 level, which of course is a large, round, psychologically significant number. With that being the case, we feel that the buyers will continue to push this market much higher. We think it’s only a matter of time before we break out to the upside though, but at this point in time you have to keep in mind that the market will be very volatile, as the Australian dollar is highly influenced by the gold markets.

Buying dips

I think at this time you can start to look for dips to buy in this market on short-term charts. I don’t think that this can be a clean move either way, so be ready to trade off of short-term charts and take advantage of momentary weakness. I believe that volatility is going to be the way going forward for most Forex markets, so quite frankly there’s no need to be exposed for long periods of time.

Given enough time, I do think that the trend will change, but we are quite a ways from that happening anytime soon. Because of this, I believe that it’s going to be difficult to hang onto the Australian dollar for any real length of time, as we try to discern whether or not economic growth is coming or not. Ultimately, caution will be needed.