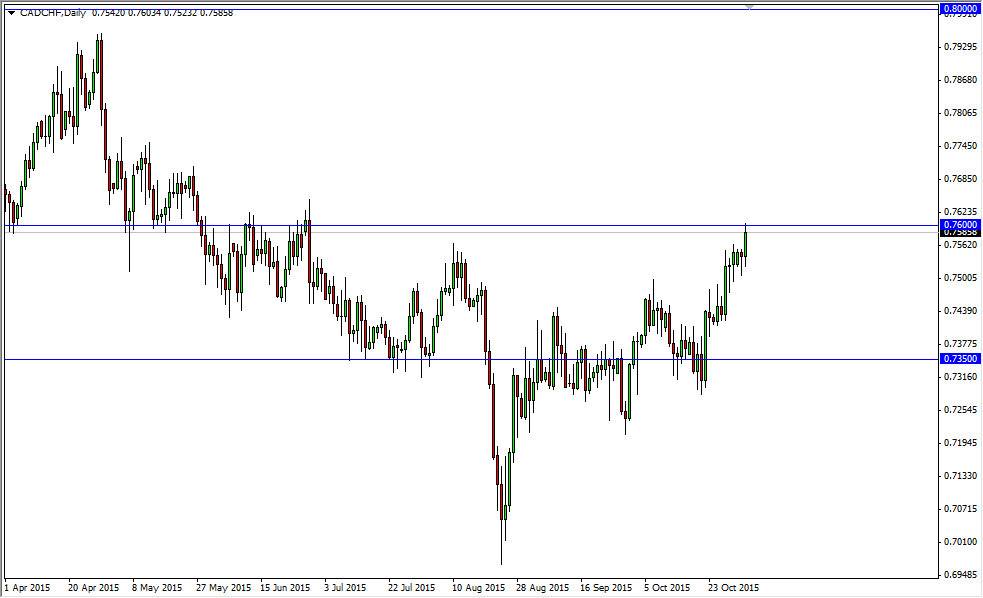

The CAD/CHF pair initially tried to fall during the course of the session on Tuesday, but as we had formed a hammer on Monday, it did suggest that we were going to go higher. We ultimately did, crashing into the 0.76 resistance barrier. This is an area that’s been resistance previously, specifically during the summer, and as a result it’s very likely that sellers will be attracted to this area, but if we can get above there it’s more than likely going to be a move that continues to go much higher. After all, the 0.80 level is the next major resistance barrier, and that gives is plenty of room to move. Having said that though, I do recognize that there is a significant amount of noise just above the 0.76 level, so I am not looking for a quick move to that level.

Canadian dollar strength

Interestingly enough, the Canadian dollar strengthened against the US dollar during the same session, and that suggests that the Canadian dollar will continue to strengthen overall. In a sense, this is a move into the Canadian dollar away from safety currencies as the Dollar and the Franc both are used as a way to protect capital, so it makes sense that perhaps we are starting to move into a little bit more of a “risk on” type of situation.

Crude oil did show a bit of strength during the day, and that of course shows that perhaps there will be more demand for the Canadian dollar itself. That could move money away from Switzerland and into Canada, and as a result I like the idea of buying above the 0.76 handle, but would prefer to see that area broken and closed above on a daily chart as it would show a little bit of resiliency on the move. On the other hand, if we formed a resistant candle here, it could lead to a decent shorting opportunity. Either way, I am not making a move in this pair until we see the daily close.