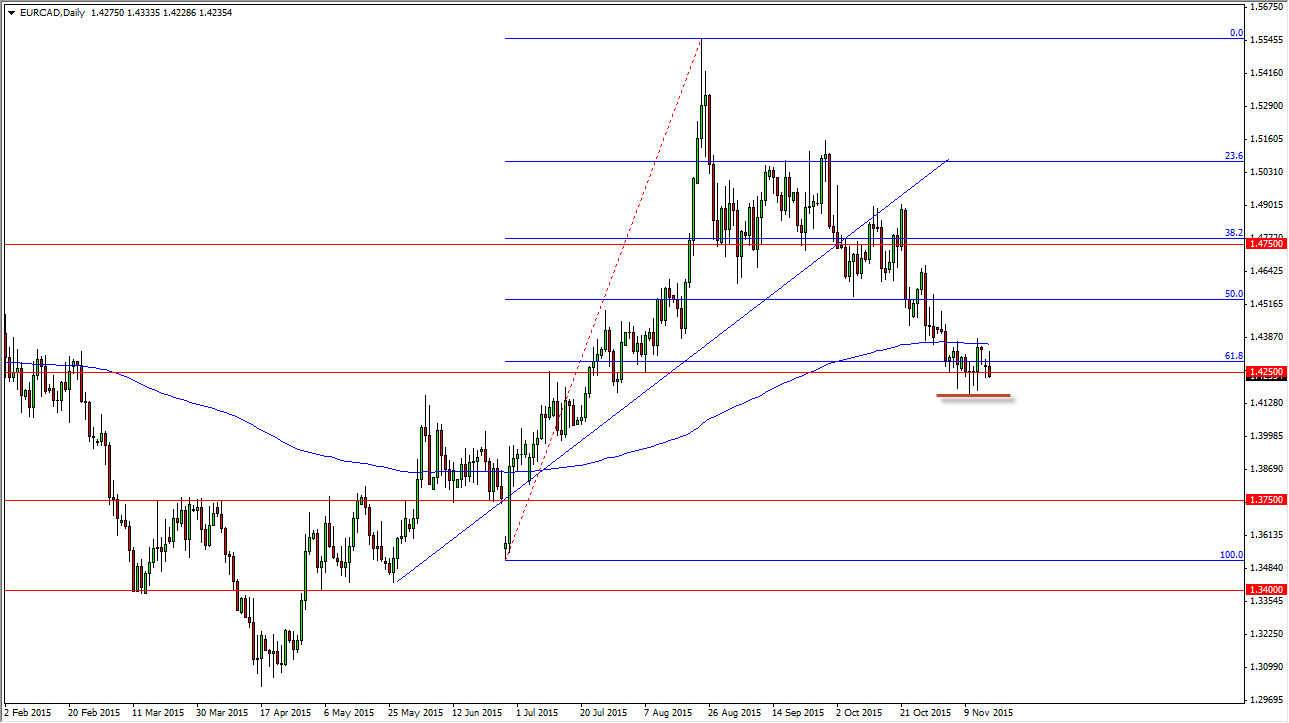

The EUR/CAD pair initially tried to rally on Monday, but turned back around to form a bit of a shooting star. I find several things interesting about this pair at the moment, not the least of which that it has the Canadian dollar in it. After all, the oil markets look absolutely anemic, and that works against the value the Canadian dollar. However, it appears that the Canadian dollar is going to continue to strengthen against the Euro. This tells me just how vulnerable the Euro is at the moment.

Looking at the chart, you can see that there is the 200 day exponential moving average just above the recent consolidation area, and that of course is a long-term trading signal. The fact that we are below there suggests that the trend is changing to the downside. On top of that, the uptrend line had been broken previously, and we are now hanging about the 61.8% Fibonacci retracement level. This is an area that only attract a lot of buying, but I think if we break down to a fresh, new low - the market falls apart.

Empty Air Underneath

If we can break down below the recent low from last week, it makes sense that we go to at least the 1.3750 level below, and if not below there, perhaps to the 100% Fibonacci retracement level which is rather common after you break down below the 61.8% level. With this being said, I believe that selling short-term rallies will be the way to go going forward, and then eventually we will break down. However, I am willing to buy this pair under a couple of circumstances.

If the oil markets absolutely collapsed, it is possible that perhaps we would get a rally over here in this market. On the other hand, if we can break above the 200 day exponential moving average significantly, I would be a buyer of this pair for the short-term. Ultimately though, this market looks extraordinarily vulnerable.