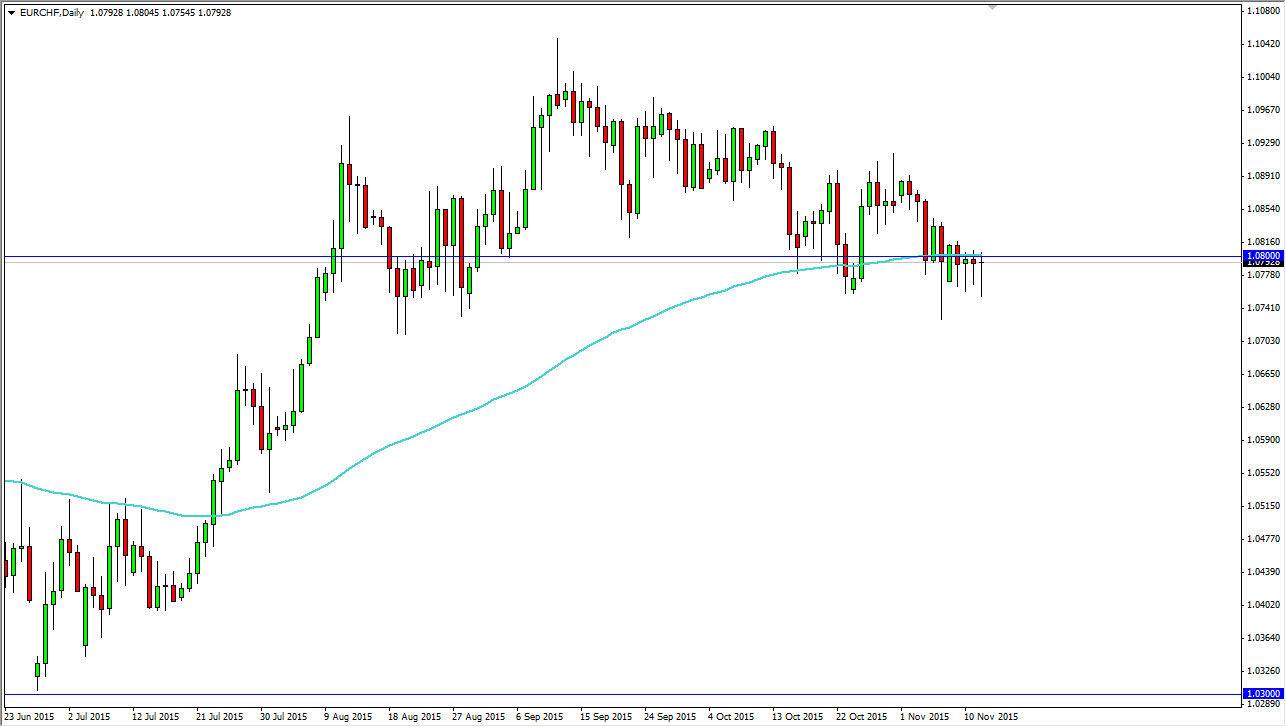

The EUR/CHF pair initially fell during the course of the session on Thursday, but turned back around to form a hammer yet again. Ultimately, this is a market that continues to show massive amounts of support in this area, just below the 1.08 handle. This is a market that shows a lot of interest in this general vicinity, based upon the action that we’ve seen in this area time and time again. Also, the fact that we have formed so many hammers in a row suggests that there are plenty of buyers below. Of course, you have to keep in mind that there are other factors as well.

The Swiss National Bank has been actively working against the value the Swiss Franc again, as noted in financial statements that were released recently. Because of this, it makes sense that this would be the pair where they spend most of their money. A break above the top of the hammer, and more importantly the 1.08 level is reason enough for me to start buying this pair.

Confluence of Support

The 100 day exponential moving average of course is offering quite a bit of support based upon the large, round, psychologically significant number, and of course the recent impulsive move higher showed that this pair was ready go to the upside. Although I don’t like the Euro in general, the fact is that the Swiss Franc is being manipulated, just as it was for several years previously.

If we can break above the top of the range for the day, I feel the market eventually goes to the 1.09 level, and then eventually the 1.10 handle. If we get above there, I feel at that point in time it becomes more or less a “buy and hold” type of situation as it should send this market looking to close the move that occurred after the currency peg was abandoned at the 1.20 level. I have no interest whatsoever in selling.