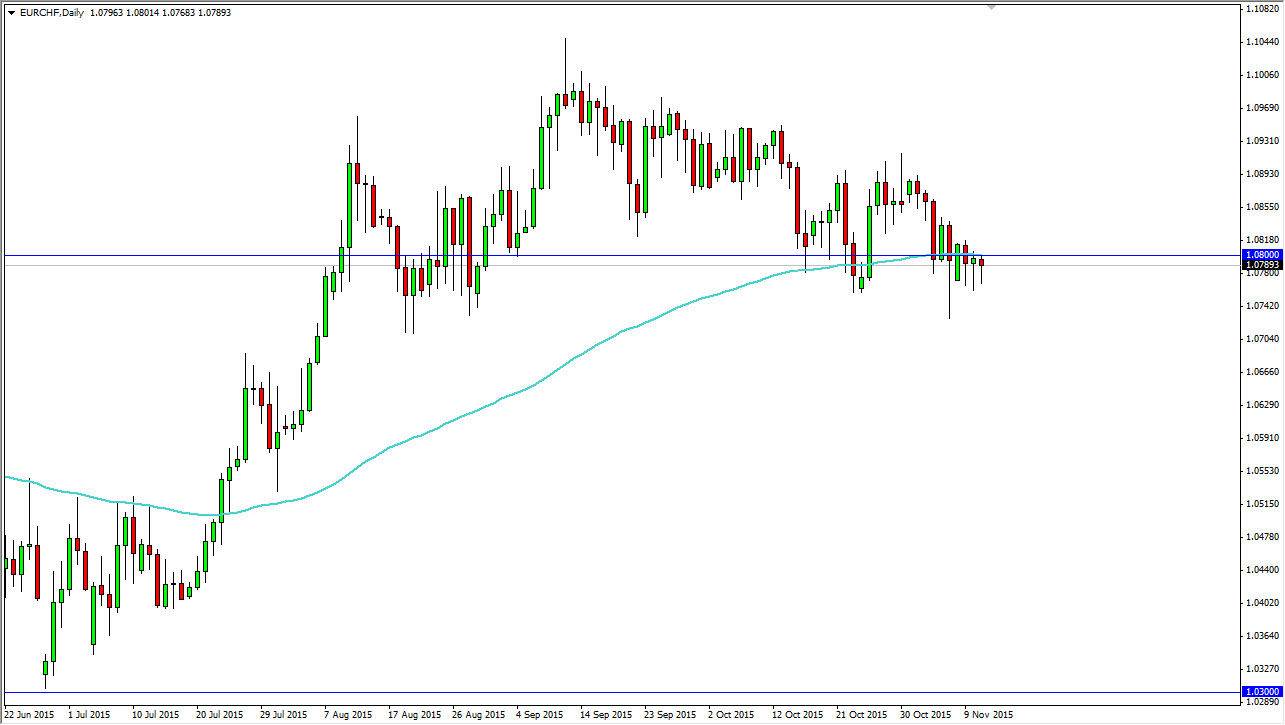

The EUR/CHF pair initially fell during the course of the day on Wednesday, but turned back around to form a hammer yet again. This is the third session in a row that we have seen this, and as a result I believe that this market is essentially forming a “floor” at this level. Recently, it has been reported that the Swiss National Bank has been buying Euros again, essentially supporting this market. While this isn’t necessarily as strong of a move as the currency peg had been for 4 years, the reality is that it still puts a little bit of a supportive barrier below this market.

The fact that the candle of course is a hammer also has me interested in going long, and I believe that if we can get above the 1.08 handle we should continue to go even higher. I believe that the next level is the 1.09 level, followed by the 1.10 level after that breakout. Ultimately, if we can break above that level, at that point in time I feel that the market will continue to go much, much higher.

Confluence of levels

Looking at this chart, I believe that there is a bit of a confluence of levels here, as the 1.08 level has been so supportive in the past, as well as resistive from time to time. Ultimately, we also have to look at the fact that the 100 day exponential moving average is currently just above current prices, and as a result I believe that the longer-term traders are starting to get involved yet again. On top of that, I believe that eventually the Swiss National Bank will get its way, and we will break out to the upside. I recognize that although they had to give up previously, they did in fact put up a fight for several years. The Forex market certainly will not have forgotten that. Ultimately, I believe that this pair is bullish.