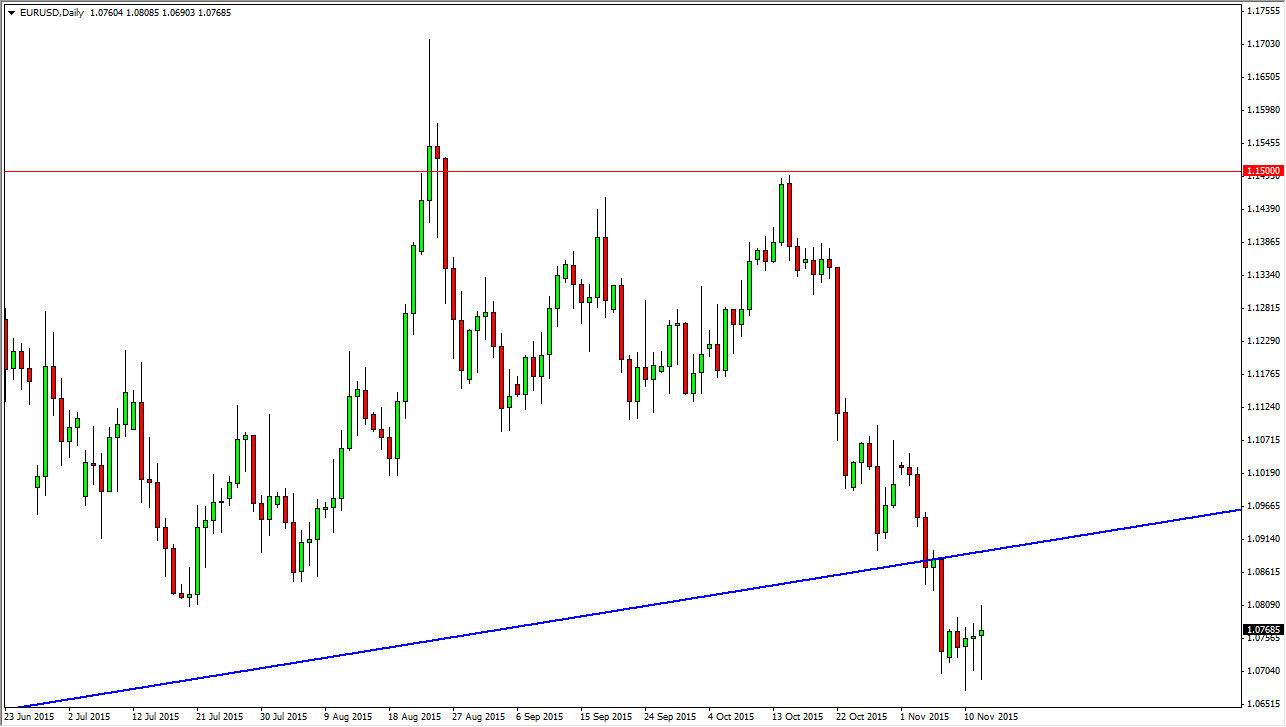

The EUR/USD pair had a fairly volatile session during the day on Thursday as we continue to bounce around the 1.0750 region. This is a market that has broken down significantly lately, and it now looks as if the 1.07 level is offering quite a bit of support. However, I also recognize that the previous uptrend line of course should be resistive now, and with that being the case, I feel it’s only a matter time before the sellers get involved again.

When we reach that area, I would fully anticipate a resistive candle that I can start selling. The fact that we formed something akin to a hammer during the session again on Thursday suggests to me that the rally is coming soon. In other words, even if we rally today, I don’t know that the trade will present itself right away. However, this is a classic “break down, retest, and continue” type of scenario.

Central Banks

The central bank situation of course has the European Central Bank recently suggesting that more stimulus was needed, and that was compounded by the jobs number coming out better than anticipated in the United States. In other words, this sets up a bit of a steady trade, to the downside of course. I don’t think that were going to break down significantly though, I think this will be more or less a grind, so short-term traders will continue to take advantage of short-term selling opportunities.

I believe that the 1.05 level should continue to be supportive, and for this moment I am thinking that it is essentially the “floor” in this market. I would not be interested in buying this pair until we get above the 1.11 level, which would show a bit of a momentum pick up and a break out to the upside. In the meantime though, I anticipate that it would be very difficult for that to happen.