EUR/USD Signal Update

Yesterday’s signals expired without being triggered as the bullish price action at 1.0684 did not take place until after London closed.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered between 8am and 5pm London time today only.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0684.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.0800 and 1.0813.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0846.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

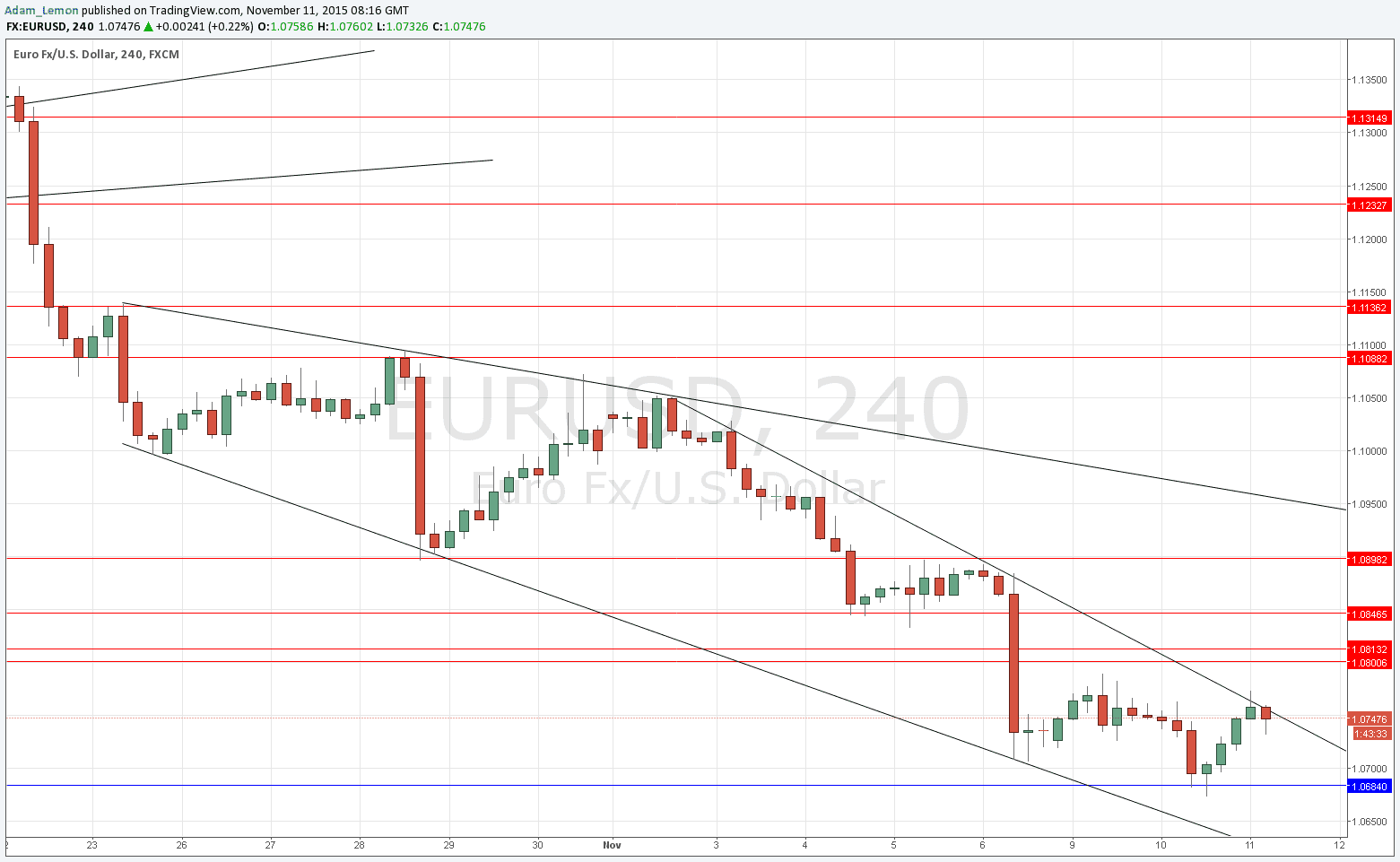

EUR/USD Analysis

Yesterday the price of this pair behaved very predictably, breaking through the Asian session low, retesting it and continuing down to the support level I had anticipated at 1.0684. Then at this point the price rose quite bullishly off this support during the late New York session. During this last Asian session, the price rejected the steep bearish trend line, but the price is showing a reluctance to move down again at the time of writing.

It is hard to say what might happen next, but another move down to 1.0684 could still produce a good long trade, and a break above that steep bearish trend line should see a move up to 1.0800 or at least very close to that level.

There is nothing due today regarding the USD, it is a public holiday in the USA today. Concerning the EUR, the President of the ECB will be speaking at a conference at 1:15pm London time, but this probably will not have a great impact upon the Euro.