EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered between 8am and 5pm London time today only.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.0868 and 1.0813.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 1.1020.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone from 1.1088 to 1.1136.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

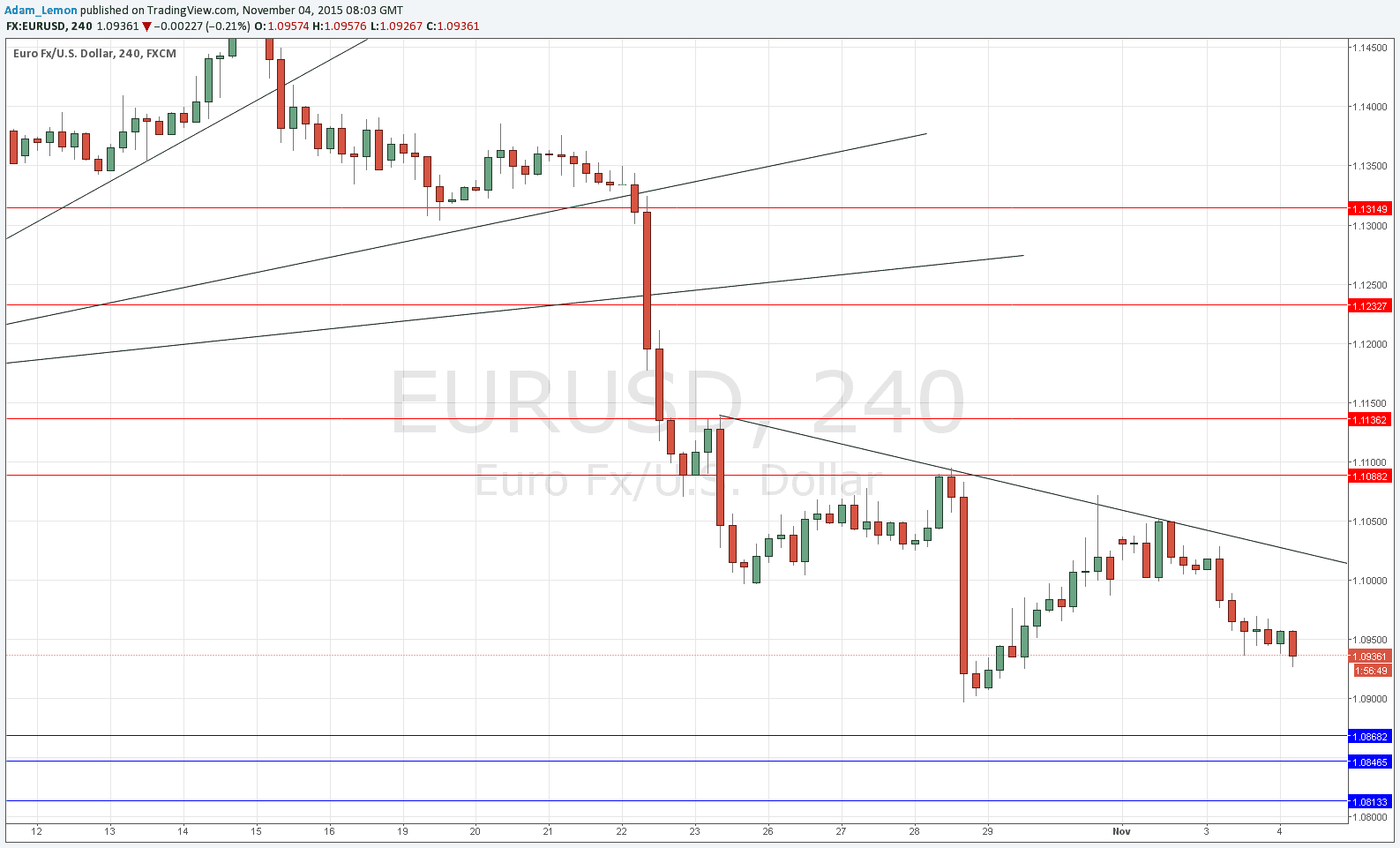

EUR/USD Analysis

This pair is starting to get interesting, as it threatens to break below the recent swing low of 1.0900 and test some very strong support levels between 1.0813 and 1.0868. The last time the price was down here there was extremely powerful buying and the price went rocketing up. It is the lower end of an obvious multi-month range that this pair has been stuck within, so anyone who is prepared to trade long and hold it should be thinking about going long if the price gets down there and starts to turn around.

Before we can reach these levels there is of course recent support at 1.0900 and we may well form a double bottom at this round number first.

Above there is plenty of good resistance: the short-term bearish trend line that is becoming confluent with the key round number of 1.1000, and a zone above there around the next round number at 1.1100.

Regarding the EUR, the President of the ECB will be speaking at 9am London time. Concerning the USD, there will be a release of the ADP Non-Farm Employment Change Number at 1:15pm, followed by Trade Balance data at 1:30pm and then finally ISM Non-Manufacturing PMI and Fed Chair testimony at 3pm.