EUR/USD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action within the supportive zone until after London had closed.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken before 5pm London time today.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0847.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0entry into the zone between 1.0813 and 1.0800.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0898.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

Yesterday was an important day for this pair, as the Fed gave a clear signal to the market to expect a rate rise in December as more likely to occur than not. As the Euro has also been weakening, this pair fell quite strongly, cutting through support easily and is now just a few pips away from reaching multi-month lows. This of course is before we even get the Non-Farm Payroll numbers on Friday which will probably be crucial to the fortunes of the USD and this currency pair in particular.

The support at 1.0847 has held so far but it looks shaky. Below that are the multi-month lows that extend down to the 1.0800 in practice. Bear in mind that if the price does not break below there and the NFP is really disappointing, this could be a fantastic area to buy. However the sentiment remains very short and if that is instead supported by the NFP, we should get a strong break below 1.0800 which should also break 1.0700.

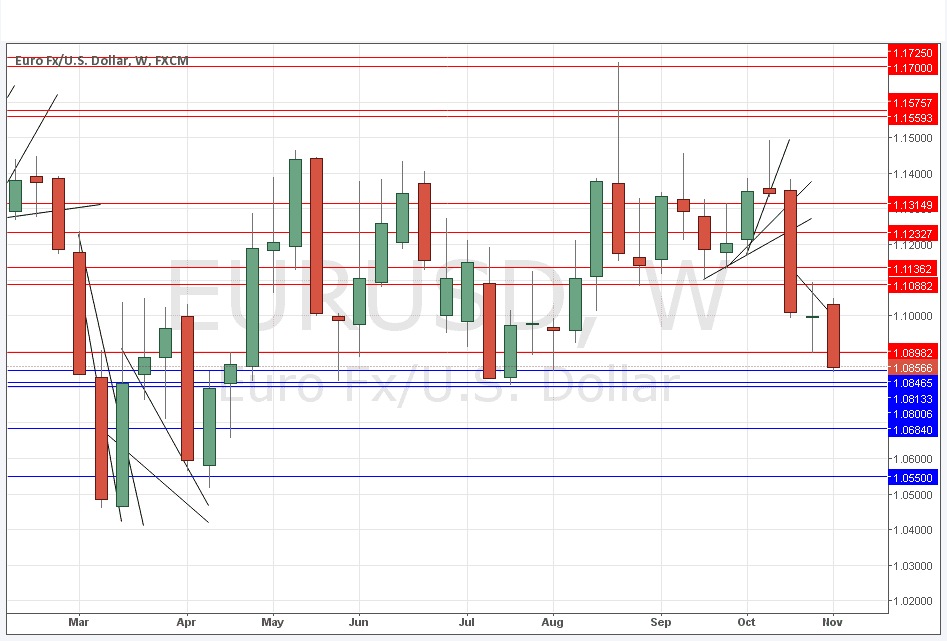

Weekly Chart:

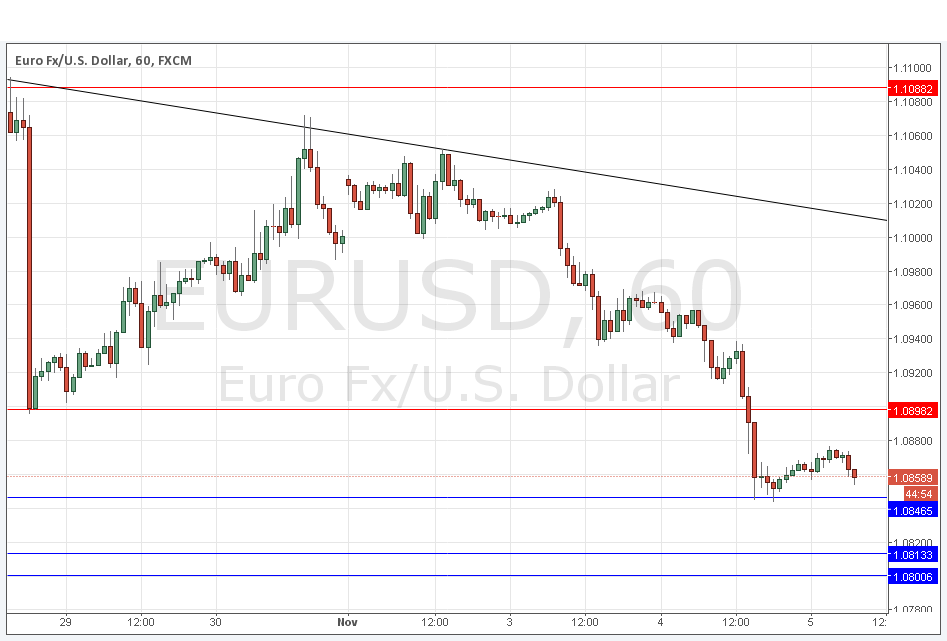

H4 Chart:

There is nothing due today regarding the EUR. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time.