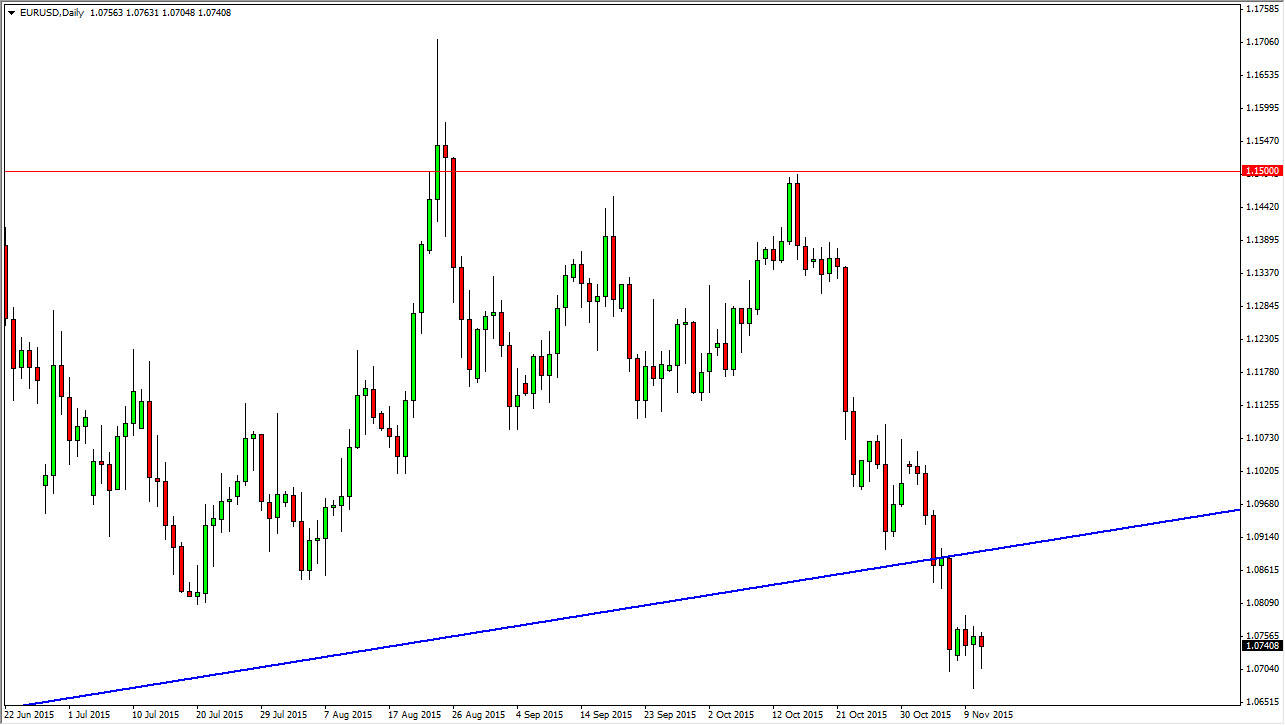

The EUR/USD pair initially fell during the course of the session on Wednesday, but bounced enough to form a little bit of a hammer. The hammer of course is a bullish sign but I do not pay too much attention to it. I simply think this means that we will get a selling opportunity from higher levels. After all, the uptrend line that sits just above on the chart previously had held out the market in the ascending triangle, and now that we are broken below there it is a pretty negative sign. I think that a bounce from here is simply the market trying to find resistance at higher levels. I think that once we get towards that uptrend line, we will see the sellers step back into this marketplace and push the Euro down again.

Central banks

Keep in mind that the central banks continue to diverge as far as interest-rate expectations are concerned. The European Central Bank has recently stated that stimulus is most certainly on the table again, and that of course spooked the market and pushed the value of the Euro down. With that being the case, we then found ourselves with a stronger than anticipated employment number coming out of the United States. That puts pressure back on the Federal Reserve to raise interest rates in America, so it makes sense that we continue to go lower. There are other things that concern the market as well, as there seems to be quite a bit of volatility and uncertainty in the global economy.

With this being the case, I feel that a lot of people will continue to start buying the US dollar as a bit of a safety bit, and as a result the market is more than likely going to reach down towards the 1.05 level given enough time. As far as buying is concerned, I have no interest in doing so until we get well above the 1.11 handle.