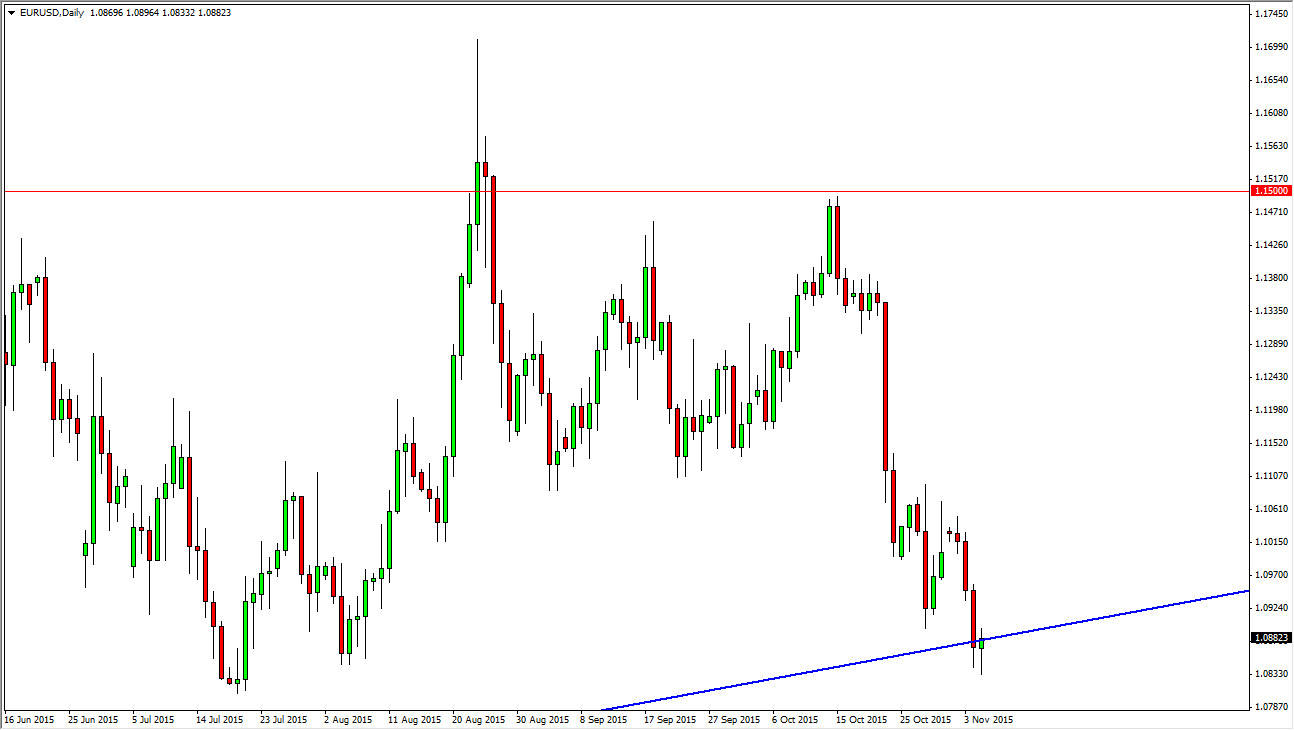

The EUR/USD pair initially fell during the course of the day on Thursday, but as you can see turned back around to form a nice-looking hammer. The fact that today is Nonfarm Payroll Friday certainly is no coincidence, just as the reality that we are sitting on top of the uptrend line that has continued to keep this market afloat for the longer-term isn’t either. Because of this, I think that the hammer is suggesting that the announcement is going to be huge for the future of the currency pair.

I think it is quite simple, but we will have to wait until the end of the day in order to place a trade in my opinion. If we break to the top of the hammer, and stay above there, I believe that this market continues to consolidate and reaches towards the 1.13 level, after fighting resistance of the 1.11 level. On the other hand, if we break down below the bottom of a hammer, we will more than likely break below the 1.08 level, and then the 1.05 level after that.

Ascending triangle

We have been in an ascending triangle for some time now, and with that it makes sense that the upward pressure isn’t ready to abate anytime soon. With fact, I think that breaking down will be difficult, but we need to see a daily close well below the bottom of the hammer in order to feel comfortable. I believe that waiting until the daily close or at least close to it is what you’ll have to do. Historically, Nonfarm Payroll Fridays tend to be very volatile anyway, and on a day like this where a lot is being decided, it will only be more so than usual.

I do think that ultimately we will have to make some decisions at the end of the day, especially considering that the European Central Bank has recently suggested that quantitative easing could be coming, and the Federal Reserve Chairwoman Janet Yellen just suggested that negative rates could be coming out of the United States. This is going to be a messy market.