The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 8th November 2015

This week I have no hesitation in saying that the best opportunities are likely to be following momentum, as we now have one currency that is clearly strong and two or three others that are clearly weak. Looking to long the strong currency against the weaker currencies is probably going to be a good strategy.

Fundamental Analysis & Market Sentiment

The strong currency is the USD. The fundamental data could be stronger, but just last week we had the Federal Reserve signaling that a rate hike in December is more likely than not to happen. Market sentiment has moved from a belief that there is about a 1 in 3 chance of such a rate hike happening, to a belief that it is more likely than not. This was then followed on Friday by a really strong NFP data release that was the strongest number for years and was far in excess of the market’s expectations. The position technically for the USD also looks strong. The currency rose across the board following both of these events, and is now trading higher than it was 3 months ago against every major global currency.

Weaker currencies are a little less clear but there are four that stand out: the CHF, GBP, AUD and EUR. Let’s take each currency in turn.

Swiss fundamentals are neutral. However there is a feeling that the “real” Swiss economy has been in trouble for a while, and the SNB wants to see the CHF fall in value to make Swiss exports more competitive. One tool to achieve this was setting a negative interest rate of 0.75%. This negative rate combines with the gloomy economic sentiment to produce a currency that feels weak.

British fundamentals are neutral. However the Bank of England gave a surprisingly dovish monthly report last week, revising its forecasts downwards. Market sentiment has turned very bearish on this currency since that report.

Australian fundamentals are neutral. The RBA gave a slightly more upbeat outlook with its last report but sentiment still feels bearish, with the market seeming to expect more weakening over the coming year.

Eurozone fundamentals are slightly negative, with most data coming in below expectations lately. The ECB recently announced an extension of its QE program and the market has bearish sentiment here without a doubt.

This suggests that the weakest currency is probably the EUR, although the CHF and GBP are quite positively correlated with the EUR so they are also good candidates, as well as looking fairly weak in their own right. The AUD is separate. It would seem that if you must pick one, it would be the EUR, but I am more comfortable looking at all 4 equally, possibly giving more weight to the EUR, or treating the European currencies as a basket and the Australian dollar as something separate.

Technical Analysis

EUR/USD

The price action looks very bearish, with the price continuing to make new 6 month lows. There is probable resistance beginning at 1.0800. Beware of the major multi-year low at around 1.05. Note that the movement of the last 3 weeks is very strong.

USD/CHF

The price action looks very bullish, with the price continuing to make new 7 month highs. There is probable support beginning at 0.9975. Beware of the major multi-year high just above 1.02 and the recent swing high at around 1.01. Note that the movement of the last 3 weeks is extremely strong.

GBP/USD

The price action looks very bearish, with the price continuing to make new 6 month lows. There is probable resistance beginning at 1.5078. Beware of the major multi-year support below. Note that the movement of the last week is extremely strong.

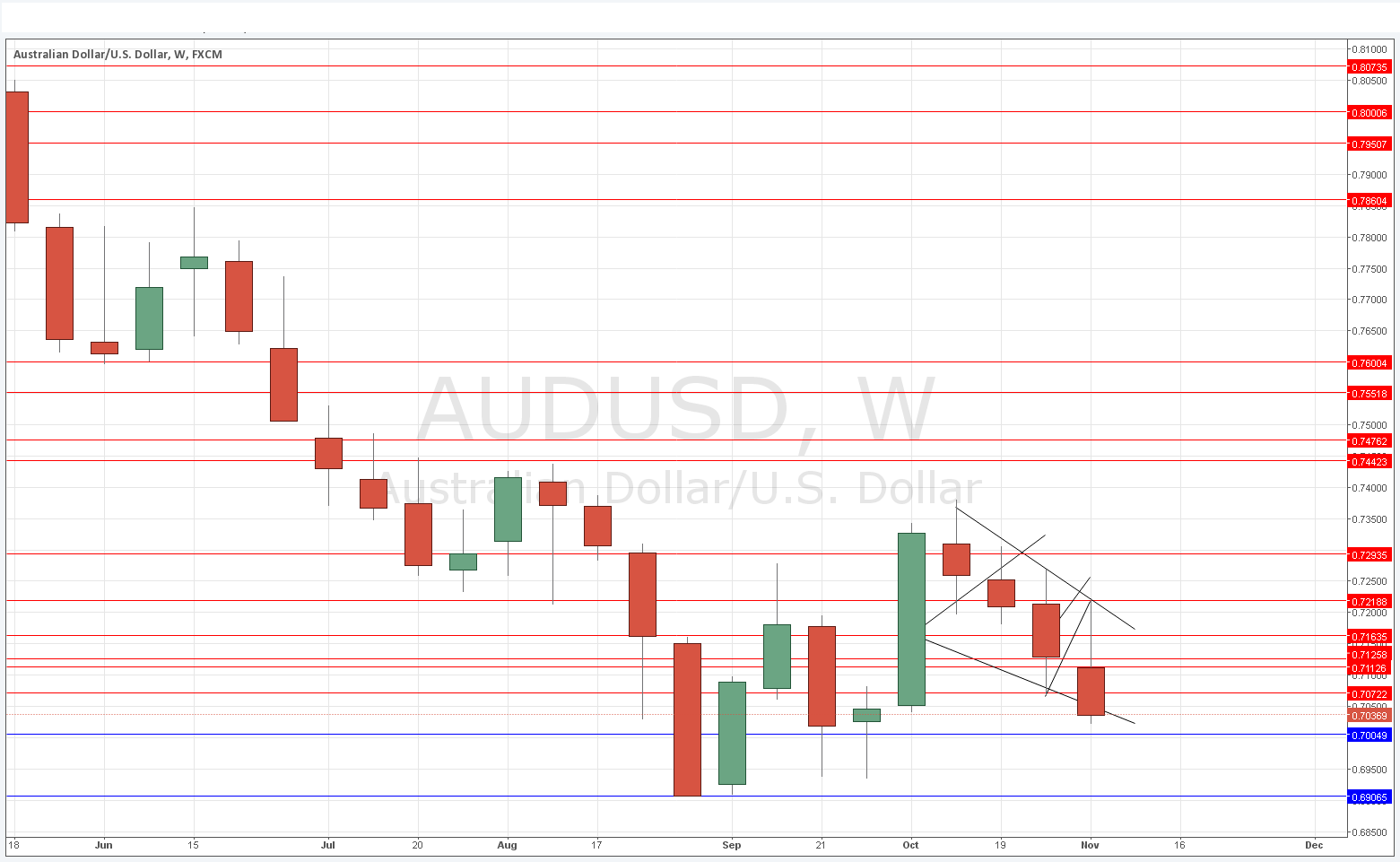

AUD/USD

The price action looks very bearish, with the price falling off a well-defined trend line. The price has fallen by about 5% over the past 3 months, which is a great deal. However it should be noted the price is not making new multi-month lows. There is probable resistance beginning at 0.7072. Beware of support below 0.7000. Note that the movement of the last 4 weeks is quite strong.

Technically, it looks as if the strongest move over the coming week is likely to come in GBP/USD.