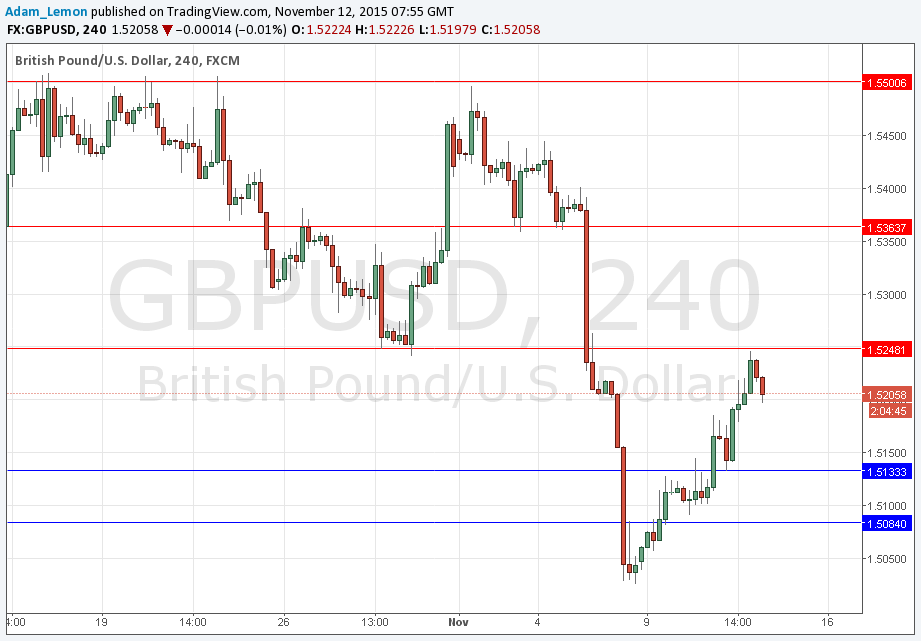

GBP/USD Signals Update

Yesterday’s signals expired without being triggered as the price did not reach 1.5217 until after London closed.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered only before 5pm London time today.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5133.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5084.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5250.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

This pair has shown some bullishness that is a little surprising. It reacted to the slightly disappointing GBP news yesterday by falling by just a few pips before continuing its bullish advance.

The key psychological level which also seems to be a flipped support to resistance level at 1.5250 has been threatened but will probably be harder to break. That will probably take a poor USD data release later today.

There will probably be little action before the New York open later today.

There is nothing due today regarding the GBP. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time, followed at 2:30pm by the Chair of the Federal Reserve speaking at a conference.