Gold prices sank nearly 2% on Friday to settle at their lowest level since August 7 as robust U.S. economic data fed expectations that the Federal Reserve could begin altering monetary policy in December. The XAU/USD pair traded as low as $1085.42 an ounce after the government report showed that the U.S. economy added 271K jobs in October, far surpassing consensus estimates of 181000, and average hourly wages jumped 0.4%. Data also showed that the unemployment rate dropped to 5.0% from 5.1% and gains for the prior two months were revised up by a total 12K. The case for the Federal Reserve to hike interest rates sooner than previously thought is getting more likely and that is keeping gold under pressure.

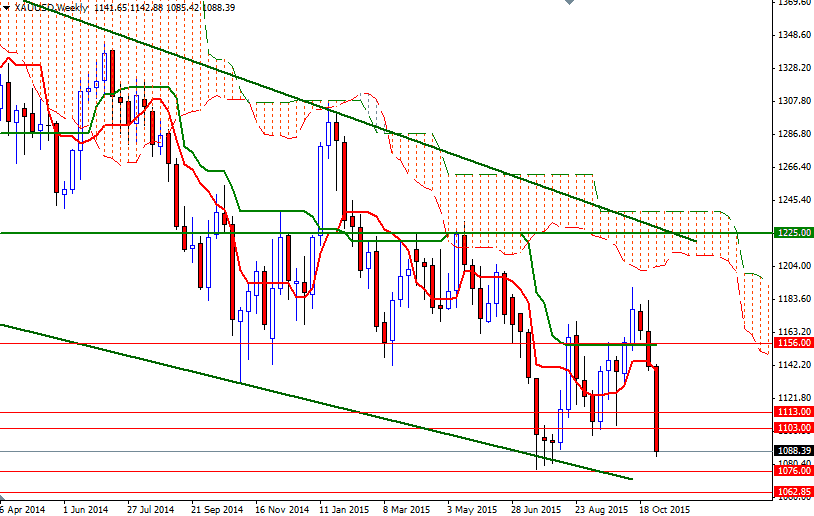

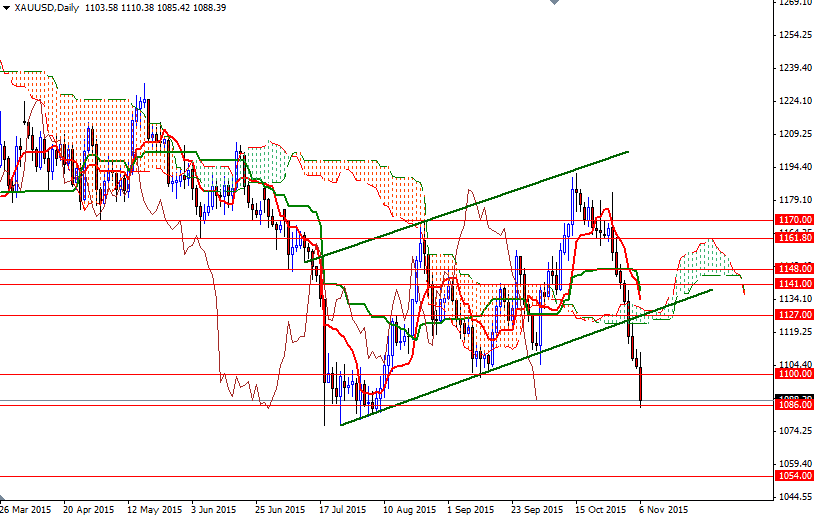

Another key factor that has been eroding the appeal of gold was stability in stock markets. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 116342 contracts, from 157434 a week earlier. The technical picture remains gloomy, with the market trading below the weekly, daily and 4-hourly Ichimoku clouds, plus gold broke below the ascending channel which had been developing since late July.

If the bears continue to dominate the market, based upon the measurements, I wouldn't be surprised to see XAU/USD reaching the 1045 zone. Down in the 1086/3 region, we have the first minor support which the bears have to overcome. Falling through 1083 would suggest that the bears are getting ready to challenge the support at 1076. A daily close below 1076 could trigger a fresh sell-off that can drag XAU/USD towards the 1062.85 level. On the other hand, if the support below remains intact and prices turn north, the bulls may find a chance to test nearby resistances at 1096 and 1098.27. Beyond that, more resistance may be found at 1103.