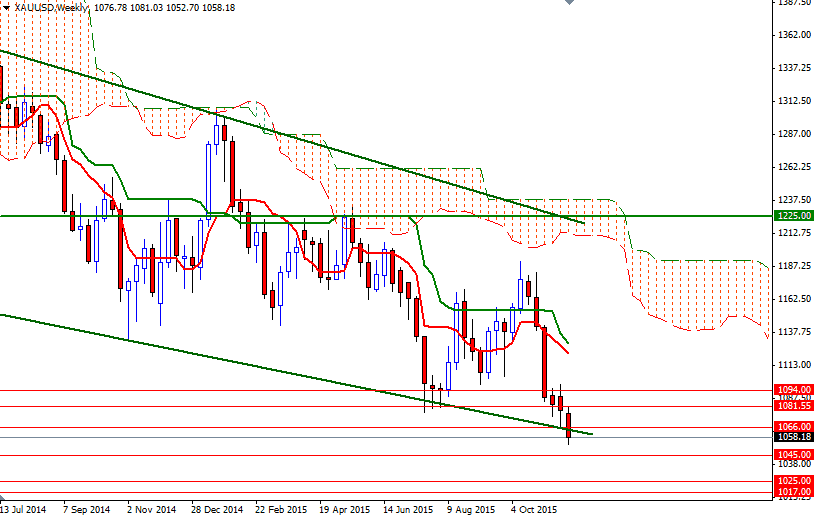

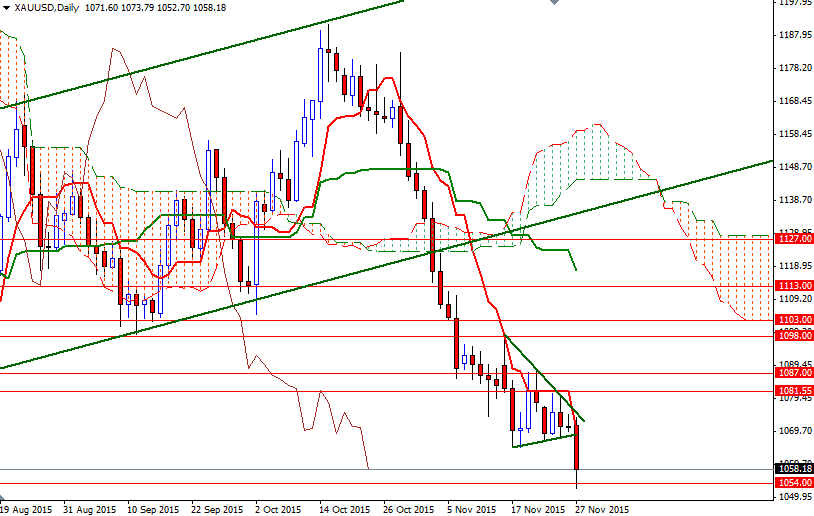

Gold prices settled at their lowest level since November 2, 2009, recoding a sixth consecutive weekly loss, as the dollar's strength continued to weigh on investor sentiment. The market spent most of the month under selling pressure after prices broke below the ascending channel originating in July and closed below the daily Ichimoku cloud. This development put the XAU/USD pair on track to target at $1045. Although prices stalled at $1066 (and formed a triangle during the consolidation period), the bears finally captured this area and tested the support at $1054.

The steep drop in prices demonstrates that market players have very limited interest in gold. Investors are understandably cautious as the dollar remains well supported by expectations that the Federal Reserve is set to raise interest rates before the end of the year. Fed officials have been emphasizing that it will soon be appropriate to begin a new policy phase, if the data and the outlook justify such a move. Traders will be eyeing key U.S. economic data closely, particularly the highly anticipated non-farm payrolls report on Friday, to speculate on the timing. However, I think the most important question is: how much of a liftoff in December is already factored in?

There is no sign that the strongly bearish trend has ended or is about to end. XAU/USD is moving below the Ichimoku clouds on all time frames and the Chikou-span (closing price plotted 26 periods behind, brown line) also indicates that there is further downside risk. On the other hand, the market is in oversold conditions, as the market has dropped from the 1180 level to the 1050 region in just six weeks. It seems that a short-term pull back is overdue but in order to support this theory, prices have to anchor somewhere above the 1081.55 level which happens to be the top of the 4-hourly cloud. In that case, we could see a renewed push up to 1098/4 or even 1105/3. The area between 1103 and 1127 is currently occupied by the daily clouds so it will probably be highly resistive. To the downside, I will keep an eye on the 1045/2 region. If this support is broken, then we are likely to proceed to 1025. Dropping through 1025 would make me think that 1017 and 1007 will be tested afterwards.