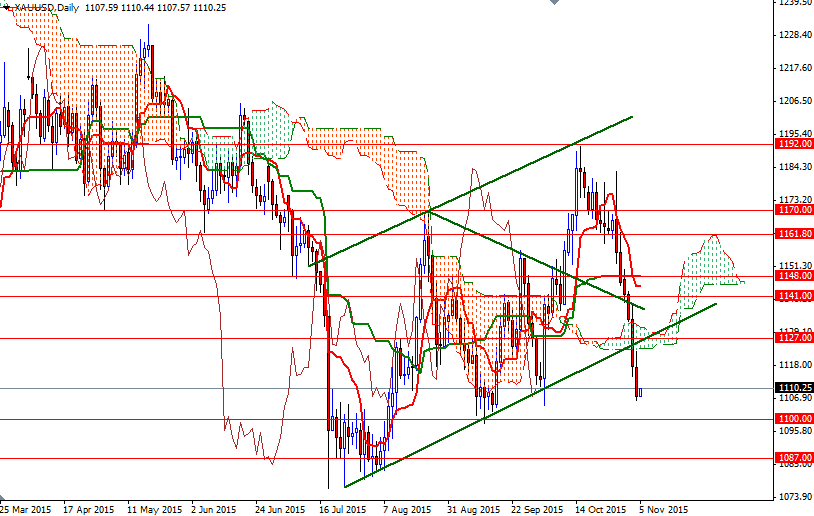

Gold prices fell 0.88% on Wednesday, extending their losses to a sixth straight session, as the dollar rallied across the board after Federal Reserve Chair Janet Yellen said the central bank could begin tightening monetary policy in December. Gold has sunk nearly 7% since the market peaked at $1191.42, based on expectations that policy makers will to take the initial step to raise the federal funds rate this year.

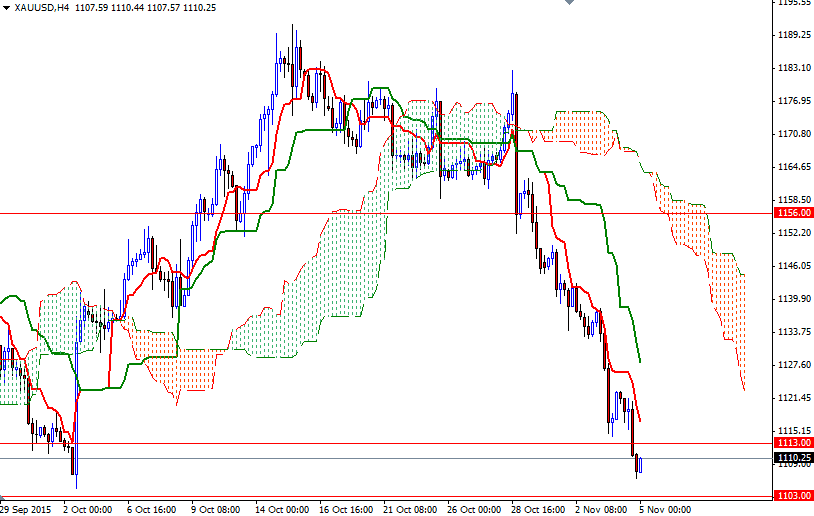

The technical picture remains weak, with the market trading below the Ichimoku clouds on the weekly, daily and 4-hourly time frames. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are negatively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices.

The XAU/USD pair is trying to pass through the 1113/0 area which was broken yesterday but we haven't seen a strong movement so far. Beyond that, the real challenge will be waiting the bulls in the 1129.12 - 1123 area. This area should be resistive as the daily and hourly clouds overlap. If the bulls run out of fuel and prices start to fall, we could see a test of the 1103/0 support. The bears have to demolish this area which reversed the market back in mid-September so that they can make an assault on the 1093 level.