Gold opened with a gap up and traded as high as $1098.08 an ounce yesterday on the back of risk aversion. However the precious metal failed to hold onto gains as initial cautiousness dissipated and demand for haven assets faded over the course of the day. The greenback resumed its advance on expectations the U.S. will increase interest rates and Asian stocks rose after Wall Street rebounded from a sharp decline.

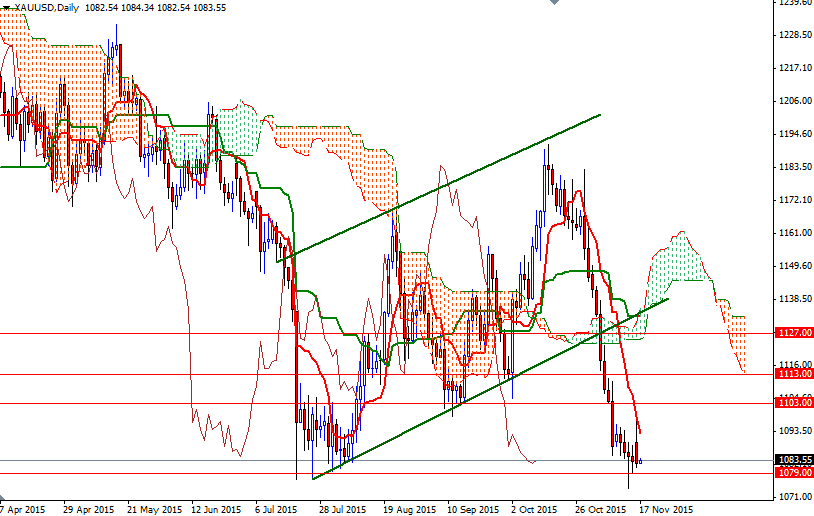

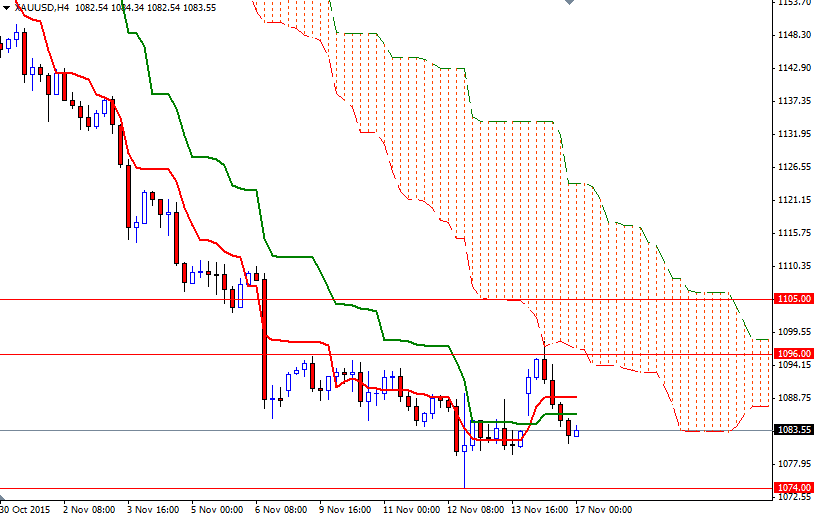

The market has been driven by the prospect of the Fed hiking rates and normalizing monetary policy and it still dominates the negative price outlook. Investors will look to U.S. inflation data today for further clues on the health of the economy. From a technical perspective, I think the rangy conditions with a bearish bias persist. The XAU/USD pair is trading below the Ichimoku clouds almost on all time frames - suggesting that the path of least resistance is to the south.

In other words, the downside risks will remain unless prices climb back above the 4-hourly Ichimoku cloud at least. There is support below at 1079, therefore the bears will need to capture that level in order to pay another visit to the critical support in the 1076/4 region. If they clear this support, there will be little to slow down their progression until the 1062.85 level. To the upside, the bulls will have to pass through 1096 if they intend to extend their ground and tackle the next barrier standing in the way at 1105. A sustained push above the 1105 level might give them a chance to proceed to the 1113 level. However, note that the 4-hourly cloud occupies this whole area between 1096 and 1113, so it could be pretty resistive.