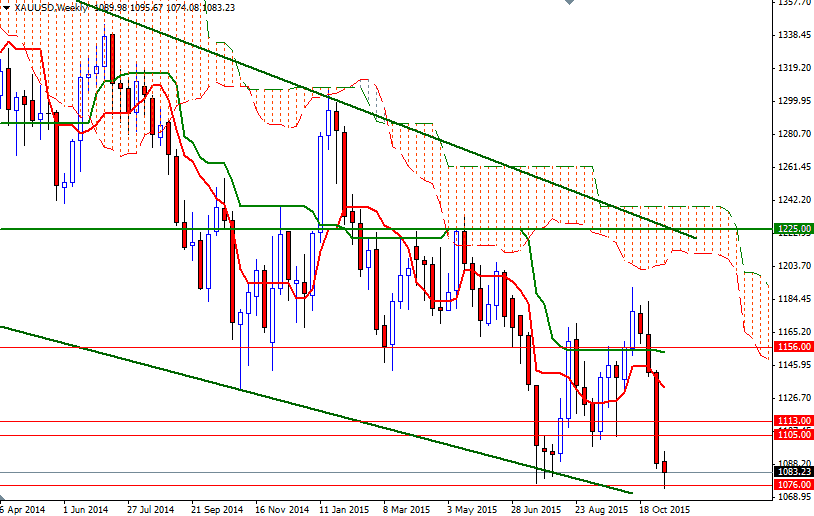

Gold prices fell for a third straight session on Thursday on worries about the possible U.S. rate hike. The XAU/USD pair dipped to a low of 1074.08, a level not seen in more than five years, after dropping through the support in the 1086/2 area put some extra pressure on the market. Recently, growing expectations of a December liftoff by the Federal Reserve have been the main driver of gold but the market may have gotten ahead of itself.

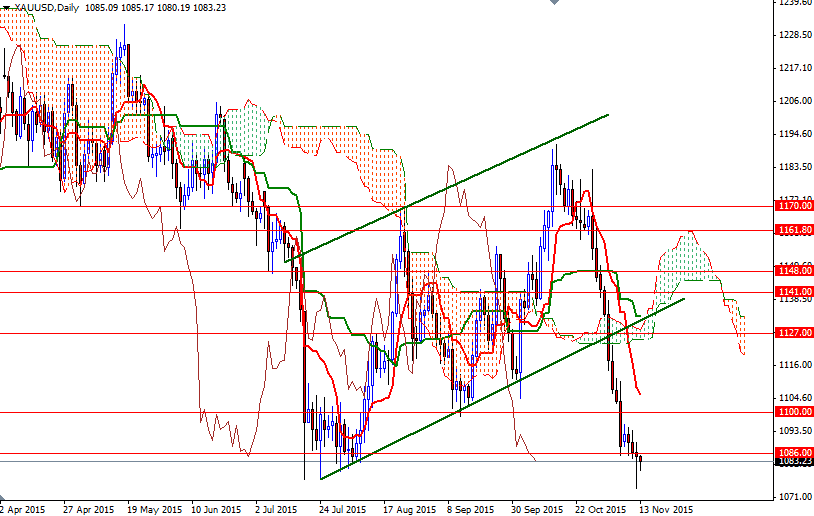

The market is still feeling the bearish pressure of last week’s bullish U.S. jobs report but yesterday's candle which has a long shadow to the down side indicates that we found some support below. Because of that, chasing gold lower at this point could be a bit risky in the short-term. If the 1076/4 support remains intact, we could see some profit taking, pushing the XAU/USD pair towards the 4-hourly Ichimoku cloud. To support this theory, the market has to anchor somewhere above 1086. Beyond 1086, expect to see some resistance at 1096 and 1100.

On the other hand, keep in mind that unless the market makes a sustained break above the 1113 level, we will probably grind lower towards 1045. As pointed out earlier, breaching the 1076/4 support is essential for a bearish continuation. In that case, the market will be aiming for 1062.85. Below that the next challenge will be waiting the bears at the 1054 level.