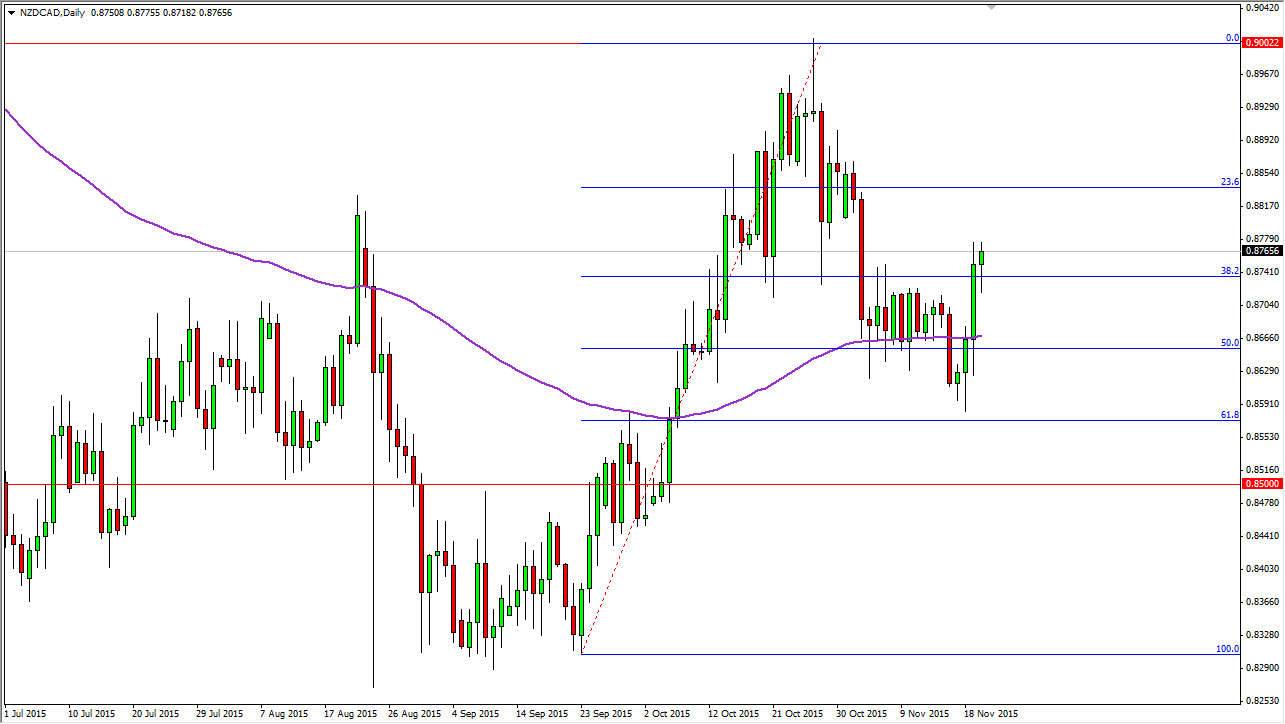

The NZD/CAD pair initially fell during the course of the day on Friday, but found enough support at the 87 region to turn things back around and form a bit of a hammer. The hammer of course is a bullish sign, and as a result it more than likely should continue to go higher. If we break above the top of the hammer, this market should then reach in our opinion back to the highs that we had seen recently in the vicinity of the 0.90 level.

I am not a big fan on the New Zealand dollar to say the least, but without a doubt the Canadian dollar is struggling overall. After all, the oil markets are absolutely decimated, and with this being the case I don’t see a scenario in which people will wish to buy the Canadian dollar in general.

Strength

This being the case, the market looks as if it is showing strength and therefore I feel that the market eventually goes higher and perhaps even breaks above the top of the 0.90 level, leading to the next leg higher on the longer-term. I believe that the market then goes to the parity level yet again, but will have to see what happens in the oil markets between now and then. After all, the oil markets are so heavily influential on the Canadian dollar that if they start to drive higher, it’s difficult to imagine that the Canadian dollar will essentially meltdown against the Kiwi dollar.

The 100 day exponential moving average of course did offer support as you can see on the chart, and that of course is a longer-term trader’s type of signal and with that it more than likely should continue to see strength going forward. On top of that, there is a positive swap in this market, so having said that I think it will be profitable to enter a longer-term “buy-and-hold” type situation.