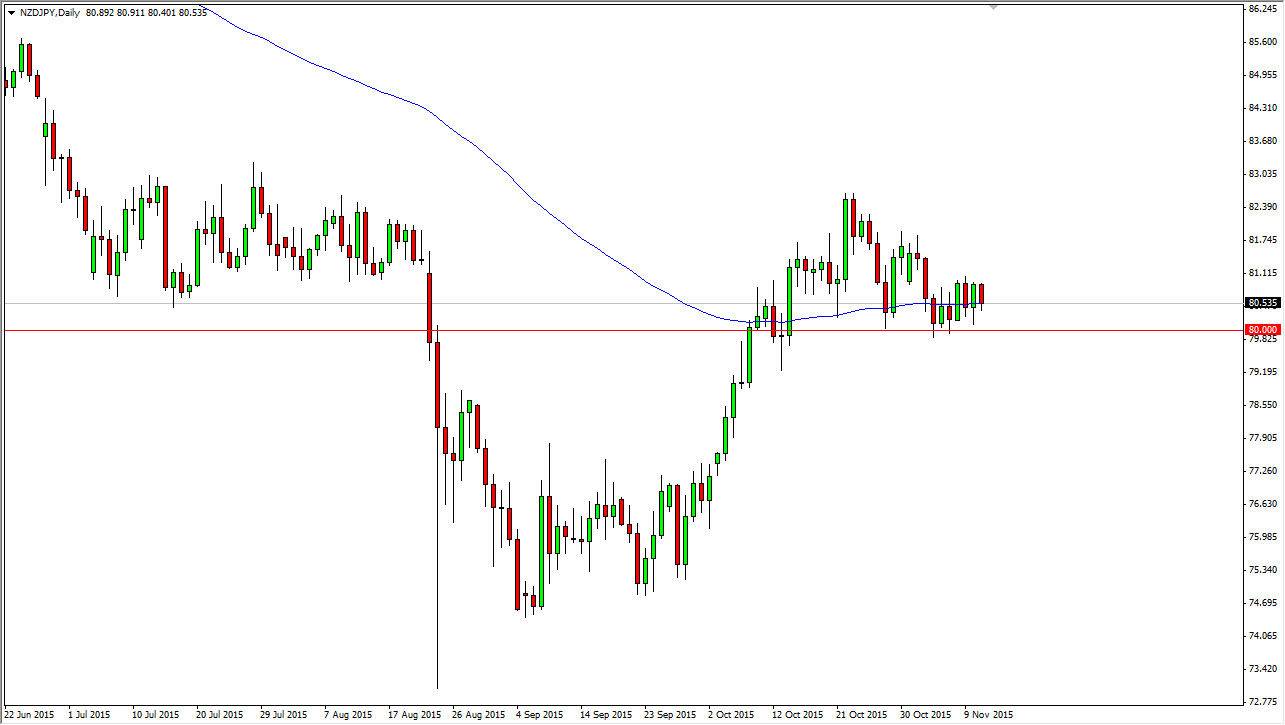

The NZD/JPY pair fell during the session on Wednesday, as we continue to go back and forth in the same general vicinity. The 80 handle just below is massively supportive, as we have seen over the last several weeks. With fact, I believe that the buyers will come back into this market and push the pair higher. The market has recently seen quite a bit of resistance at the 83 handle, but I feel that it’s only a matter of time before we break out above there. If we do get above there, the market will then be free to go much higher, probably 85 handle and then eventually the 90 handle.

I feel that if any pullback at this point in time will eventually attract enough buying pressure in order to offer a short-term long position opportunity. The 100 day exponential moving average on the chart is also hugging the general area that we are trading in right now, so at this point in time I believe that the longer-term traders are going to continue to put a little bit of upward pressure in this market.

Bank of Japan

While I am not a huge fan of the New Zealand dollar in general, the reality is that the Bank of Japan is light-years away from doing anything as far as economic tightening is concerned. The interest-rate differential should continue to favor the New Zealand dollar, and with that I believe that a lot of longer-term traders are now starting to look at the possibility of collecting swap at the end of the day.

Honestly it’s been a while since I’ve suggested that trading for swap is a viable trading strategy. However, it looks as if that’s what’s going on in this market at the moment. Ultimately, I think that we do break out to the upside but expect a lot of volatility in the meantime. This is why longer-term traders favor this market though, because as long as we can stay in the same general vicinity, it will simply hold onto the position and collect the gains at the end of every day.