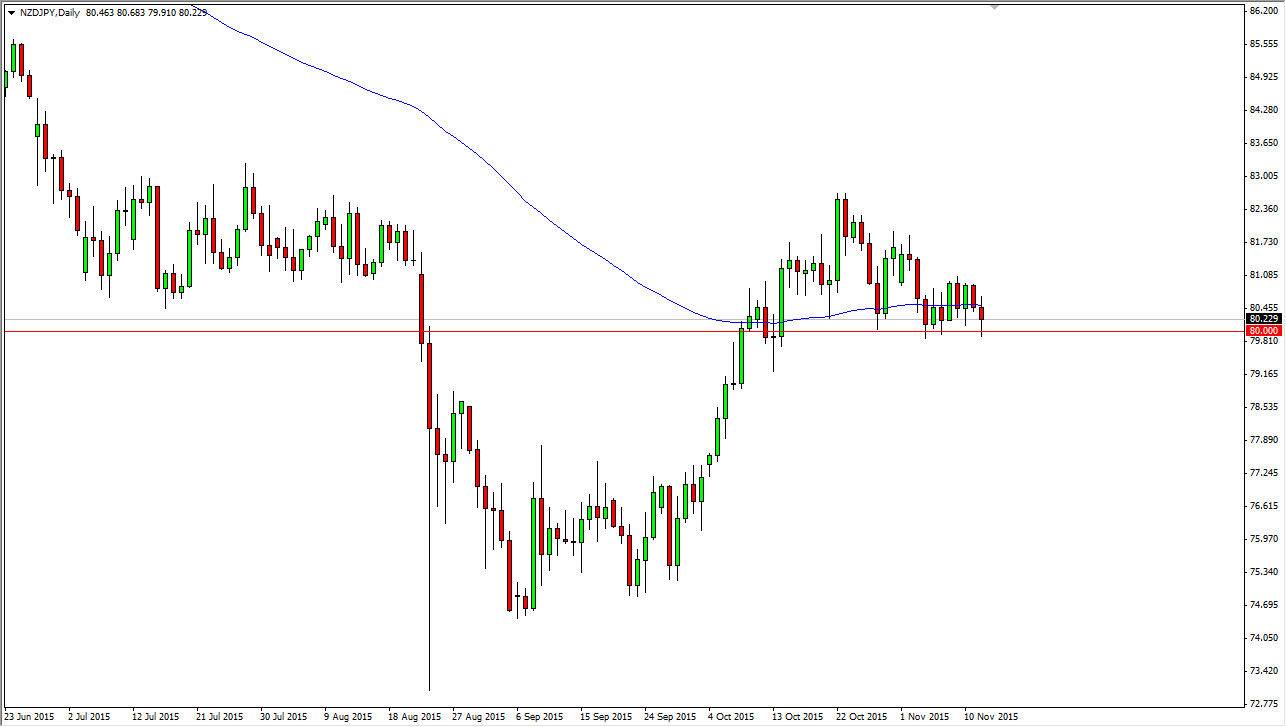

The NZD/JPY pair fell slightly during the course of the session on Thursday, testing the 80 handle. We bounced from there, and ended up forming a bit of a hammer. However, the overall attitude of the market continues to be sideways, and as a result I believe that we are simply trying to build up enough momentum to continue the uptrend that we’ve seen recently. The 80 handle of course is a large, round, psychologically significant number, so it makes sense that it would attract a lot of buying pressure. At this point in time, I am comfortable buying this pair, but I also recognize that you may have to be very patient in order to realize any profits.

The 100 day exponential moving average of course is sitting right here as well, so having said that it looks as if the longer-term traders are thinking about getting involved as well. If we break above the 81 handle, at that point in time I feel that this market will reach towards the 82.50 level. That area has been resistive previously, but once we get above there we would be broken out and could continue to go much higher, perhaps reaching towards 85.

Japanese central bank

The Bank of Japan is working against the value of the Yen, so I don’t necessarily think that this trade has a lot to do with New Zealand itself. I think it’s more or less a trade against the Yen more than anything else, and of course the interest-rate differential coming out of these countries. After all, the Japanese are light-years away from raising interest rates, while New Zealand continues to have some of the highest interest rates in the major currencies at the moment.

If we manage to break down below the 79 handle, the market should then reach towards the 76 handle where there is quite a bit of support as well. At this point though, I feel that is a bit unlikely.