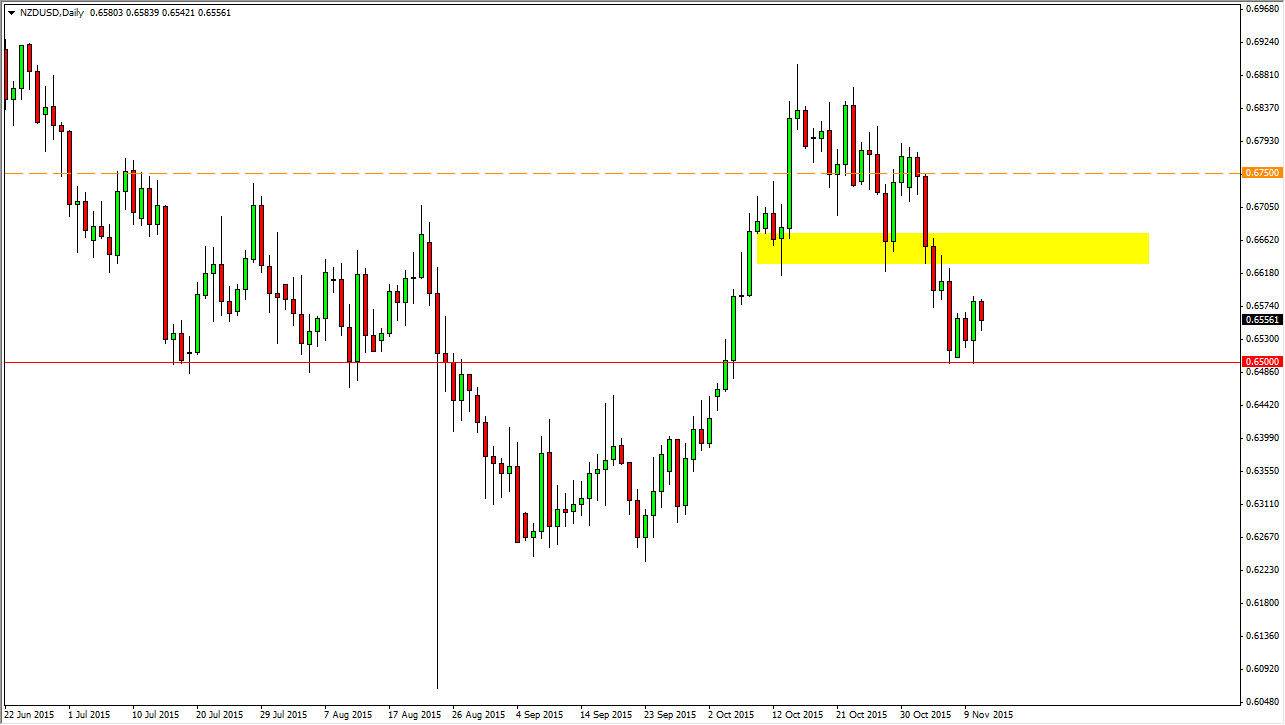

The NZD/USD pair fell slightly during the course of the session on Wednesday, as we continue to see quite a bit of volatility in this area. I still see the 0.65 level as support, but with the 0.66 level above is resistance. On top of this, I believe that the 0.6650 level is also resistive, so I feel that selling is the only thing that can happen at this point. Any rally from now that shows signs of exhaustion should be reason enough to start selling yet again. After all, the New Zealand dollar is highly sensitive to the commodity markets, and with that being the case I would be a little bit hesitant to buy the Kiwi at the moment right now. After all, commodity markets are shaky at best and of course the US dollar continues to be one of the favored currencies in the world. As long as commodities are priced in US dollars, it’s difficult to imagine that they are going to take off to the upside.

Selling rallies

I continue to sell rallies in this market, and of course a break down below the 0.65 level as it would show a buildup in the downward momentum. Ultimately, if we break down below there I feel that the market will reach towards the 0.6250 level given enough time, which of course had been so supportive previously. With that being the case, I feel that the New Zealand dollar will continue to show quite a bit of selling opportunities going forward.

In the meantime though, I feel that more than likely the most abundant trading opportunities will present themselves on short-term charts. The pair isn’t one that I want to buy, because even if we break above the 0.6650 level, I see a significant amount of resistance all the way to the 0.6850 and a. In other words, the bearish pressure should continue to pressure this market, and that being the case I think selling again and again will be the best way to go.