NZD/USD Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be made 8am to 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6451.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6390.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6637.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6704.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

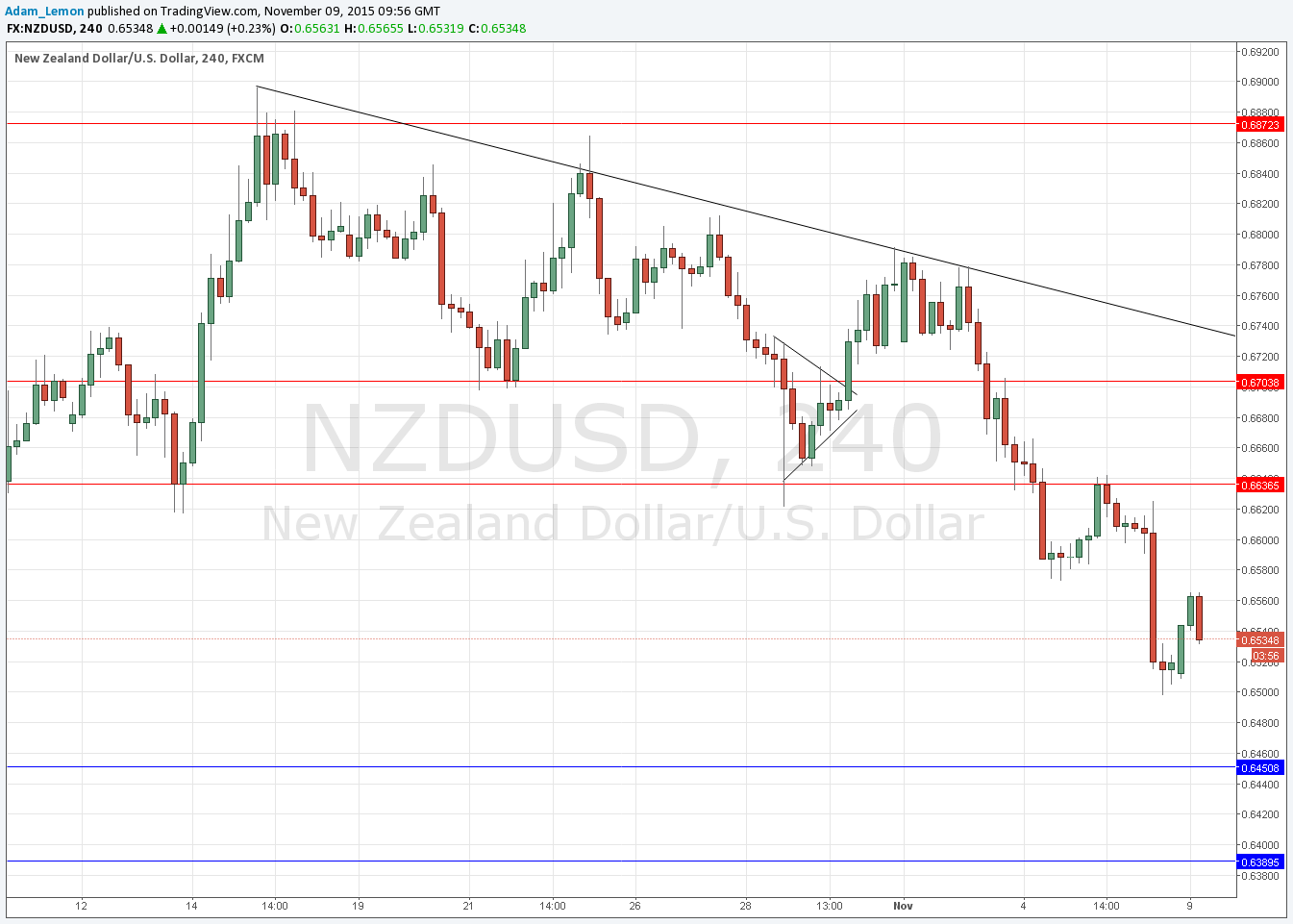

NZD/USD Analysis

This interesting thing about this pair is that over the last 3 months or so it is mostly unchanged. Until recently the NZD was the strongest currency against the USD. Now with the rise in value and renewed bullish sentiment over the USD, the NZD has been falling faster over the short term than any other major currency. Despite that I am not convinced this is one of the better pairs to trade to exploit a bullish USD.

Technically, there is a sharp fall, but watch out for a double bottom below at the psychologically key round number of 0.6500. There is also 0.6450 which is quite likely to be strongly supportive.

The best nearby resistance looks to be up at 0.6637 as this is a relatively “proven” area. However there is an inflection at around 0.6575 that could also be a logical place for the high of the day to occur at.

There is nothing due today regarding either the NZD or the USD.