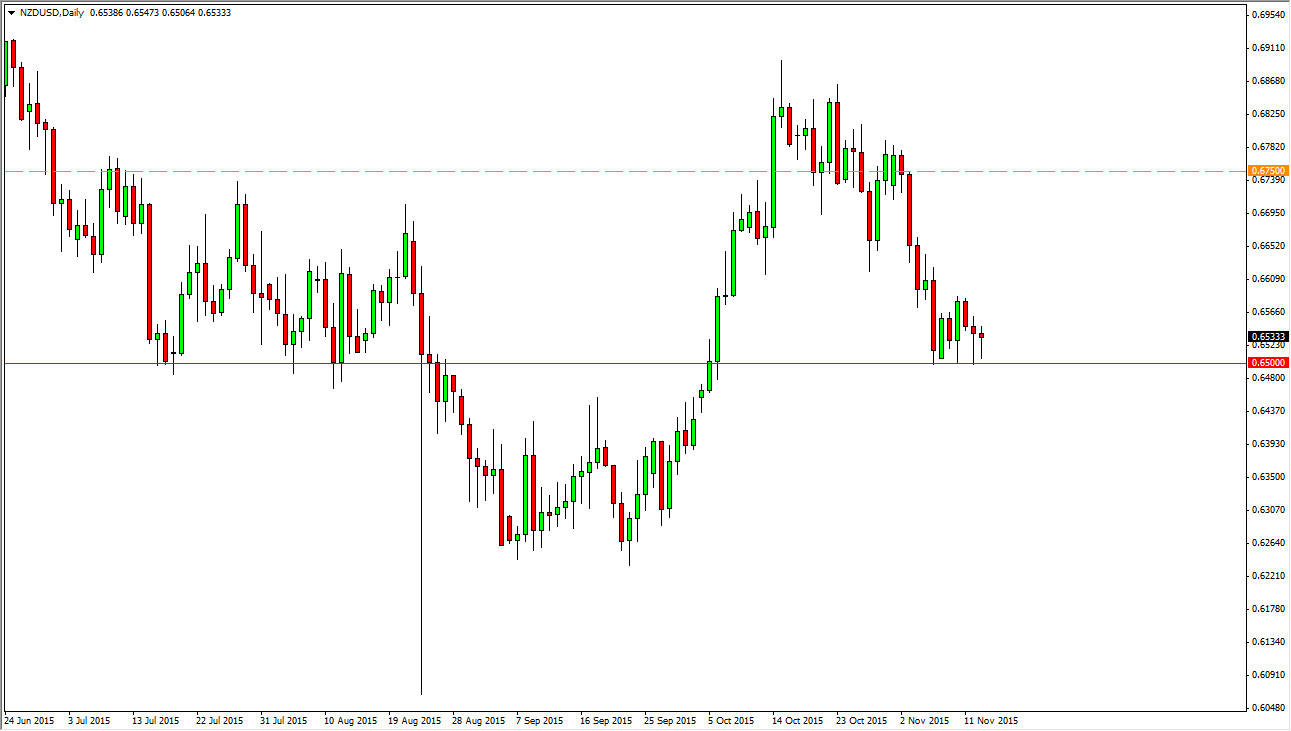

The NZD/USD pair fell during the course of the session on Friday initially but found enough support at the 0.65 level to turn things back around and form a hammer for the session, which is a repeat of what we saw during the Thursday session as well. Ultimately, I feel that this market is ready to bounce from here, but I’m not looking for some type of major move. A break above the top the hammer should send this market looking for roughly 0.6650, offering a short-term back and forth type of trading opportunity as we have seen over the last week or so.

The New Zealand dollar is of course very sensitive to commodity markets in general, although not to a specific market itself. It tends to be a barometer for the overall attitude of commodity markets, so as the commodity markets look very soft, it’s hard to believe that the New Zealand dollar will be able to keep gains for any real length of time.

Selling Strength

Although I see the opportunity for a short-term buying opportunity, I am much more comfortable selling strength, or more specifically rallies that show signs of exhaustion. I think we will get an opportunity to sell this market at higher levels on signs of exhaustion, so that’s actually the trade I am more comfortable with. I just mention the fact that we could go higher in the short-term simply because short-term traders may be interested in that. On the other hand, I do see another potential opportunity to the downside as well.

If we break down below the 0.65 level, I don’t see any reason why this market does reach down to the 0.64 level. That level should be supportive, and there is a lot of noise just below so that being the case I think it is a short-term opportunity at best. The one thing that I think will be the case going forward will be that this market shows plenty of volatility. Be quick to take your profits on any of these trading opportunities.