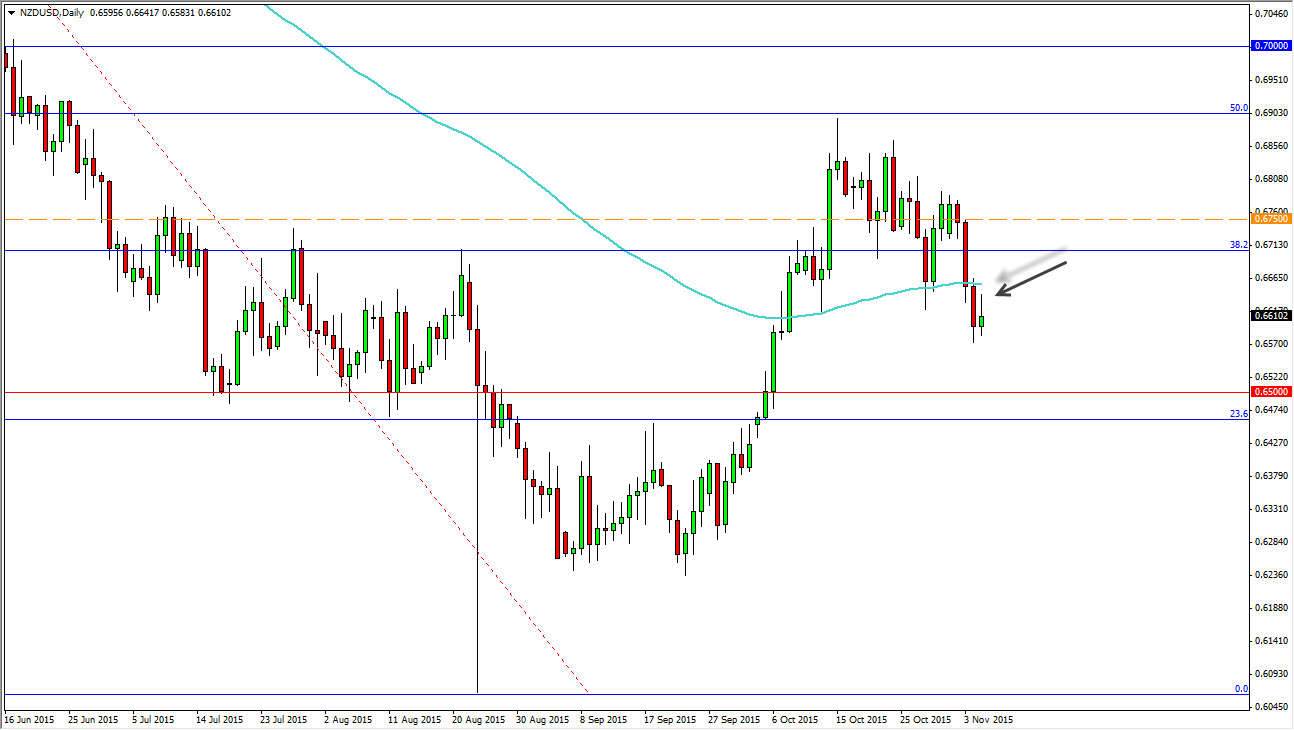

The NZD/USD pair initially tried to rally during the course of the session on Thursday, but turned back around to fall significantly. By doing so, we formed a shooting star that of course is a negative sign. I believe that the recent break down below the 0.6650 level signaled that we were in fact going to continue lower. By forming a shooting star, I feel that is only more so the truth, and with that I think we will be reaching towards the next major psychological barrier, the 0.65 handle below.

On top of that, I recognize that the 100 day exponential moving average has been broken to the downside is in fact a longer-term sell signal as well. While I don’t think that you can simply sell and hold onto the position, I do think it signals bad things ahead could be the case.

Commodity markets

Remember, the New Zealand dollar is highly sensitive to the commodity markets, from a general perspective. While there are some agricultural markets that the New Zealand dollar can be influenced by, the reality is that it is essentially a “barometer” of how the commodity markets “feel.” In general, if commodity markets are going higher, the New Zealand dollar gathers strength. On the other hand, if commodity markets are falling, so does this pair. While that isn’t always the case, it’s a general rule.

I think if we can break down below the 0.65 handle, this market can really take off to the downside. I recognize that there is a lot of noise just below there though, so it will cause quite a bit of volatility if we reach down in that general vicinity. On entering, if we break above the 0.6750 level, we could go a little bit higher, but quite frankly there’s so much noise that I feel that is a signal that I could ignore as it just wouldn’t be worth my time.