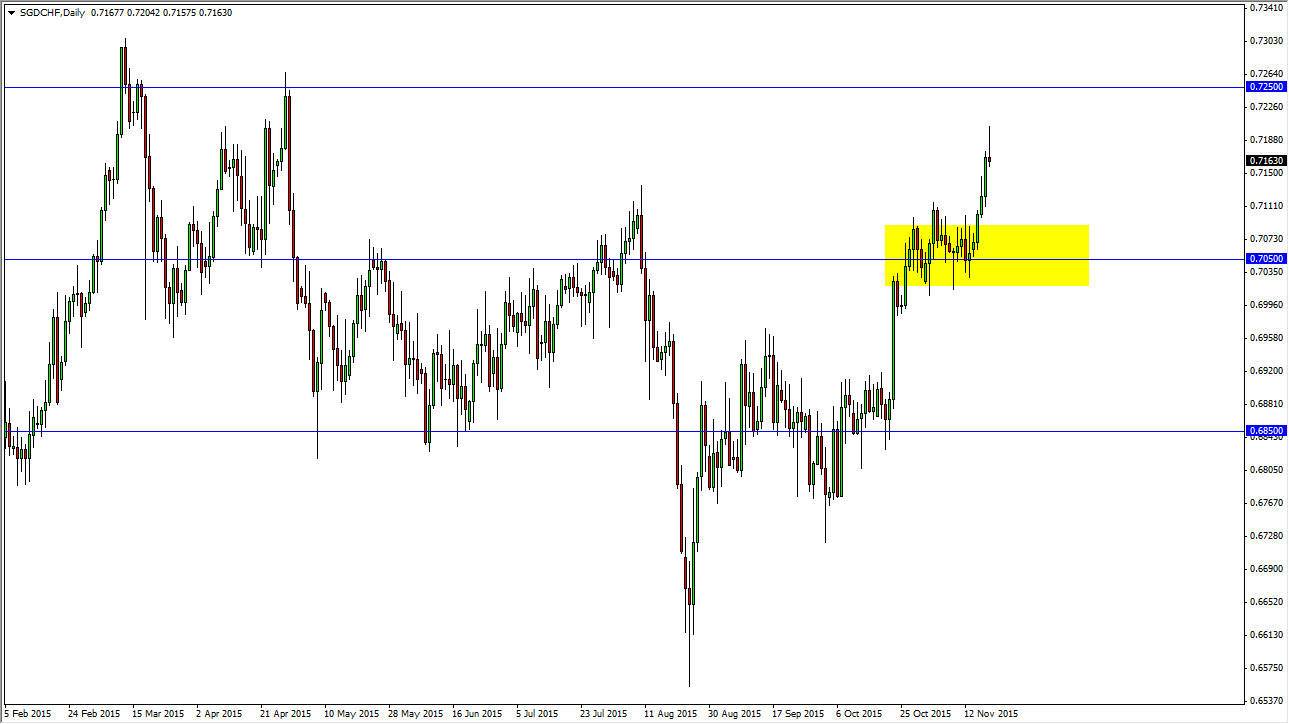

The SGD/CHF pair initially rallied during the course of the day on Thursday, but as you can see turned back around and formed a bit of a shooting star. This is a pretty negative sign, but at the end of the day I still think that we are going to reach towards the 0.7250 level given enough time. This is simply a market that is a bit overextended and starting to run out of momentum.

The fact that we formed this shooting star suggests that the buyers are starting to run out of momentum at the moment, but I think it is only temporary. As we are overextended, I feel that we will turn around and fall towards the yellow rectangle. The 0.70 area of course has been an area that has seen quite a bit of resistance as well as support, so I feel that the market has formed a “floor” at this region.

Looking for Value

Looking at this, I believe that the market pulling back should offer value, and as a result people will pick up the Singapore dollar “on the cheap.” However, with the Swiss National Bank working so hard against the value the Swiss franc, I feel it’s only a matter time before we go higher. Also, you have to keep in mind that the European Union is struggling, and that of course affects the Swiss economy at the same time. I believe that it’s only a matter of time before the Swiss franc sells off in general, and that perhaps we’ve just got a little bit ahead of ourselves around the Forex world. With that being the case, and the fact that the Singapore dollar is a bit of a safety currency, I feel that it makes sense that we continue to go higher.

The first signs of support below would be reason enough to start buying in my opinion. I also believe that a break above the top of the shooting star and more importantly, the 0.7250 level, would be buying opportunities.