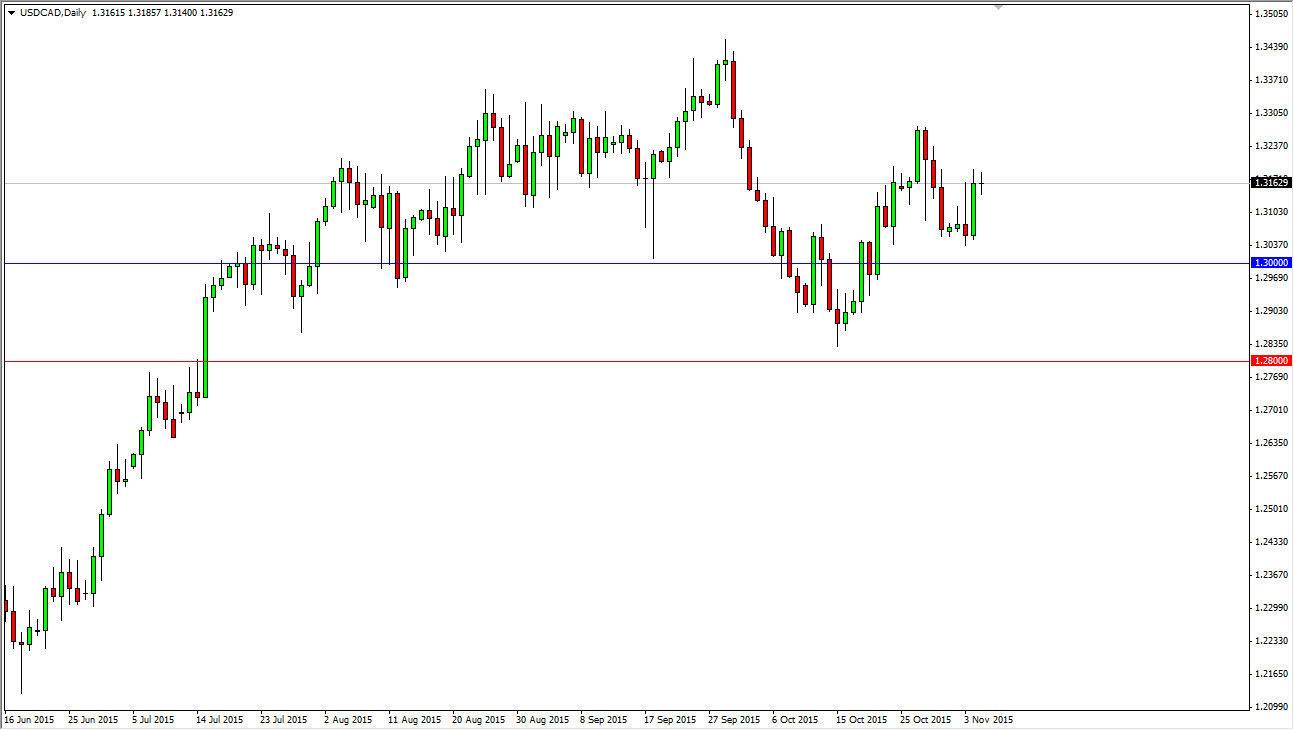

I believe that the USD/CAD pair has the most likelihood of producing a massive trade on Friday. This is because of course we have the Nonfarm Payroll Numbers coming out of the United States, but we also have Employment Numbers coming out of Canada. In other words, if we get the right combination coming out of both countries, it could become a very rapid “one-way trade.” With that being said, I do prefer the upside in general because I see quite a bit of support below. Ultimately, I think the 1.30 level still begins a significant amount of support all the way down to the 1.28 handle. I believe that any pullback at this point in time should more than likely be a buying opportunity, unless of course there is some type of massive collapse in the United States employment numbers, while we have a massive jump higher in Canada. However that is likely that it's not going to happen.

Buying dips and impulsive candles

I believe that buying dips and impulsive candles to the upside on shorter-term charts will probably be the way to go in this market. Quite frankly, if you can keep your position size small enough, you can be involved at this point, and simply write the volatility out. Don’t be surprised if it takes a while for the volatility to go away though, because there will be a lot of moving pieces when it comes to this announcement. The biggest problem of course is that a lot of the trading is automated based upon numbers and words that come out during the press announcement. However, if you are patient enough you can get the signal that you need.

I believe that any pullback at this point in time will find buyers soon enough, and that it is essentially value returning into the marketplace. This isn’t to say that I think the Canadian dollar is going to collapse, just that we have broken above significant resistance recently, and that of course doesn’t happen by accident.