USD/CAD Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm New York time today.

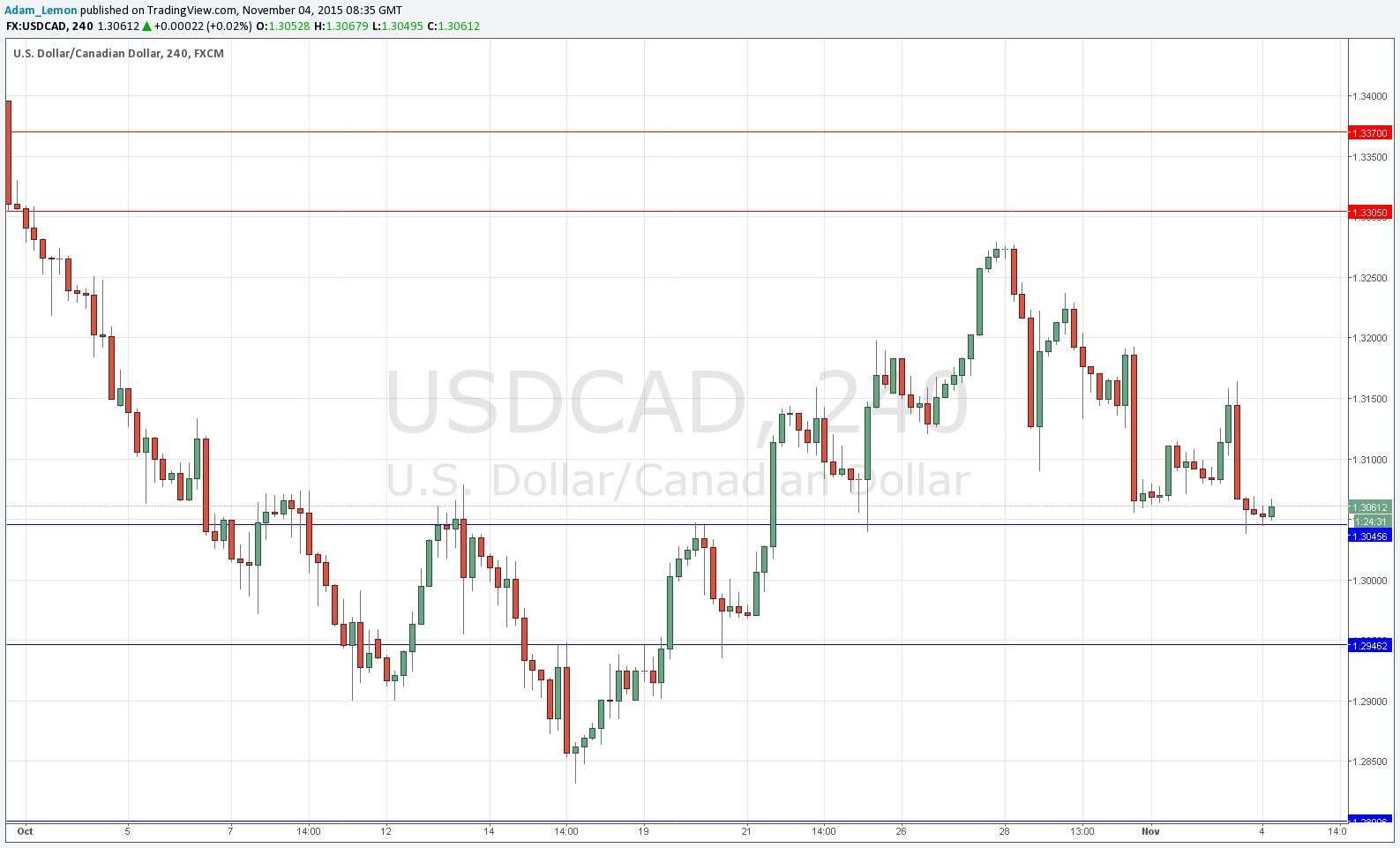

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3046.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2946.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3305.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

This pair is sitting on a really key resistance level but has been moving down and shown no strongly bullish bounce. Therefore it might be early to get long, but it is a very key level here as at the time of writing. If the price of oil begins to fall, I would expect a move up from here.

There is strong support 100 pips below.

Concerning the CAD, there will be a release of Trade Balance data at 1:30pm London time. Regarding the USD, there will be a release of the ADP Non-Farm Employment Change Number at 1:15pm, followed by Trade Balance data at 1:30pm and then finally ISM Non-Manufacturing PMI and Fed Chair testimony at 3pm.