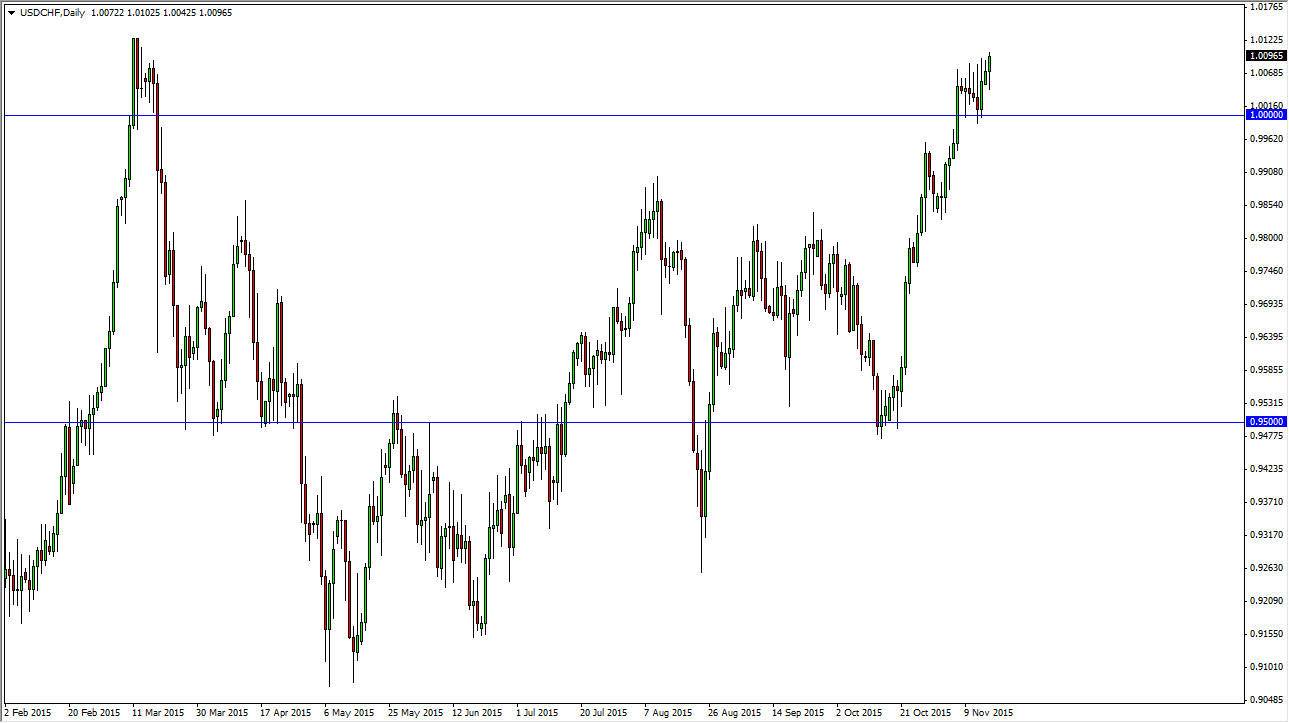

The USD/CHF pair initially fell during the course of the day on Monday, but as you can see found enough support to turn things back around. We ultimately formed a bit of a hammer, and that of course means that the buyers are starting to come into play. I think that the parity level below will continue to offer support, and with that I think that this is essentially a “buy only” type of situation. The US dollar of course continues to strengthen in general, and unfortunately for the Swiss, they are in the middle of Europe.

Even though the Swiss franc isn’t the currency representing the European Union, the sad fact is that the Swiss are highly leveraged to the European economy, as they send 85% of their exports into that region. With this, we believe that the market should continue to go higher given enough time, as the Swiss franc will get punished for its reliance on the Europeans.

Central Bank

You have to keep in mind that the central bank comes into play when you think about a currency. The Swiss National Bank has worked against the value the Swiss franc on and off for several years now, so that of course puts a bit of softness in that currency to begin with. Ultimately, the Federal Reserve will more than likely have to raise interest rates fairly soon, because of the strength of the US jobs market. We recently had a bit of a shock to the marketplace as the announcement came out almost twice as strong as anticipated.

I believe that the parity level offers support, but I also believe that the 0.99 level below there offers support. After all, I believe that this market should continue to go higher but also recognize that we could be a little bit extended at this point. Because of this, we may have to build up enough momentum to finally break out to the upside for the longer term. Once we do, which is essentially a move above the 1.0150 level, I feel that this market goes much higher and it becomes a “buy-and-hold” situation.