USD/CHF Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

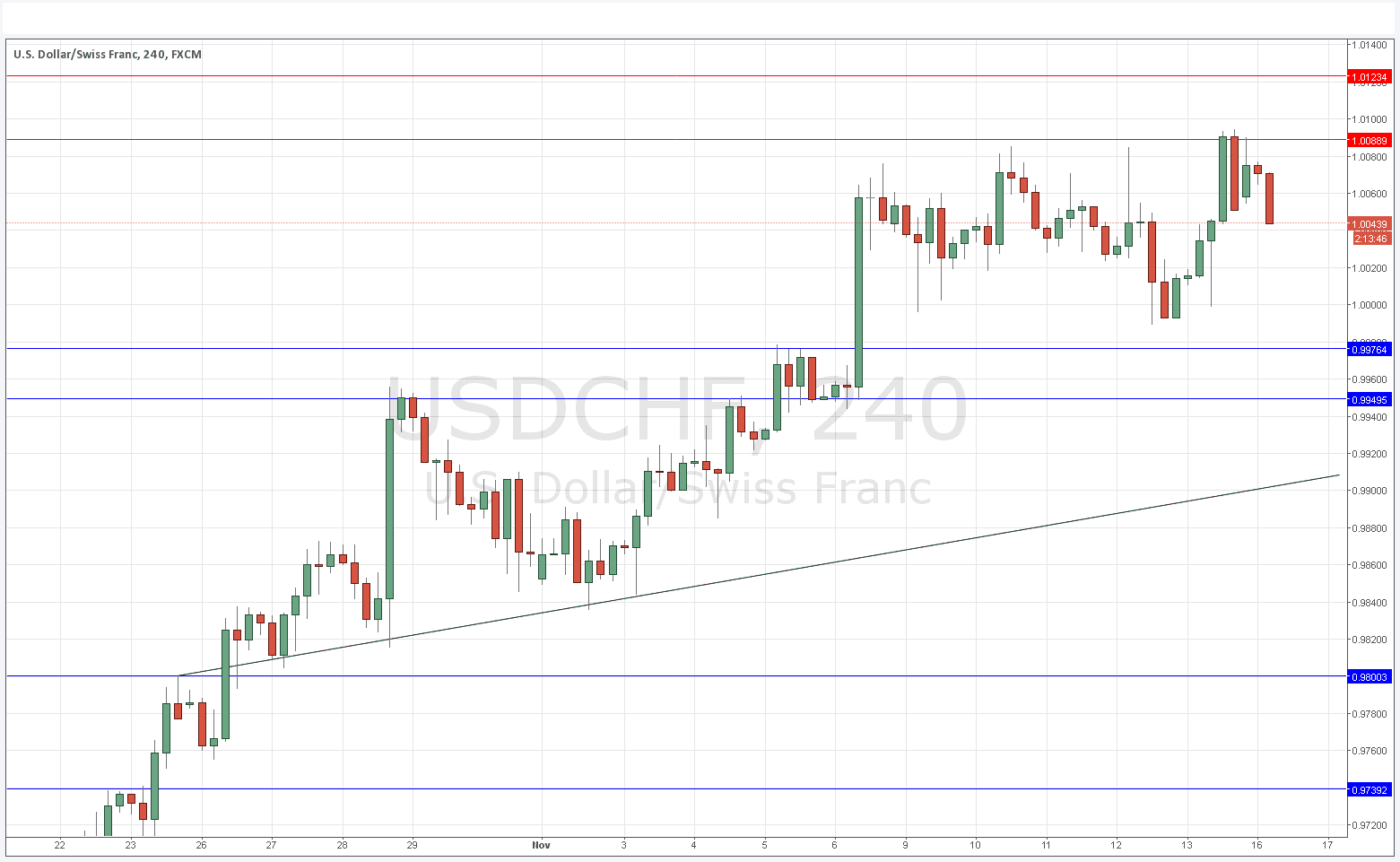

Long Trade 1

* Long entry after bullish price action on the H1 time frame following a touch of 0.9976.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry after bullish price action on the H1 time frame following a touch of 0.9950.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 3

* Long entry after bullish price action on the H1 time frame following a touch of the bullish trend line currently sitting at around 0.9905.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0089.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I have been identifying the level at 1.0089 as likely to provide good resistance and this is exactly what finally happened Friday as the price reached a level just above there before printing a doji on the hourly chart and falling. There was another fall from there overnight and at the time of writing the price is making new lows.

There might well be support at the psychologically important round number of 1.0000 but there are more key levels not far below there.

There is nothing due today concerning either the CHF or the USD.